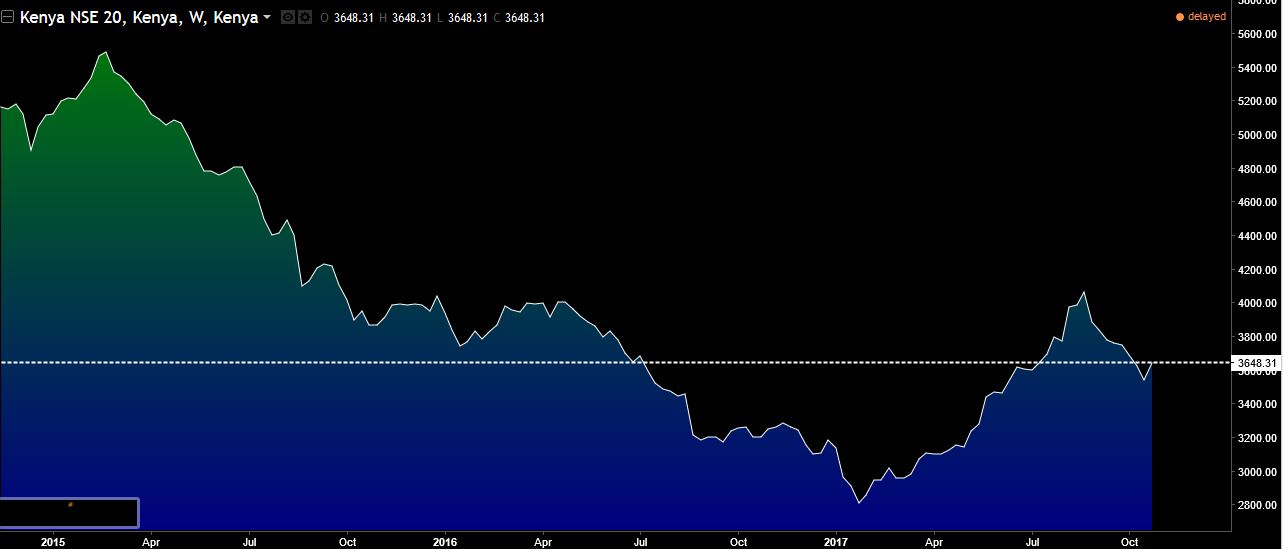

The NSE 20 Share Index closed Friday’s (October 27, 2017) session at 3,648.31 points. The Index has fallen by 12.8% since touching the year’s high of 4,114.01 points on August 15 following the week after Uhuru Kenyatta was declared president. After annulment of the August 8 Presidential results by the Supreme Court on September 1 the market then took a reversal to its current level. However on a year-to-date basis the index is still up by 14.50%.

So far which companies in the Index have had a great performance and which ones have not delivered positive returns?

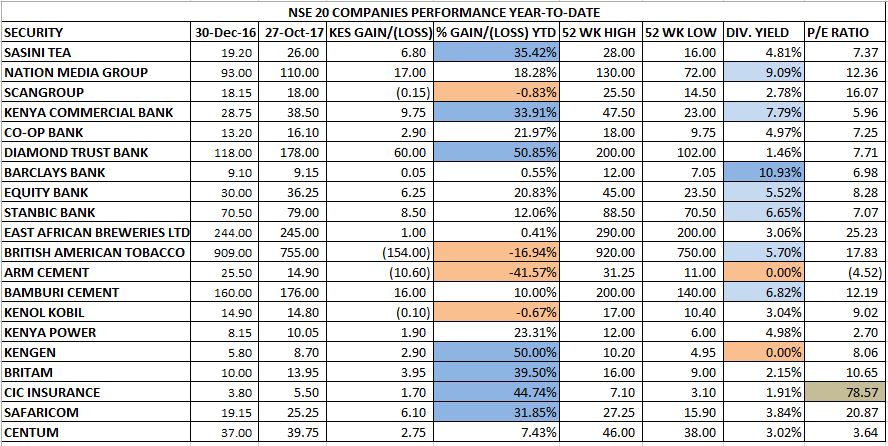

Only 4 companies from the 20 in the index have had negative returns since the year began that is Scangroup (-0.83%), BAT (-16.94%), ARM Cement (-41.57%) and Kenol Kobil (-0.67%).

The top performer on the index so far has been Diamond Trust Bank which has risen by 50.85% since the year began. The lender has demonstrated resilience in its fundamentals that has undoubtedly been a contributing factor.

Energy producing company Kengen has also had a good year with its price appreciating by half to KES 8.70. The company however in its latest results did not pay a dividend which investors had hoped for.

Barclays Bank of Kenya currently has the highest dividend yield on the index standing at 10.93%.

CIC Insurance seems to the most overvalued counter on the index with a P/E Ratio of 78.57 based on its FY16 Earnings. The counter showed improved HY17 results however historically the company’s second half performance tends not to do well.

Post Election Performance

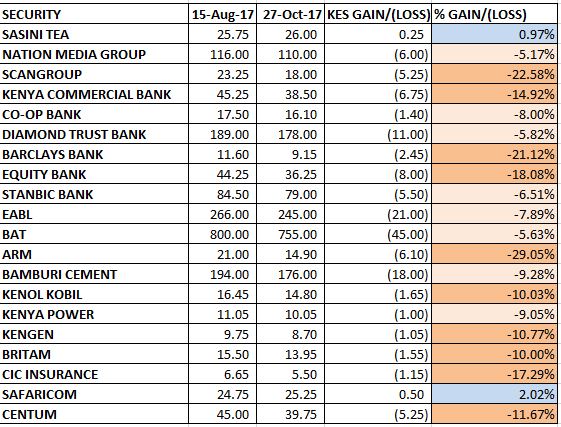

Most investors might have not had an opportunity to get in on the market during the gloomy first half of the year which was filled with pessimism and no one knew when the market would bottom out. At current levels can investors still take positions and find some quality counters? Can a rebound trade be in the offing after the political situation settles? Well let’s look at which counters have been affected the most since August 15 below.

Only two counters have been steady after the country spun into political uncertainty i.e. Safaricom and Sasini Tea.

NSE 20 Index Rules

The NSE 20 Share Index is the benchmark index in the Kenyan market for blue-chip counters. It is a price weighted index whose members are selected based on:

1. Trading activity measures weighed in the ratio of 4:3:2:1. I.e Market Capitalization 40%, Shares traded 30%, Deals/liquidity 20%, and turnover 10%.

2. A company that has a free float of at least 20%.

3. Must have a minimum market capitalization of Kshs. 20 million.

4. A company should ideally be a blue chip with superior profitability and dividend record.

Source: Nairobi Securities Exchange (NSE), Kenyan Wall Street