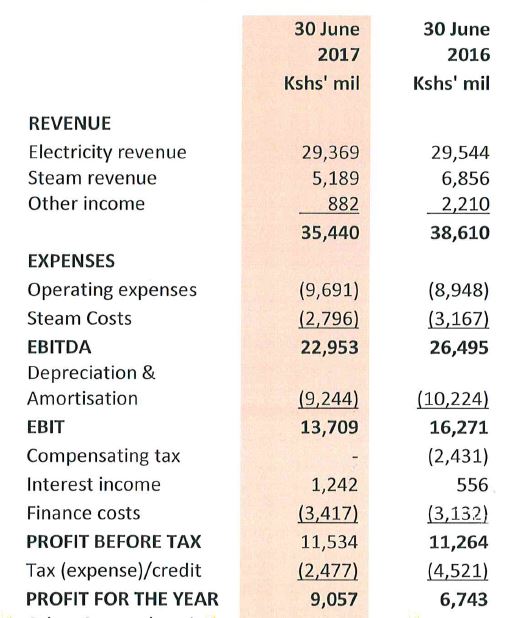

Energy producing company KenGen released its full year 2017 results that was characterized by a tough operating environment however the company managed to book in a 2.4% increase in profits before tax coming in at KES 11.5 billion compared to the previous financial year’s (2016) KES 11.3 billion. Profit after tax was up by 34% to KES 9.06 billion compared to the previous period. Despite the results, the company did not declare a dividend as it cited cash flow needs and investments in new projects.

Revenue

The Company’s revenue dipped by 8.2% to KES 35.44 billion compared to KES 38.61 billion in 2016. This was due to a 1% dip in electricity revenues to KES 29.4 billion, lower income from steam revenue and lack of income from commercial drilling services which earned the company KES 1.5 billion in the previous year.

Interest income grew by 123% to KES 1.2 billion compared to the previous period’s KES 556 million largely due to earnings from the investments of funds raised during the March 2017 rights issue as it awaits deployment to projects.

Rights Issue

The company highlighted that the March 2017 rights issue was successful following the issuance of 351 million shares to the Public Investment Corporation (PIC) of South Africa that managed to raise KES 2.3 billion providing support for future growth.

Share Price

On Wednesday October 18, 2017 KenGen closed the day’s session down by 2.86% to KES 8.50. KenGen however has realized value creation in 2017 that has seen its share price go up by nearly 50% on a year-to-date basis. From a 52 week range it has returned 23%.

Source: (Company Financials, Nutcracker Analytics Portal)