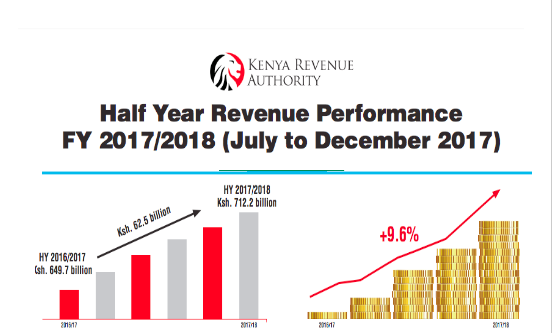

Kenya Revenue Authority says its overall revenue for the first half of financial year 2017/18 grew by Sh62.5 billion to Sh712.2 billion from Sh649.7 billion recorded in the previous year. On the other hand, exchequer revenue grew by 10 percent to reach Sh664.77 billion up from Sh604.27 billion in financial year 2016/17.

The overall growth, representing 9.6 percent rise was recorded against the backdrop of a depressed economic climate occasioned by the prolonged election cycle that stretched for the better part of the calendar year 2017. The prolongation adversely affected business confidence and depressed consumer spending, leading to weak performance in consumption related taxes especially in the non-essential goods sectors.

Moreover, delayed normalisation of the Government’s fiscal programme adversely impacted public and private sectors’ tax remittances, the latter due to delayed settlement of bills.

KRA says for the second half of the year, the target is to raise Sh798.84 billion.

The authority further says the iTax system presently provides a valuable data which will be used to issue tax assessments against previously non-registered persons or registered taxpayers whose filings materially differ from the declarations they submit to KRA. To date, assessments totaling Sh29.6 billion have been issued and collection efforts are in progress.

On the side of Customs, consistent focus on valuation benchmarking and cargo scanning have shored up revenues by Sh3.1 billion for H1 to push Customs collection to Sh235.6 billion up from Sh218.7 billion in FY 2016/17.

Consumption Taxes

VAT recorded growth of 7.5 percent mainly driven by the expansion of withholding VAT framework which now encompasses almost 7,000 agents. Sectors that exhibited robust growth include telecommunications, transport and energy, while depressed growth was recorded in agriculture, manufacturing, construction and mining sectors. VAT has consistently performed strongly since 2013 with annual growth averaging 21.5 percent.

Income Taxes

Corporation Tax

Corporation Tax grew by 7.2 percent in H1 with the key banking sector recording growth of 11.1 percent. Profit performance within the sector was mixed with several Tier 1 banks issuing profit warnings whereas a sizeable proportion of Tier 3 banks recorded losses. Other sectors that recorded improved growth were telecommunication (16.1 percent); construction (124 percent); and transport (40.0 percent). As would be anticipated weakest growth was recorded in the manufacturing sector, while the energy sector performed poorly, a fact mainly attributed to high investment deductions.

PAYE

PAYE recorded growth of 9.2 percent driven by improved compliance within the Public Sector following the establishment of a dedicated compliance programme within KRA for this critical sector. The new compliance programme focuses on education and compliance support interventions geared towards helping public enterprises better understand requirements, with a resultant 29.5 percent growth in remittances from the sector. PAYE from large private firms recorded subdued growth of 2.4 percent with key sectors such as construction, wholesale/retail, agriculture and transport collectively declining by 5.8 percent.

Excise Tax

Domestic Excise Tax recorded the worst performance, declining by 9.0 percent in H1 compared to annual average growth of 16.0 percent over the previous 3 years. Remittances from the main excise sectors of beer, tobacco and spirits, declined by 8.4 percent attributed largely to drop in volumes; 16.0 percent for tobacco, 11.2 percent for spirits and 16.3 percent for beer.

Customs

Customs recorded overall growth of 7.7 percent, with non-oil collections, which account for about 70 percent of revenue growing at 8.1 percent.