Kenya’s National Social Security Fund (NSSF) has disposed its entire 2.25 percent interest in mortgage finance provider Housing Finance Group of Kenya (HFCK).

HF Group’s latest annual report shows that NSSF is no longer listed among the top shareholders having sold 7.86 million ordinary shares which represented 2.25% of HF’s issued share capital.

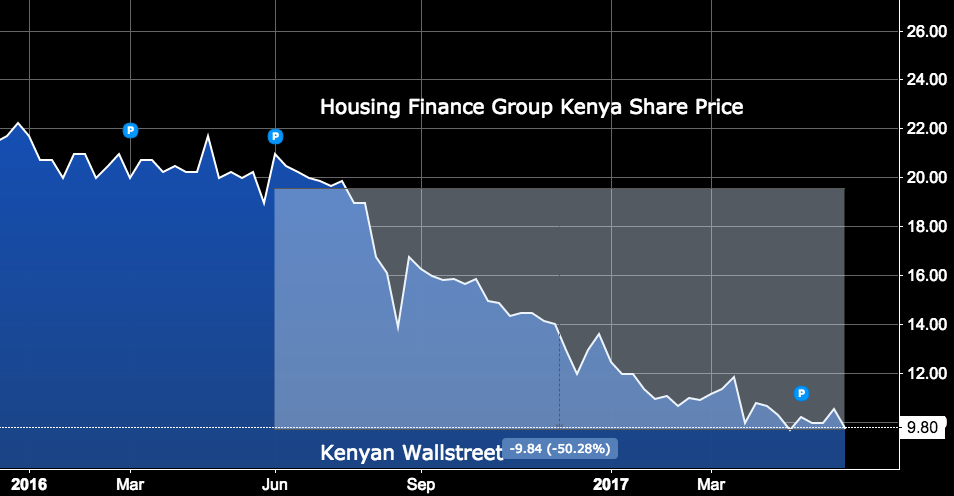

From the report, its not clear on the exact time and reason behind the move but its worth noting that Housing Finance’s share price has declined by over 50 percent over the last one year. On 3rd June 2016, the counter closed at Sh 19.5 to a closing price of Sh 9.8 posted on Friday 2nd June 2017.

Britam still holds the largest chunk of 35.43 percent in HF Group while Equity Bank is second with 11.1 percent. The Kenyan government has a 2.41 percent shareholding in the bank.

Last week, HF Group released its Q1 2017 results which saw its profits after tax drop by a massive 73% from Ksh 327.42 million in Q1 2016 to Ksh 88.34 million.

HF Group recently announced plans to borrow Sh1.5 billion from a development finance institution as part of a cash mobilisation plan to repay its Sh7 billion corporate bond which is due on October 2 this year. At the time, the bank said it had Sh4.1 billion at hand and plans to raise the balance of Sh2.9 billion from borrowings and monthly cash collections from its lending and property development operations.