Nairobi Securities Exchange listed mortgage finance provider Housing Finance Group (NSE; HFCK) has released its Q1 2017 results which saw its profits after tax dropping by a massive 73% from Ksh 327.42 million in Q1 2016 to Ksh 88.34 million in Q1 2017.

The drop is attributed to a 20.4% drop in Net Interest income from Ksh 1 billion in Q1 2016 to Ksh 797.6 million in Q1 2017.

Quarter on quarter, the Bank also reduced its holdings in government securities by 13 percent to Sh 3.09 Billion at a time when most of the lenders have increased their allocations in the same.

Customer deposits declined from Sh 41 Billion to Sh 38.3 Billion while total operating income quarter on quarter reduced by a huge margin from Sh 4.69 Billion to Sh 970.5 Million.

Loan loss provision also declined by 73 percent to Sh 200.1 Million quarter on quarter as staff costs reduced from Sh 1.07 Billion to Sh 266 Million.

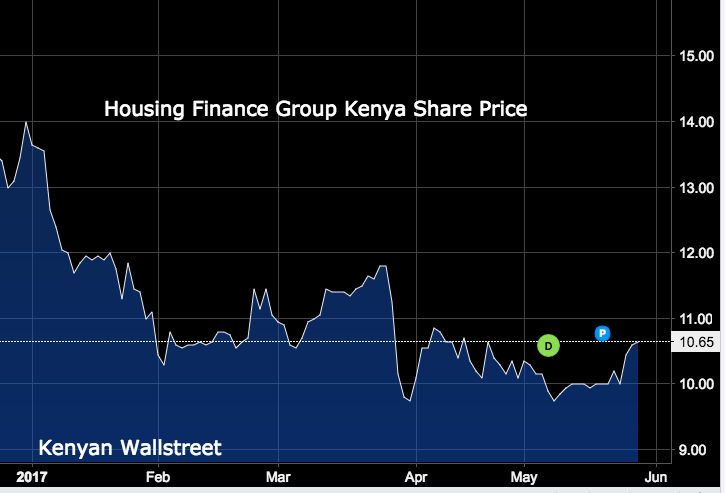

The counter closed Monday’s session at Ksh 10.65 per share, down by 20.82% year-to-date.