Dividend-paying stocks are very popular with investors because they provide a regular, steady stream of income. Owning dividend-paying stocks is a great way for the average investor to build long-term wealth. You can earn passive income from the dividends and benefit from capital appreciation. Historically, stocks that pay dividends have outperformed those that don’t.

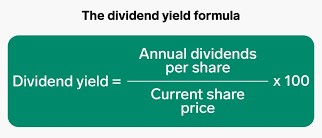

Investors evaluate companies that pay dividends on the value of annual dividends paid relative to the price of the company’s stock, known as the company’s dividend yield. A stock that pays yearly dividends of 0.50 Ksh per share and trades for 10 Ksh per share has a dividend yield of 5%.

Dividend yields enable investors to quickly gauge how much they could earn in dividends by investing a certain amount of money in a stock. If a stock has a yield of 5%, you know you would earn 5 Ksh on every 100 Ksh invested, 50 Ksh on every 1,000 Ksh invested, and so on. A dividend yield also allows you to compare a stock to other investments such as bonds and Unit Trusts.

These are some of the Kenyan stocks that have the highest dividend yields in 2022:(1st December 2022)

| Company (Ticker Symbol) | Share price in Ksh (1st Dec 2022) | Final Dividend | Dividend Yield % |

| 1. Umeme (UMME) | 7.02 | 1.74 | 24.79% |

| 2. Williamson Tea Kenya plc (WTK) | 150 | 20 | 13.33% |

| 3. Standard Chartered Bank Kenya (SCBK) | 145 | 19 | 13.10% |

| 4. British American Tobacco Kenya plc (BAT) | 433 | 53.5 | 12.36% |

| 5. Crown Paints (CRWN) | 33.65 | 4 | 11.89% |

| 6. Bamburi Cement plc (BAMB) | 31.5 | 3.58 | 11.37% |

| 7. BK Group plc (BKG) | 29.65 | 3.24 | 10.93% |

| 8. Kapchorua Tea Kenya plc (KAPC) | 105 | 10 | 9.52% |

| 9. Nation Media Group (NMG) | 15.8 | 1.5 | 9.49% |

| 10. Absa Bank (ABSA) | 11.95 | 1.1 | 9.21% |

Benefits of Dividend Investing

Generate Passive Income

Most investors like dividend stocks because of the fact that they can provide a steady source of income with little or no work, much like interest from a bank account but with a greater potential for return on investment.

Take Full Advantage of Compounding

Compounding is a powerful way to increase your income by using earnings to generate even more earnings. Through compounding, you can earn more income without having to invest any additional money of your own, simply by letting your earnings go to work for you. In the case of dividend investing, when you use your dividend earnings to purchase additional shares of company stock, you’ll earn more money because every share you purchase earns its own regular dividend payout. This compounding strategy benefits from the power of exponential growth: your original investment generates a certain return that can be reinvested to produce greater returns, and those returns can be reinvested, and so on. The longer you continue to reinvest, the more quickly your returns will grow.

Invest Once and Profit Twice

When you invest in dividend stocks, you stand to profit in more ways than one. Non-dividend-paying stocks only offer the potential for profit when you buy their shares at a low price, and sell them for a higher one. Dividend stocks, on the other hand, allow you to share in company profits while also retaining ownership of your investment. And since a large number of dividend-paying companies are financially stable and relatively reliable, their stock prices tend to increase over time, as their perceived investor value continues to grow.

Maximize Returns with Dividend Reinvestment

We know that reinvesting dividend earnings is an effective way to take advantage of the power of compounding, but it can become even easier and more convenient when you use a DRIP, or dividend reinvestment plan. As a program that allows investors to automatically reinvest their cash dividends back into additional company shares, DRIPs combine the advantages of both compounding and dollar-cost averaging. These automatic share purchases generally occur on a company’s dividend payment dates and may be managed by the stock company itself, or by an outside agent or brokerage. One of the best features of many DRIPs is that they allow you to buy additional company shares commission-free, or at a discount.

How To Retire Early & Live Off Your Dividends

The Complete List of Stocks That Pay Dividends in November