Kenya’s ongoing fiscal reforms have outpaced other major economies in the Sub-Saharan region, according to a report by the Fitch Group-owned BMI Research.

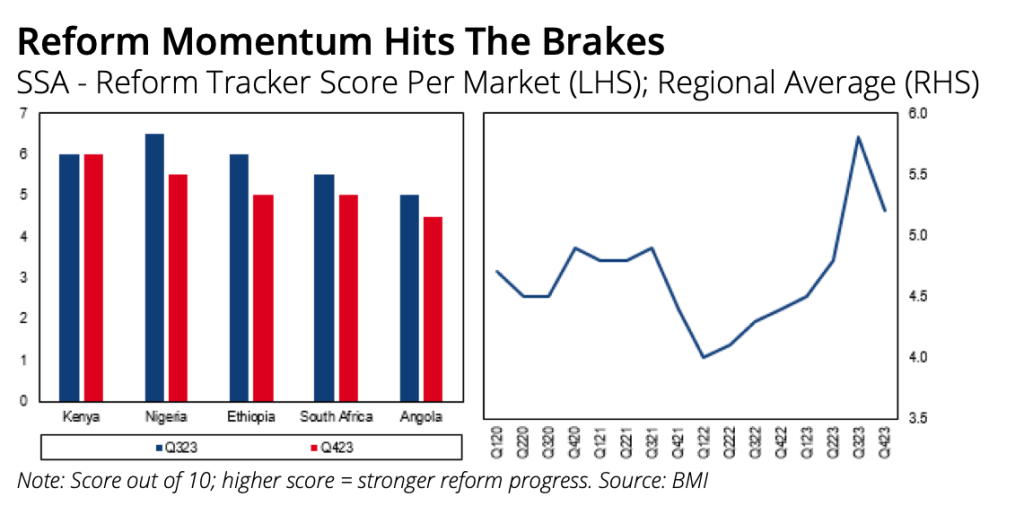

The research company maintained Kenya’s reform score at 6.0 in Q423, while downgrading the scores for Ethiopia, South Africa, Angola, and Nigeria. The net effect is a marginal drop in the region’s scores for progress on reforms, as countries struggle to balance international debt obligations with local social and political concerns.

The research company pointed out Kenya’s implemented fiscal reforms have reduced budget deficits, and the government has so far warded off challenges to ongoing tax modifications.

- “Unsuccessful judicial challenges against the recent tax modifications suggest that President William Ruto’s fiscal reform plan is likely to stay its course over 2024,” the analysts said.

- They also expect that the privatisation law will “accelerate the process of privatising 25 SOEs over the coming years.”

- In October, the IMF estimated that Kenya’s economy will grow by 5.5% in 2023 and 6% in 2024, significantly higher than the regional average of between 3.3% and 4% in 2023 and 2024 respectively

Addis’ Struggles

The analysis downgraded Ethiopia’s reform score to 5.0 in Q423, from 6.0 in Q323. It noted the slowdown of Prime Minister Abiy Ahmed’s reform program after the post conflict boost. “Little to not advancements have been made regarding the country’s economic liberalisation programme, despite previous positive announcements, such as the plan to issue a second private telecoms license,” the analysts said.

The country raised $ 850mn when it sold the first private telecoms license to the Safaricom-led consortium, which has so far spent $1.6 billion to launch operations in the country

- Ethiopia failed to attract any bids for its second private telecoms license, according to a report by Bloomberg.

- At the same time, the Financial Times reports that Ethio Lease, the only foreign-owned financial services company in Ethiopia is pulling out of the country after a four-year presence, citing foreign exchange constraints.

- The company, a unit of the US-based African Asset Finance Company, offered leases on imported equipment, including farm machinery and medical products.

To rebalance, Ethiopia is in talks with the IMF for a loan of at least USD 2.0 bn. This will require the devaluation of the Ethiopian birr, which will most likely worsen Ethiopia’s foreign exchange challenges. On 15th November, Ethiopia announced it had reached a deal with bilateral creditors to temporarily suspend debt payments. Earlier this year, China had agreed to suspend debt repayments until July 2024.

From Angola to Nigeria

The research company downgraded Angola’s reform score from 5.0 in Q323 to 4.5 in Q423. This is partially because of the rise in global oil prices, and the Angolan government’s slowdown in its phased removal of the fuel subsidy for fear of social unrest.

- The weakened economy has also slowed down the ongoing privatisation process, which has so far seen 96 out of 178 state-owned enterprises privatised.

It revised South Africa’s score to 5.0 from 5.5. Despite a plan to increase taxes and cut spending, and an improvement in reducing electricity supply concerns, the downgrade was attributed to, among other things, a new privatisation bill that “will allow for continued political influence.”

It also lowered Nigeria’s reform score to 5.5 from 6.5, noting that “…President Tinubu’s reform drive is losing momentum… Tinubu’s reforms have lost pace due to soaring inflation, potential nationwide strikes, and increasing social unrest.”

- “Following the partial removal of the fuel subsidy and a 40% devaluation of the naira in June, inflation rose to an 18-year high of 26.7% y-o-y in September, “ the analysts noted.

Can Kenya Stay the Course?

As international debt obligations loom, markets are closely watching how Kenya navigates its debt. In July, Fitch Ratings affirmed Kenya’s rating at “B” and revised outlook to Negative. It further warned of “…a significant risk of further fiscal slippage, particularly if the exchange rate weakens further.”

In addition to the current reform program supported by Bretton Woods Institutions, the Trade and Development Bank and the African Export-Import Bank, Kenya has also expressed likely plans to embark on a partial buyback of the upcoming Eurobond maturity.

- So far, President Ruto’s government has embarked on an aggressive fiscal reform program, but its plans to raise revenues may need to be recalibrated in 2024.

- In addition to a weakening shilling that the Central Bank said had been overvalued, an increase in tax rates has reduced consumption of critical tax earners and economic drivers such as fuel.

- There’s also concerns that ongoing customs tax vigilance and an increase in park fees and other places frequented by tourists will reduce or slow down visitor numbers. Tourism is one of Kenya’s top foreign exchange earners.

The rise in the cost of inputs has real economic risks, as its ripple effects on the economy and inflationary pressure will stymie consumption and worsen the cost-of-living crisis. Similar to concerns in Luanda, the government has backtracked on the complete removal of fuel subsidies, increasing them in the Nov-Dec pricing cycle to keep prices unchanged or marginally lower.

Concerns of social unrest and political pressures are likely to shape whether or not some fiscal reforms, especially the aggressive vigilance and new measures to raise revenues, remain unchanged in 2024.