A report by I&M Burbridge Capital shows that Kenya is leading East Africa nations in corporate deals.

As reported by the East Africa Financial Review, there were 9 disclosed corporate transactions in November valued at $35.6 million.

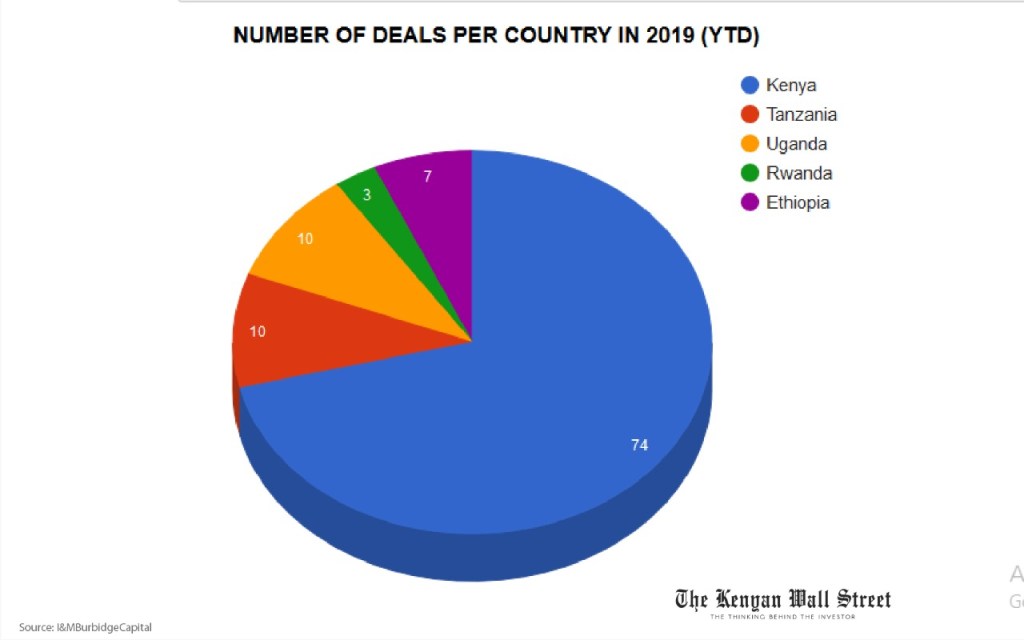

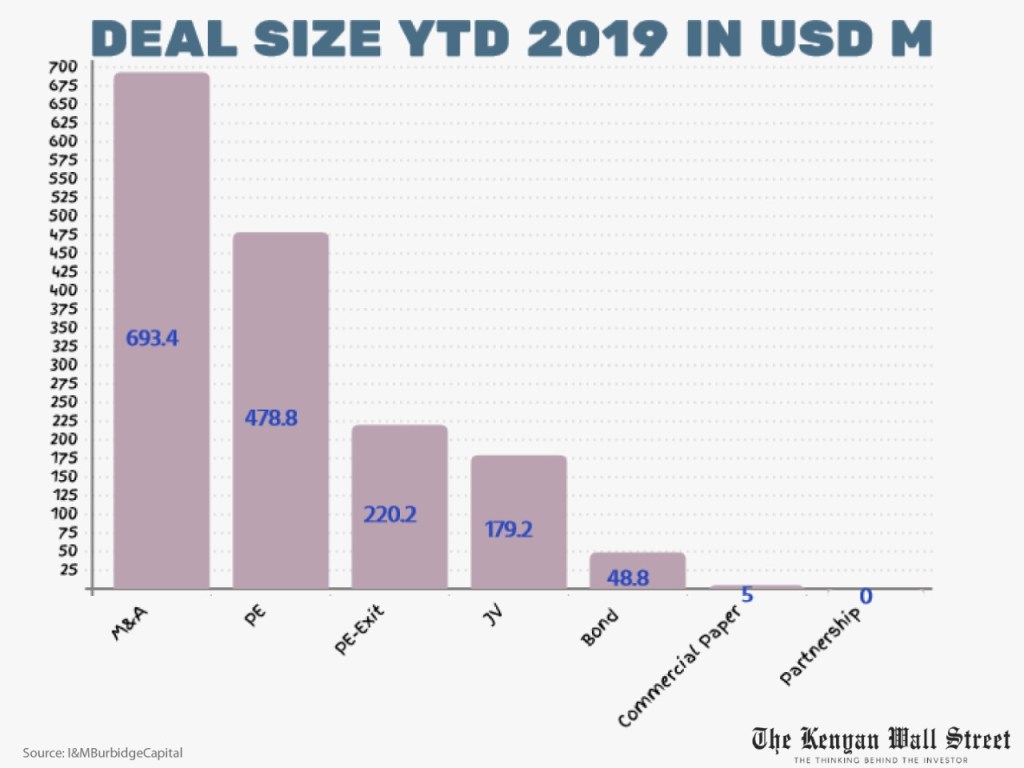

Moreover, total deal value and volume for the year to date (YTD) is $1.62 billion and 104 respectively. Kenya takes the lion’s share with 74 deals out of the 104 to date.

Additionally, 62% of all disclosed deals YTD are private equity transactions although by value mergers and acquisitions (M&A) edge equity transactions.

On the flip side, financial services (45%) had the highest volume of deals YTD, agribusiness (13%), and the energy, oil & gas sector (11%).

Notable deals in Kenya for November include;

- •Fund manager ICEA Lion Asset Management acquired its rival StanlibKenya in a deal estimated at more than KSh1.5 billion.

- • ViktoriaBusiness Angels Network (VBAN) and Pangea Accelerator together invested $200,000 in Kenyan startupManPro.

- • Nairobi-based fintech startup Asilimia raised $350,000 in funding from pan-African investment firm the Unicorn Group. Asilimia helps small businesses make transaction-free mobile money payments and also provides its users with access to financial services.

Related:

East Africa’s Top PE Firms & Venture Capitalists Feted in Gala