Kenya Airways has released a performance report for the nine month period from 1 April 2017 to 31 December following a board resolution to change the airline’s year end from 31 March.

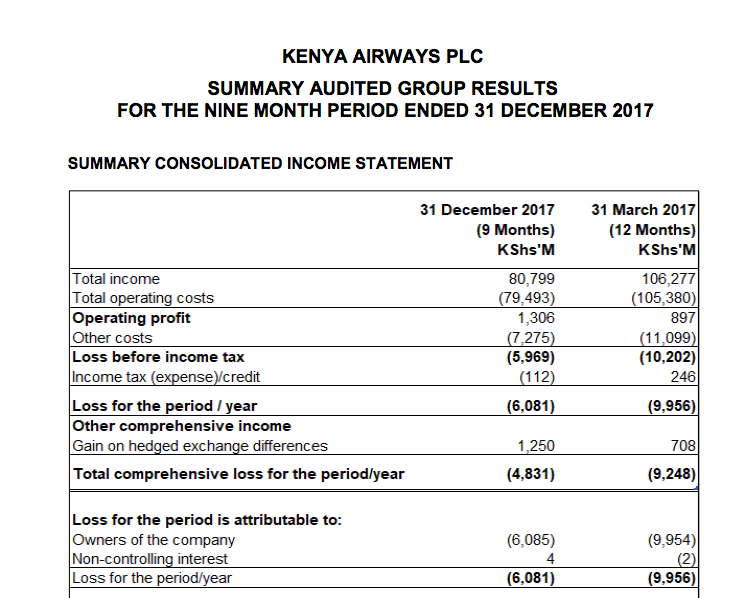

Loss before tax for the 9-month period was KShs 5.97 billion compared to a loss before tax closed of KShs 10.2 billion the prior year ended 31 March 2017 .

KQ chairman Michael Joseph said that the long electioneering period & rising fuel costs had negatively impacted the business. He further added that yield per revenue passenger kilometre declined by 6.5% citing market capacity pressure and currency fluctuations. Domestic traffic during the period declined by 20%.

“The Group’s revenue for the period under review were heavily impacted by the elevated political tension as a result of the prolonged electioneering period which saw reduced transit and terminating passenger through our hub at JKIA.” noted Michael Joseph.

On a positive note, fleet costs reduced to KShs 10.6 billion compared to Ksh 15.5 Billion in the prior year ended 31 March 2017. Operating profit for the nine month period was KShs 1.306 Billion compared to Ksh 897 million posted in the prior year covering 12 months.

According to CEO Sebastian Mikosz, the airline’s direct flights to New York are expected to grow KQ’s top-line numbers by 8% to 10% with the full effect to be realized from full year 2019 onwards.