Banks are part of the core elements of any modern economy. With the rapid evolution of the modern financial ecosystem, it is fundamental that banks strategize timely and effectively to keep in step with the ever changing face of commerce. As one of Kenya’s largest banks, Barclays Bank sits at the heart of the country’s economy. Holding such a market share means that Barclays has to be developing a dynamic business model to keep in stride with evolving customer needs and market expectations.

Putting the strategic period in context over the last 5 years as noted by the Chief Executive Jeremy Awori, the bank has doubled its balance sheet, generated Kes 7bn of new revenues from new and existing businesses, established a new business bank from scratch currently with Kes 25bn of assets and re-invested in a bank that was underinvested in the prior strategic periods. According to Jeremy, the bank has gained market share and turned around from negative growth rates in 2011 – 2012 to post double digit balance sheet. As at quarter 3 2017, Barclays has gained one market position to no.4 and has set its sights to returning to a top lender position.

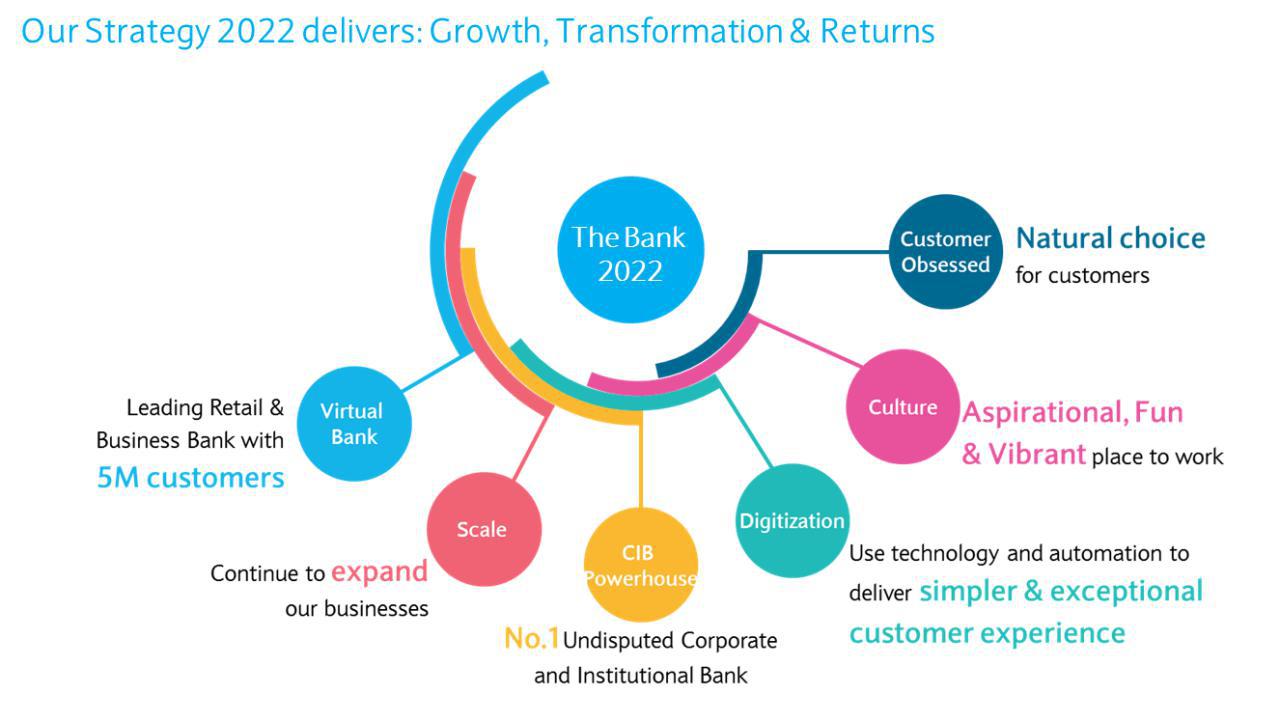

Looking ahead, Barclays Kenya has mapped out a new 5-year strategy to transform the bank into an even more competitive and dominant market player. Let’s explore the composition of the new “Strategy 2022” according to an investor presentation by the Chief Executive Jeremy Awori and the Head of Strategy Moses Muthui.

The strategic foundation

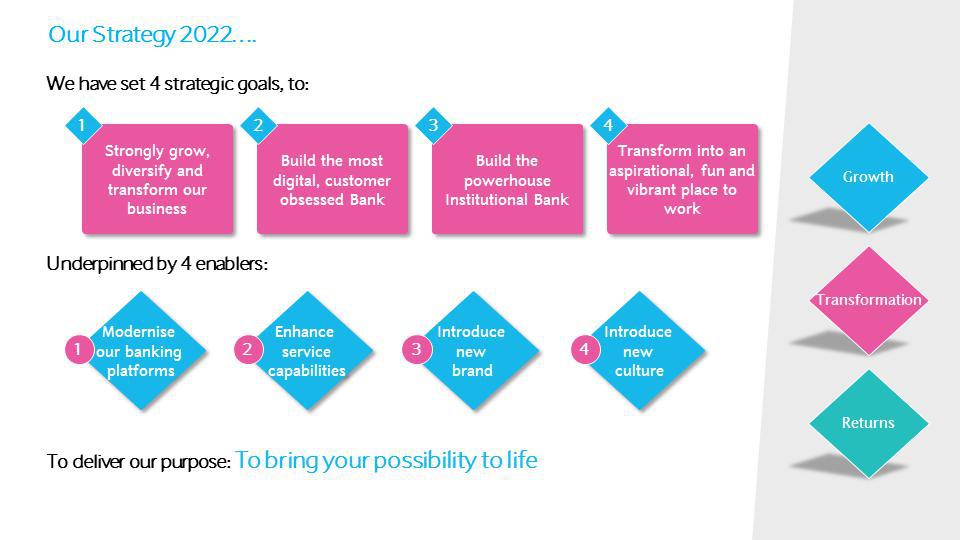

The underlying aspiration of the new strategy is to deliver Growth, Transformation and Returns. This strategy was formulated over the last one year, with the arrival of the ex-Wall Street Investment Banker Moses Muthui to head a newly created Strategy unit.

The strategy formulation process was based on 4 simple but fundamental principles:

Fact-based: Analytical rigour and data-driven.

Collaborative: Continuous feedback from various stakeholders of the bank including customers, employees, regulators and the group head office;

Bold: Material dial movers, Innovative and forward looking

Localized: Adjustments to adapt to the idiosyncratic characteristics of the Kenyan market while aligning with the ‘One Africa’ strategy of the parent company Barclays Africa Group, and globally relevant.

According to Moses Muthui, articulating the way forward requires comprehensive understanding of the complexity of the external operating environment and the consequent internal imperatives; Along with an introspection of the bank’s strengths, strategic challenges and strategic responses and tying all that into strategic priorities, enablers, a measure of success and a singular purpose.

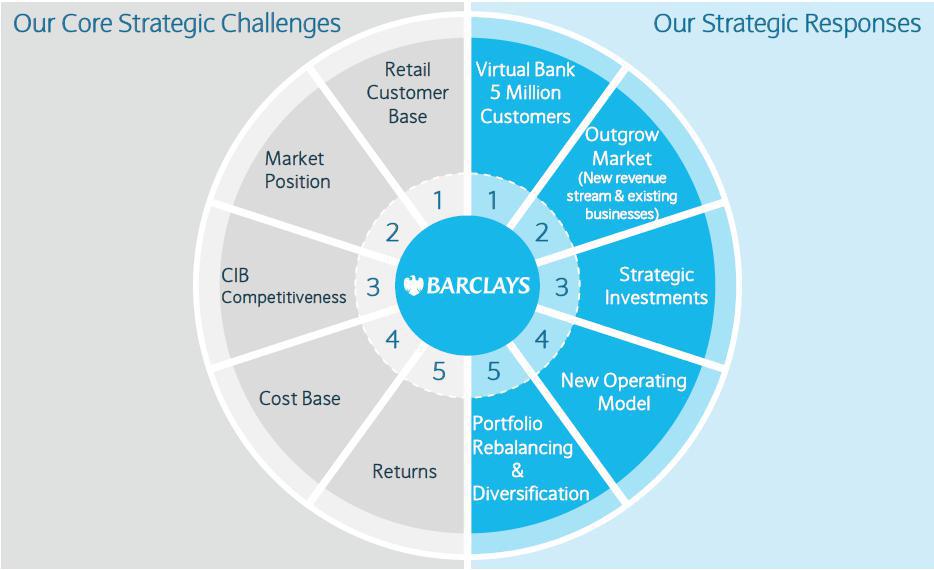

Commenting on the operating environment forecast, Barclays highlights 3 key phenomena: firstly, the global trend and regional imperatives in banking industry post 2008 global financial crisis; secondly, the evolution of technology, which plays a vital role in changing customer behaviour and paving the way to new non-bank players into financial services; and lastly, the continued evolution of expectations of different stakeholders such as the investors, the society and colleagues. No great undertaking is without challenges. As such here is a chart of the 5 immediate strategic challenges and the strategic responses that that the bank is setting out to execute.

As we know money does make the world go round (Astronomers do not attest to this). Hence, to generate the essential profit margins, the bank determined 4 pillars of the shareholder value creation process:

High operating leverage: A larger profit margin through achieving the right pricing adjusted for risk and the right cost to serve;

Optimized financial leverage: A favourable level of profit generations from fixed income securities through changes in capital allocation, capital distribution and valuations;

Strategic investments: Accelerating investments in initiatives leading to long term yields;

Portfolio trade-offs: Securing short-term returns through evaluating and rebalancing the balance sheet portfolio.

The go-forward strategy

Against that strategic foundation backdrop, the Chief Executive illustrated their Strategy 2022 to deliver Growth, Transformation and Returns with the following key highlights. To add on the announcement of changing the brand from Barclays to Absa, the bank said this change is in line with regulatory requirement following the reduction in controlling interest of Barclays PLC in Barclays Africa Group Limited, which is the parent company of Barclays Kenya. Subject to regulatory and shareholder approval, by June 2020, the bank will be known as Absa. The bank also reassured that significant planning activities have been completed and solid execution is underway.

To add on the announcement of changing the brand from Barclays to Absa, the bank said this change is in line with regulatory requirement following the reduction in controlling interest of Barclays PLC in Barclays Africa Group Limited, which is the parent company of Barclays Kenya. Subject to regulatory and shareholder approval, by June 2020, the bank will be known as Absa. The bank also reassured that significant planning activities have been completed and solid execution is underway.

With the Strategy 2022, accountability, digitization, active public participation, customer obsession, and focus on growth & returns are at the forefront. The strategy seeks to draw operation guidelines and business culture from the operating eco-system rather than from traditional corporate culture.

The end-to-end digital transformation strategy creates a symbiosis between enhanced front-end digital customer experience and the simplified & automated back-end processing. The development on front-end platforms transforms the back-end, which in turn powers the front. Both will draw heavily from digital talent and culture.

Commenting on the side-lines of the recent launch of the new virtual, Barclays Bank Kenya Head of Strategy Moses Muthui said, ‘The launch of our virtual consumer and SME bank is a revolutionary step towards achieving our 2022 ambitions. We aim to on-board 5 million customers on the virtual banking platform, delivering simpler and exceptional customer experience and applying best in class modern day technology in providing finance. We see this launch as a first step towards that goal.”

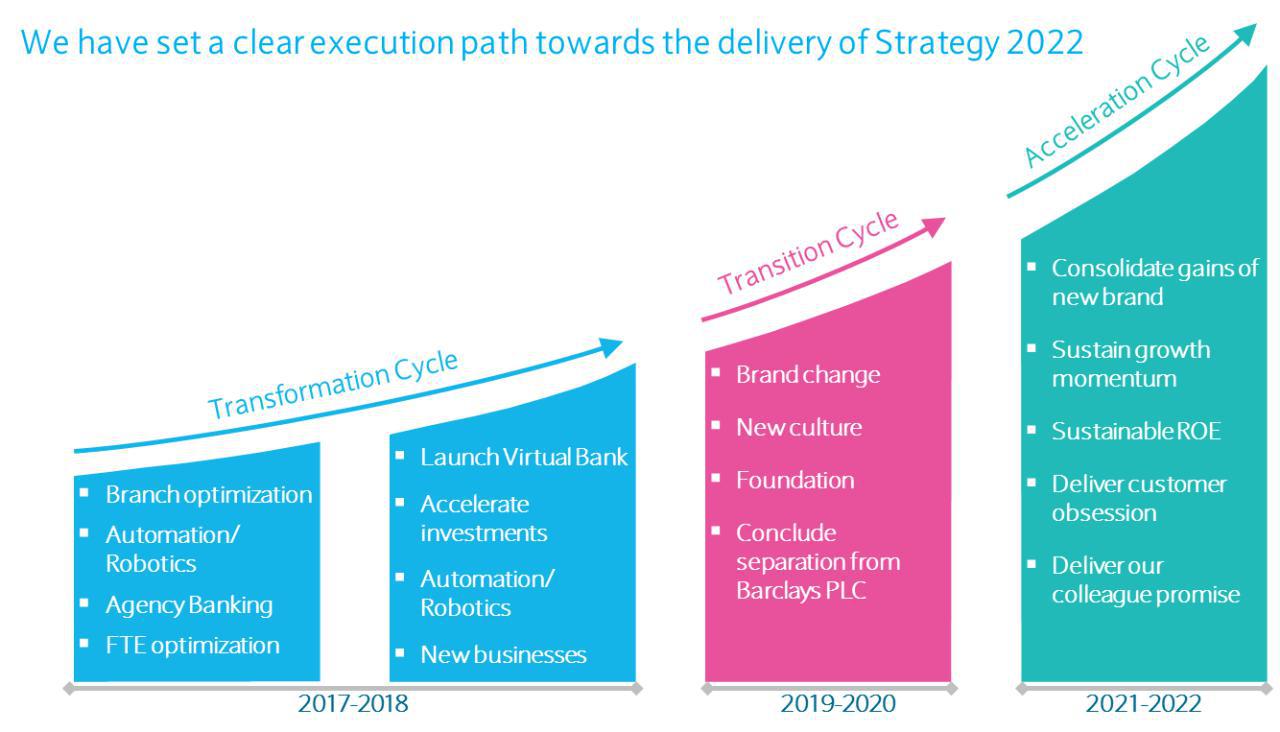

- The road map to the Strategy 2022 is broken down into 3 phases:

- The transformation cycle (2017-2018) will see localized transformations and adjustments to existing business mechanisms;

- The transition cycle (2019-2020) will involve major changes to the face of the company including the Absa rebranding and the conclusion of separation from Barclays PLC;

- The acceleration cycle (2021-2022) where there will be rapid movement towards achievement of long-term goals.

- The put the success of Strategy 2022 in context, the Chief executive shared the feel & look of the bank projected in 2022:

It is our view that Barclays has set the pace for the Kenyan banking industry in designing and articulating a clear strategy to external stakeholders.

It is our view that Barclays has set the pace for the Kenyan banking industry in designing and articulating a clear strategy to external stakeholders.