“In the last year 171 employees left through natural attrition but we do not see technology having a huge impact on the number of staff” Barclays Bank Kenya CEO Jeremy Awori.

This past week, Barclays Bank of Kenya became the first lender to announce its 2016 FY results posting impressive top line growth and a slight decline in the bottom line numbers. The results by the bank were delivered during a tough year for the banking industry as a whole considering that in the previous quarter, the Banking Amendment Act seeking to regulate lending by banks in Kenya was effected. Other notable global events such Brexit, the election of Donald Trump as US President have also created uncertainty in the market. At the same time, technology has become an integral part of banking both in service delivery besides presenting a new competing front. We sat down with the Bank’s CEO Jeremy Awori where we discussed the banking amendment act, technology, uncertainty in the market owing to elections and global event and his outlook for 2017.

We sought to understand how Barclays had managed to guard itself against these shocks that would have naturally had a profound impact on the company’s results.

“The results show our diversification strategy is working,” says Jeremy “Our revenue growth is coming through and we continue to offer our customers a different range of products such as bankassurance, we have reignited fixed income, mortgages while at the same time investing in other areas of the economy”, he says.

Mr Awori also noted that the Bank’s 3-5 year strategy has focused on growing their non-funded income component to offer sufficient shocks against events such as the recent enactment of the Banking Act. The strategy is also geared more towards the SME segment by offering customers the services and products they need and this has started to pay off as seen in the results.

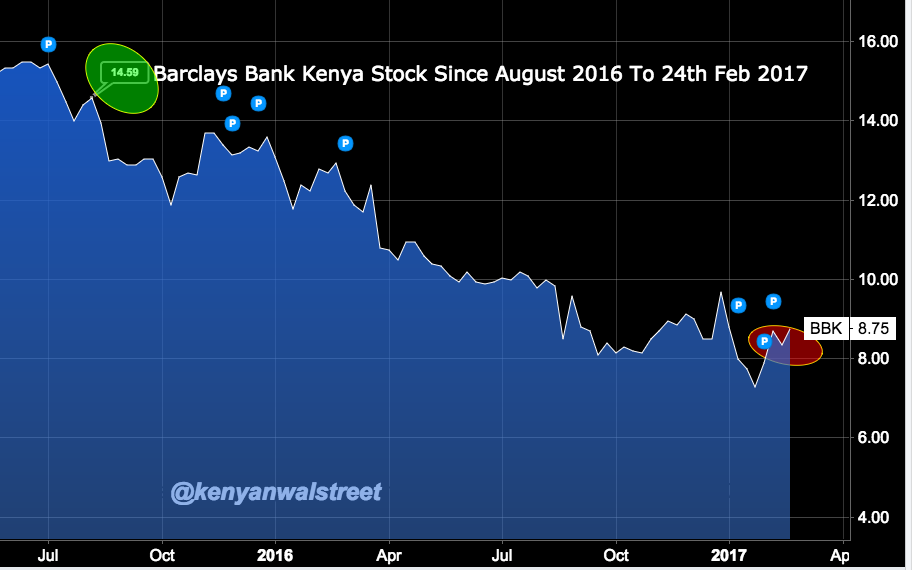

Part of the factors attributed to the decline in the bank’s bottom line was the Banking Amendment Act which has not only had an impact on the bank’s earnings but on their share price at the Nairobi Stock Exchange.

On this Jeremy says there is need for honest reflection on the impact of the law not just to the bank but to the people.

“We need healthy banks providing credit to grow the economy and not just to corporates but to SMEs to scale, people to achieve their dreams and the impact will be felt in terms of economic growth,” he says. “Through an honest revisit, we shall gauge is this the right thing for Kenya? What is the impact of the same towards long term sustainable growth of the economy?” he added.

The issue for the banks is that their revenues have come down while their costs remaining the same. As such, their profits will shrink and this uncertainty will begin to manifest itself on the stock market. “If shareholders do not see a return on their investment, they will have no reason to invest in banking stocks, which is not good for any market,” he says.

At the same time, the law has posed a problem with regards to access to credit for certain customers with banks now becoming more weary against lending to risky borrowers. “Risky customers have had challenges accessing credit because as a bank you cannot get a return for the impairment and delinquency of customers in this segment. So as a bank we have to ensure we continue to identify who to lend to and this inadvertently locks out certain customers,” he added.

Still on risk, 2017 being an election year presents numerous challenges for business regarding political risk. Elections have always had an impact on how companies operate and we sought to understand how Barclays is preparing themselves for the uncertainties around this event.

“We understand how elections impact business but we cannot have businesses work on a five year horizon owing to elections,” he says “We are currently working with different players to build confidence and are hoping leaders from both sides will help the country have stable elections”. Jeremy says he hopes business will remain intact and continue despite the pull back over election as this is good for the overall economy.

Technology continues to dramatically change the financial services industry, particularly in the retail business segment. In the announcement of their results, the bank stated that they have invested about Ksh3 Billion in technology and systems and are still making bigger bets that technology will continue to drive business.

“One of the key things I noted since joining the bank was that the institution had not made large investments in technology both towards innovation and the infrastructure that powers our operations,” he says. The bank’s current investment has been in areas such as cabling, computers servers and the traditional areas of technology. Jeremy says technology plays an important role in that is ushers convenience while delivery of the service is cost effective hence the increased investment.

“Our current technology could not allow us to innovate, where we create solutions and plug them into our ecosystem. The refresh of our IT assets and technology such as ATMs places us ahead and will play a crucial role going forward,” he added.

Jeremy says Barclays is also making bets in the digital space particularly in mobile and is set to launch these soon. “Mobile will be important for our retail customers where will offer them products aimed at making banking convenient for them. The investment in IT on the other hand be it making payments efficient, tax remittance serve an important role for our corporate customers,” he added. The bank has also an internal innovation arm which has been looking towards creating solutions for the banks customers while looking to partner with innovators to drive this space.

This past week, Kenya’s biggest bank in terms of assets KCB announced it will shed 500 jobs owing to the changes fostered by technology. Will this be the case at Barclays as technology becomes a core of the firm’s operations?

“The issue of technology and redundancies has been a key area of focus in the recent past but how I look at it is that our customer channels have evolved over time and will continue to evolve over time. This in turn presents an opportunity to do things in a cost effective way by channeling resources towards areas of the business that need it,” he said. “In the last year 171 employees left through natural attrition but we do not see technology having a huge impact on the number of staff,” he added.

On the outlook for 2017, Jeremy sees the year as a challenging one but he remains optimistic about it. “I believe in 2017 we shall start to feel the full impact of the Banking amendment act as each quarter passes”, he says. “With the elections and several global events, I think it will be a challenging year”. Jeremy says that the bank has a clear strategy that they will continue to execute will evolving as the year goes on to deal with these possible challenges.

“As a bank, you have to remain relevant to your customers to keep them. We shall continue to seek to understand their needs and provide them with services they can afford,” he says.”At the end of the day, our goal is to offer decent returns to our shareholders and this we shall do by implementing our set out agenda”.