Barclays Bank Kenya became the first lender to report its Full year results for 2016 after the signing into law the Banking Amendment Act which aims to regulate lending rates.

In a very challenging environment, the listed lender managed to post a growth of 11.21% in interest income to Ksh 28 Billion largely driven by a modest increase in interest from loans, government bonds and other income. Non Interest Income shot up by 9% to Ksh 22..3 Billion compared to 2015’s 20.41Billion.

On the Bottom line, Barclays Profit After Tax fell by 12% to Ksh 7.4 billion compared to Ksh 8.4 Billion in the previous year. Profit Before Tax also declined by 10% to Ksh 10.85 Billion from Ksh 12.07 Billion in 2015.

“The performance was however impacted by an increase in impairment as well as the implementation of the Banking Amendment Act in Q4.” The Bank said in a statement.

Notable Improvements;

Despite the Interest Cap Bill, Barclays Bank managed to grow its Loan Book by a whooping KSh 24 Billion from Ksh 145 Billion in 2015 to Ksh 169 Billion in 2016. The Bank posted the fastest Growth Quarter on Quarter given that in the nine months to Sept, its loan book grew from Ksh 145 Billion to Ksh 158 Billion vs Ksh 169 Billion as of December.

Related; KCB Group to Lay Off Over 500 citing tech changes & interest cap regime

Customer deposits also increased by 8% to Ksh 178 billion mainly driven by savings and transactional accounts.

The Bank posted a profit of Ksh 885 Million from fixed income from loss of Ksh 453 Million in 2015 and a massive 127% growth in its bancassurance business.

Generally, revenue was on the upward by 8% to Ksh 31.7 billion while customer asset book grew 16% to Ksh 169 billion. Corporate and SME businesses registered 33% and 25% growth respectively.

“During the period under review, impairment grew due to a turbulent macro-economic environment which caused heightened job losses resulting in higher than usual default rates especially in unsecured personal loans. The growth in impairment was also driven by the early adoption of some aspects of the more conservative global accounting model IFRS 9.” The Bank’s CFO Yusuf Omari noted.

Related; East African Portland Cement records HY Loss Before Tax of Ksh. 533Mn

However, since Njoroge happened, there have been new prudent reporting guidelines and this led to Barclays Non Performing Loans surging to Ksh 11.4 Billion. Gross NPLs Ratio increased to 6.5% from 3.6% but still below the industry average of 9.1% as of Q3 2016.

The Bank’s CEO, Jeremy Awori noted that they had invested close to Ksh 3 Billion in Technology in order to grow their online and mobile banking channels adding that they expect the number of transactions in these outlets to rise by over 250%.

The lender retained its dividend payout of Ksh 1.0 per share.

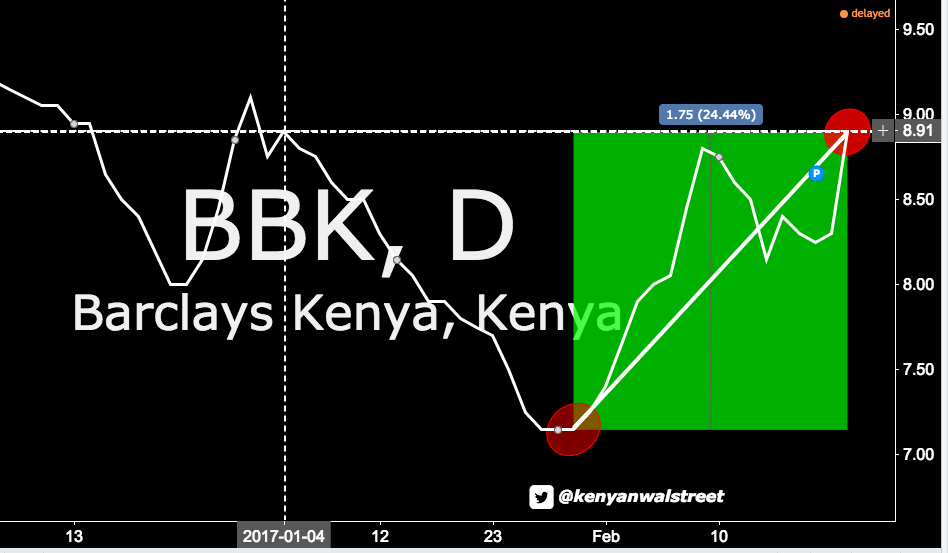

Share Price Performance

At the Nairobi Securities Exchange, Barclays Bank stock on Wednesday hit a 2017 High of Ksh 8.90, having rallied by more than 24.44% since the 1st of February as shown in the Chart Below.