Foreign investors who account for a significant contribution to equities turnover shied away from the Nairobi Securities Exchange (NSE) as they chased yields in safer jurisdictions, the CMA Market soundness report Q4 2022 has revealed.

The foreign net equity outflow during the quarter, however, reduced to KES 4.87 billion compared to the KES 6.97 billion recorded in the previous quarter.

The equity turnover ratio in Q4 reduced by over 22%, from 0.36% to 0.28%, reflecting lower market liquidity.

The report identified the lingering Russia-Ukraine war, aggravated cost of living and energy crisis on the global front as the most pressing economic risks facing investors.

Consequently, global growth is forecast to decline to 2.7% in 2023 from 3.2% registered in 2022, with the World Bank warning that it could further weaken to below 2 per cent.

However, the domestic capital markets remained sound amidst exogenous shocks.

During the quarter, volatility for the three market indices, NSE 20, NSE 25, and NASI, reduced from 0.49%, 0.60%, and 0.89% to 0.42%, 0.46%, and 0.48%, respectively, which was attributed to the market having shaken off the post-election jitters, with no panic selling by investors, coupled with the slowing down of foreign investors trading.

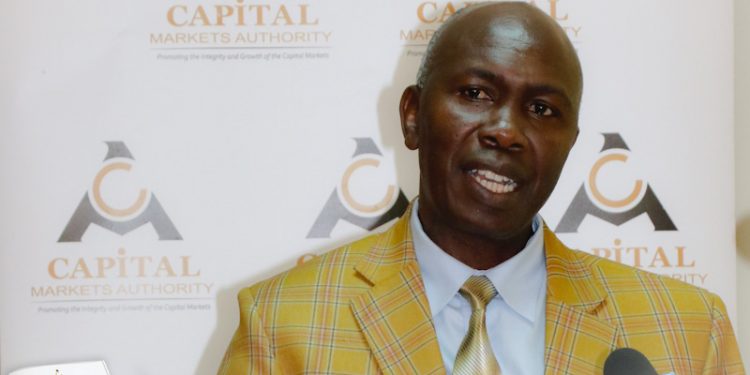

CMA Report

The CMA projected that market Volatility is projected to remain low in 2023.

The report further noted that global equity markets registered high volatility in 2022 due to the sustained aggressive monetary tightening by central banks globally, increased bond yields and geopolitical risks. While the MSCI Emerging Markets index lost 19.74% YTD in 2022, some developed markets saw benchmark indices declining in the range between 9-20%.

Consequently, global debt markets activity declined by 19% compared to 2021, totalling $8.3 trillion during the full year 2022, with the number of new fixed income offerings slowing down by 12% compared to debt offering transaction values of 2021, totalling 26,6257 deals.

The Market soundness report recommended favourable conditions to be set in place to avert a global economic downturn in 2023.

“Favourable conditions seem to be set in place to avert a global economic downturn in 2023. The effects of monetary policy tightening are projected to tame inflation by the first half of next year, leading to a normalization of monetary policy. This will be critical in supporting positive investor sentiments as the securities market becomes more attractive for investors. Corporates will be enabled to borrow at lower interest rates, while the equities market will be more attractive in an environment with low single-digit inflation.”

CMA in the report.

Read also; CMA Extends Licence for Nairobi Coffee Exchange.