There are all indications that commercial banks will experience a significant increase in the number of loan defaulters as the global coronavirus pandemic affects virtually all sectors of its economy.

Although commercial banks have entered into fresh repayment as well as loan moratorium agreements with individual borrowers as well as firms, currently experiencing difficulty in meeting their loan repayment obligations, experts warn that the situation will get worse when these amnerty agreements lapse.

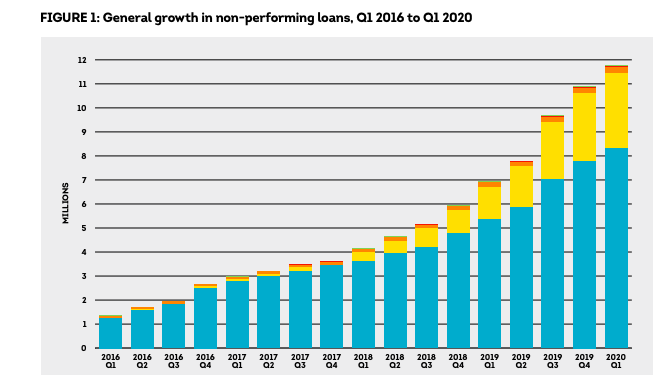

According to the latest TransUnion Q1 2020 Kenya Market Analytics Report, the credit market is under strain as the level of number of defaulters and non-performing loans (NPLs) increase significantly.

This is despite pressure from the Central Bank of Kenya (CBK) for commercial banks to enter into negotiations with financially distressed borrowers.

Despite the total number of loan accounts increasing by 21% from 108.2 million in Q4 2019 to 131.4 million in Q1 2020, the report notes that banks appetite to lend dropped as most of them have been hoarding cash to cover the anticipated effects of the COVID-19 crisis.

While Mobile loans make up to 75% of loan accounts offered by Kenya’s banking sector, the total number of mobile loan borrowers increased to 10.2 million in Q1 2020 from 6 million in Q4 2019.

With more customers shifting their transactions from bank accounts to mobile wallets, this has denied commercial banks a huge chunk of revenues that is part of their non-funded income.

The consumer credit reporting agency expects that over the next few months-when these loan moratoriums lapse-, the volume of non-performing loans will increase significantly. This is as the rising rate of COVID 19 infections continue to disrupt small businesses, big corporates and households.

“With COVID-19 changing the economic and consumer landscape at pace, we are likely to see a deterioration in the Q2 2020 data, reflecting the impact of COVID-19 on the credit market from April 2020,” says TransUnion Africa Product Director Samuel Tayengwa.

A Survey by Kenya Bankers Association (KBA) titled Spillovers and Feedback Loops: The Banking Industry’s Response Scenarios to the Effects of COVID-19 Pandemic outlines that 65% of banks expect non-performing loans (NPLs) to increase to 14 per cent from the current level of 12.4%.

ALSO READ:

Kenyan Banks Restructure Personal Loans Worth KSh 102.5 Billion – Central Bank

Kenyan Banking Industry to Survive Pandemic, KBA survey

Majority of Kenyan Banks Now Offer Mobile Banking – Survey