Initial Coin Offerings (ICOs) were a big deal in 2017 where start-ups raised billions of dollars to fund their projects. As a matter of fact, 30 percent of seed investments in 2017 were sourced from ICOs. Therefore, 2018 could also see an increase in ICOs not only in the rest of the world but also in Africa. For instance, Nigeria’s SureRemit ICO just recently raised $7 million.

What is an ICO?

Companies can secure funding in different ways: through angel investors, Initial Public Offerings (IPO), and ICOs. During an IPO, a company puts up its shares for sale to the public, initially at cheap prices. If the company becomes successful, the shares will, as a result, grow in value.

On the other hand, an ICO is based on this same idea but the blockchain environment. That means that ICOs are not controlled by a central authority hence they are unregulated. Additionally, rather than giving shares to investors, ICOs offer investors tokens in return for their investments.

Therefore, if you are interested in the project behind an ICO, you simply send the team your money in either Ethereum or Bitcoin and in return you receive the corresponding amount of tokens.

One of the most important factors when evaluating the viability of a coin is that the coin should solve a real issue that’s not covered by another coin. However, most of the time, a majority of coins always fail this taste and many are simply money grabs.

Nurucoin

According to their site, Nuru Inc, claims to be a blockchain company running the NuruCoin ICO, founded by Pastor Isaac Muthui. According to a TechishKenya interview with the founder/CEO, the company is incorporated in Mauritius because of the country’s Regulatory Sandbox License.

They say the goal of the ICO is to fund Blazebay, an e-commerce platform that will enable intra-African trade using the NuruCoin token. The pre-sale which ended pre-Valentine’s day was going at Sh10 and at a 40 percent discount. Basically, all you had to do was pay Sh10 in Ethereum and in return get the equivalent NuruCoin token. The ICO begins this month.

RED FLAGS/CONCERNS

- Their goal is clear but the same idea can be achieved using bitcoin. Additionally, the concept does not improve on the innovation of current cryptocurrencies.

- Social Media Activity; Nurucoin has very low social media presence with less than 800 followers on Twitter as of Wednesday 14th Feb 2018. Most importantly, they don’t have a Telegram or Slack group which is a critical factor when building a community.

- NuruCoin through their website CLAIM that they are working on prototype which currently has 150 registered merchants, 100,343 community members, and 5,664 investors. There’s no evidence on the above claims.

- Nurucoin whitepaper was initially available on its website but it has recently been revealed that it was allegedly copied from the Monetha ICO’s whitepaper. Presently, the white paper is not available on the website.

- From its website, NuruCoin is backed by a board of directors and a team of advisors. Some of the team members that Kenyan Wall Street reached out to were unresponsive. However, Mark Senteu, a founding partner boldly stated, “We were bold enough to trust and believe in the first cryptocurrency Mpesa! We can now invest in our own. It is our right and privilege to make the future […].”

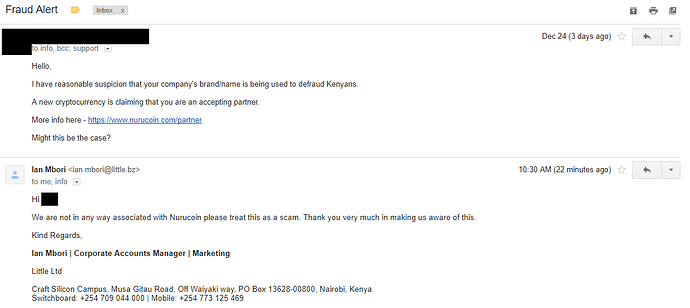

- Initially, Nurucoin’s website had listed local taxi hailing platform Little and Jambo Pay as one of its partners which ideally means that the two companies will accept the coin as a mode of payment. However, the two companies have since been delisted from the website without explanation. In fact, an online user on Techweez Forums recently contacted Little to inquire about the firm’s relationship with Nurucoin. Below is Little’s response;

- Are the ICO funds being stored in an Escrow wallet? Unknown

- NuruCoin’s compatible wallets; Unknown

- Blockchain and crypto-currency developers; Unknown

- Team strength; The NuruCoin team has no previous experience in the blockchain and cryptocurrency space. Listed advisors are not prominent members in the cryptocurrency world. The entire team has neither shown dedication towards their goal nor the talent to make it happen.

- The partners listed on NuruCoin’s website are associated with Churchblaze. Muthui the CEO of nurucoin is also the CEO of Churchblaze.

- There’s no legal framework between developers and contributors

- Nurucoin ICO is not listed in any Exchange

We reached out to Kenya’s Central Bank to get their opinion on the coin, their response was that their stand on Bitcoin and other crypto currencies stands across the board.

Should You Invest In The Nurucoin ICO?

The choice to invest in the NuruCoin ICO will depend on if you believe in their goal or not. Furthermore, the decision to invest in your money in an ICO will eventually rest with you.

Are we in an ICO bubble?

The popularity of ICOs has led many to wonder if we are in an ICO bubble. According to an article by Blockgeeks, the internet was a big deal in 1997 and a lot of tech companies emerged. Everyone was investing their money in these companies driven by the fear of missing out. In fact, the craze resulted in investors throwing caution to the wind and investing in businesses blindly.

In 2002, the internet bubble popped and most of these companies failed while others turned out to be nothing but scams.

Warren Buffet, one of the most successful global investors, said, “The fact is that a bubble market has allowed the creation of bubble companies, entities designed more with an eye to making money off investors rather than for them.”

Similar to the internet bubble, ICOs are appealing to people who want to cash in and get rich. However, whether we are in an ICO bubble or not will be determined in time. For now, though, we can see that ICOs are fickle. The fact that they are unregulated and driven by speculation makes them risky ventures for investors. In addition, blockchain projects in most cases will lead to nothing even though they are not necessarily scams. Then again, “Africa coins” appear more like money-making opportunities than projects that actually want to make a difference.

So its important for any ICO investors to do a lot due diligence. Unfortunately, there are a lot of new and ignorant people in this space, so many will lose their money before some of these scams get exposed.