History

ICDC was founded in 1954 as a government parastatal, whose primary objective was to provide a vehicle for Kenyans to invest in the economy of newly independent Kenya by investing in Kenyan companies. In 1967, ICDC formed the subsidiary ICDC Investment Company Limited, whose shares were listed on the NSE.

In 1998, with the Government of Kenya having sold some of its majority shareholding, ICDC Investment Company adopted a new management structure, handing over day-to-day management to an independent professional managerial team, supervised by an independent board of directors elected by the shareholders.

In 2007, the shareholders changed the name of the company to Centum Investment Company Limited. The shares of Centum Investments Company Limited have been publicly traded on the NSE since 1967 and on the USE (Uganda Securities Exchange) since 10 February 2011.

Profile

Centum Investment Company Limited is a Kenya-based investment company.

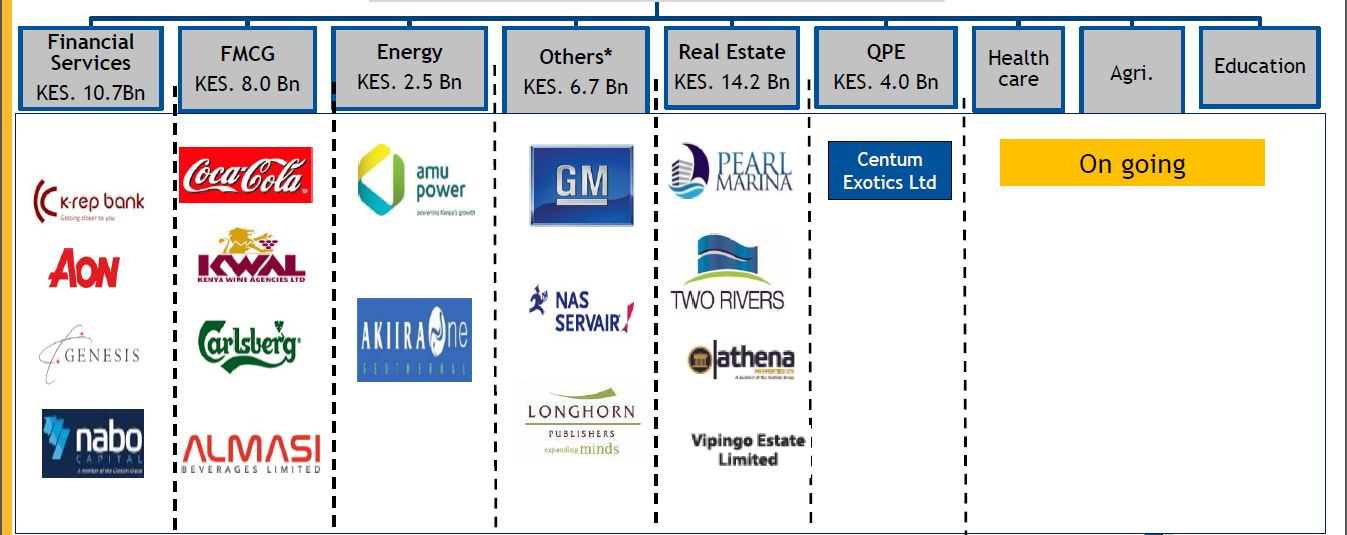

The Company operates through segments, including Financial Services, Fast moving consumer goods (FMCG), Energy, Real Estate, Quoted equity and others.

The Company’s real estate and infrastructure subsidiary, Athena Properties Limited, is engaged in developing real estate solutions, including retail, entertainment, offices, hotel and serviced apartments.

The Company’s real estate projects include Two Rivers project in Nairobi, and Pearl Marina project in Uganda.

It has interests in the sectors, including asset management, banking and microfinance.

The Company is a developer and sponsor of power assets in the east African region.

The Company, through its subsidiaries, is engaged in manufacturing, distilling, importing and distributing alcoholic beverages.

Its subsidiaries include Rasimu Limited, Centum BVI Limited, eTransact Limited, Centum Exotics Limited, Almasi Beverages Limited and Nabo Capital Limited.

Financials

HY 16 Results

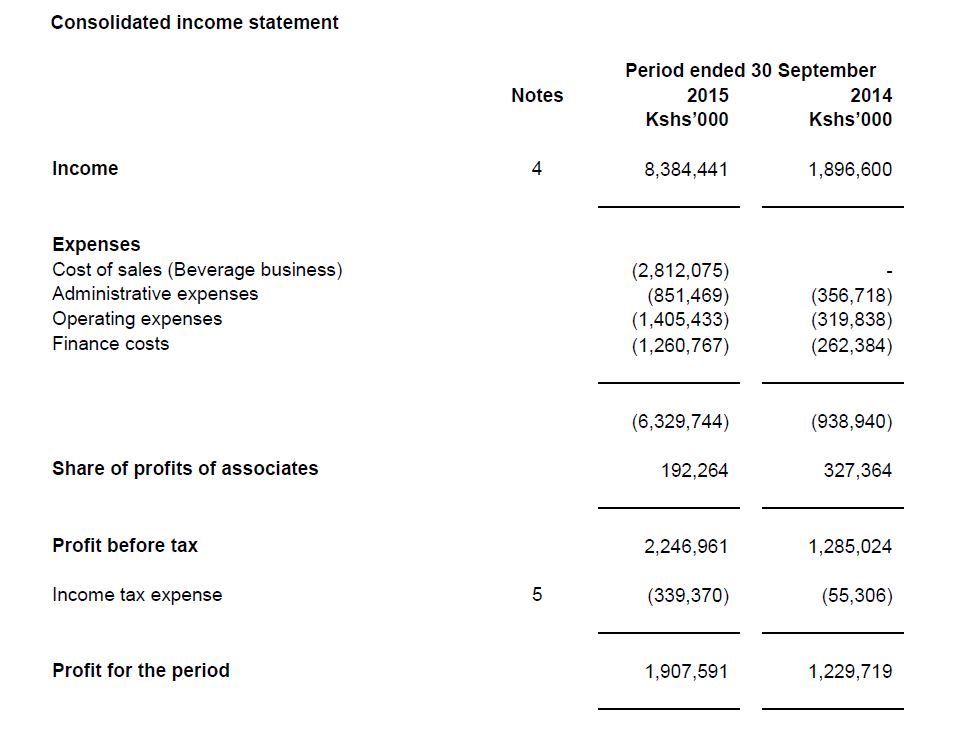

For the six months ended 30 September 2015, Centum Investment Company Ltd. revenues increased from KES1.9B to KES8.38B.

Net income increased 55% to KES1.91B.

Net income was partially offset by Share of Profit of Associates decrease of 41% to KES192M (income).

Asset Growth

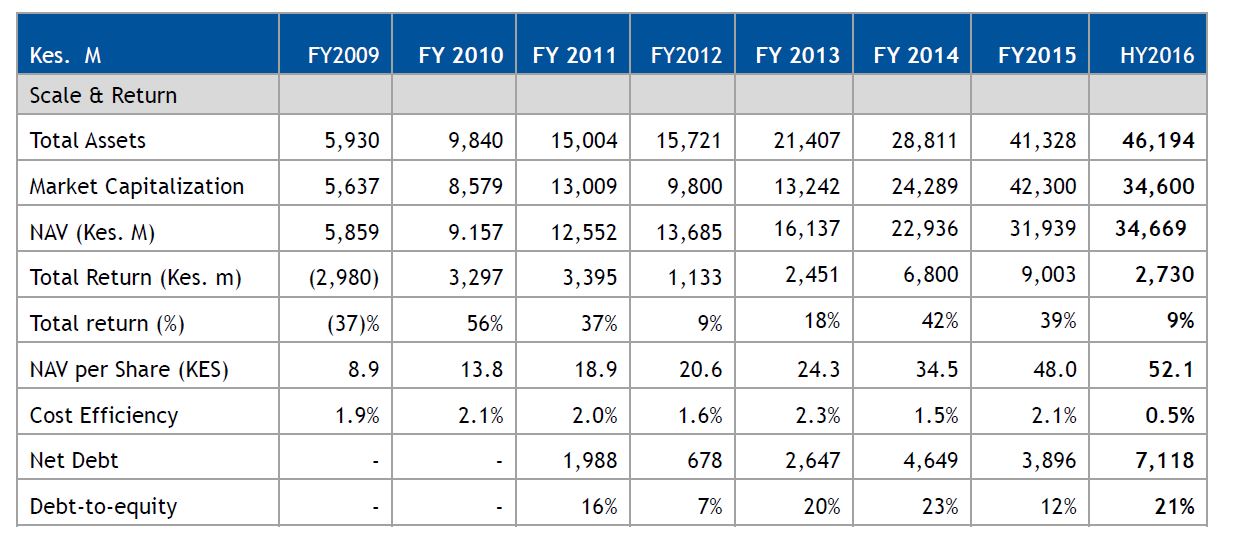

Centum has been able to grow their asset base consistently year on year and have managed to keep their debt levels at manageable levels. Their current debt to equity is at a comfortable 21%.

Recent Deals

– Old Mutual’s property division, Old Mutual Property (OMP) invested Kenya Shillings 6.4 Billion in Two Rivers Lifestyle Centre (TRLC), the holding company for the Two Rivers Mall, The announcement was made public on January 14th 2016.

Shareholder Analysis

Total Number of Shares in Issue: 665,441,714

Free Float: 85%

More than half the company is owned by local individuals and local companies.

Top 10 Shareholders

- •CHRISTOPHER JOHN KIRUBI – 26.52%

- •INDUSTRIAL & COMMERCIAL DEVELOPMENT CORPORATION – 22.97%

- •CHRISTOPHER JOHN KIRUBI – 1.67%

- •UGANDA SECURITIES EXCHANGE – 0.89%

- •JOHN KIMANI KIBUNGA -0.89%

- •INTERNATIONAL HOUSE LIMITED – 0.81%

- •STANDARD CHARTERED KENYA NOMINEES LTD A/C KE002070 -0.77%

- •THE JUBILEE INSURANCE COMPANY OF KENYA – 0.69%

- •JAMES MWORIA MWIRIGI – 0.61%

- •INTERNATIONAL HOUSE LIMITED – 0.59

Notable Institutional Investors

- •BI Asset Management Fondsmæglerselskab A/S

- •Silk Invest Ltd.

- •Nile Capital Management LLC

- •Alquity Investment Management Ltd.

- •Stanlib Asset Management Ltd.

- •Ashburton Fund Managers (Pty) Ltd.

- •Parametric Portfolio Associates LLC

- •Evli Fund Management Co. Ltd.

- •Galler Kantonalbank AG (Private Banking)

- •Old Mutual Global Index Trackers (Pty) Ltd.

Foreign Investor Movement

Share Price

Current share price: KES 46.25 (Friday 5th February close)

In analyzing the following the chart, take the following into consideration:

- •ICDC had an Additional Offer in 2001 where KES 211.9Mn was raised the subscription level was 64%

- •Bonus Issue in June 2010 with a ration of 1:10

We managed to chart out Centum’s chart since 1995 and we have to say it has been an interesting ride for the long term investors.

Interestingly Centum closed at an all-time high of KES 334.71 in 1/10/2006, volumes traded on that day were 3.69Million.

From the above chart Centum touched an all-time-low of around KES 7.02 per share in early 2009, this was after the 2007/08 post-election violence and the Global Financial Crisis of 2008.

We now narrow the chart down from 2008 when the current Managing Director and CEO James Mworia took the driver’s seat. On confirming the date he took position at the apex, James Mworia shared the following, “The share was 11.6 on Dec 15 08 when I took office Adjusted for two share bonuses Return is 379%.” Massive returns!

On the other hand if an investor managed to accumulate his position during the share price lows between 2009 and 2010, no doubt that investor would be giving you his ultimate investment story.

Conclusion

Going forward we believe the team running Centum Investments Company is talented and highly motivated ultimately driving continuous growth.

Centum currently maintains a zero dividend policy in order to fund their projects. As an investor the only play left is on capital gains. So far the share price has been moving positively in relation to their Net Asset Value, and as long as their NAV increases, we believe the share price will do the same.

Data Sources: (Centum Annual Reports/Filings, Investor Briefings, Financial Times, Factset Research Systems, CMA Q3 2015 Bulletin)

Other Analysis by Kenyan Wallstreet

Safaricom Analysis

Kenya Commercial Bank Analysis

Kenya Electricity Generating Company (KenGen) Analysis

National Bank of Kenya Analysis

Disclaimer: The contents of this website have been prepared to provide you with general information only. In preparing the information, we have not taken into account your objectives, financial situation or needs. Before making an investment decision, you need to consider whether this information is appropriate to your objectives, financial situation and needs. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.