Kenya Electricity Generating Company (KenGen)

Profile

KenGen is a Kenya-based electric power generation company.

The Company is engaged in the business of developing, managing and operating power generation plants to supply electric power to the Kenyan market.

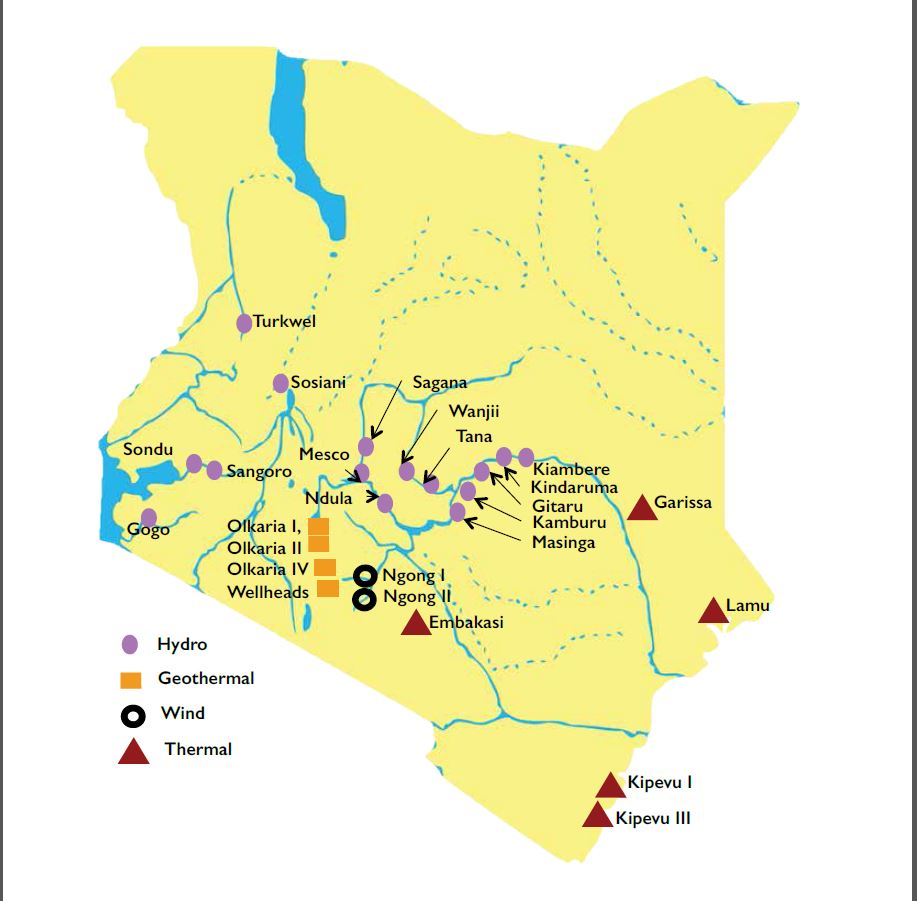

It owns 32 power generating plants with a combined installed capacity of 1,617 megawatts from generation modes, consisting hydro, thermal, geothermal, and wind technologies.

It operates 15 hydroelectric power plants with a combined capacity of 819.9 megawatts.

KenGen develops 508.8 megawatts of geothermal power through six geothermal power plants and 262.5 megawatts of thermal power through five thermal power plants.

It also has a wind farm at Ngong with an installed capacity of 25.5 megawatts.

The graphical image below shows the locations of their generating plants.

Milestones

2015

- •Completed the single largest geothermal power plant in the world; (280MW) project.

- •Largest contributor to the +5000MW in 40 months GOK initiative: with 375MW already installed out of the allocated 844MW to KenGen.

- •ISO QMS 9001:2008 and EMS 14001:2004 recertified.

Financials

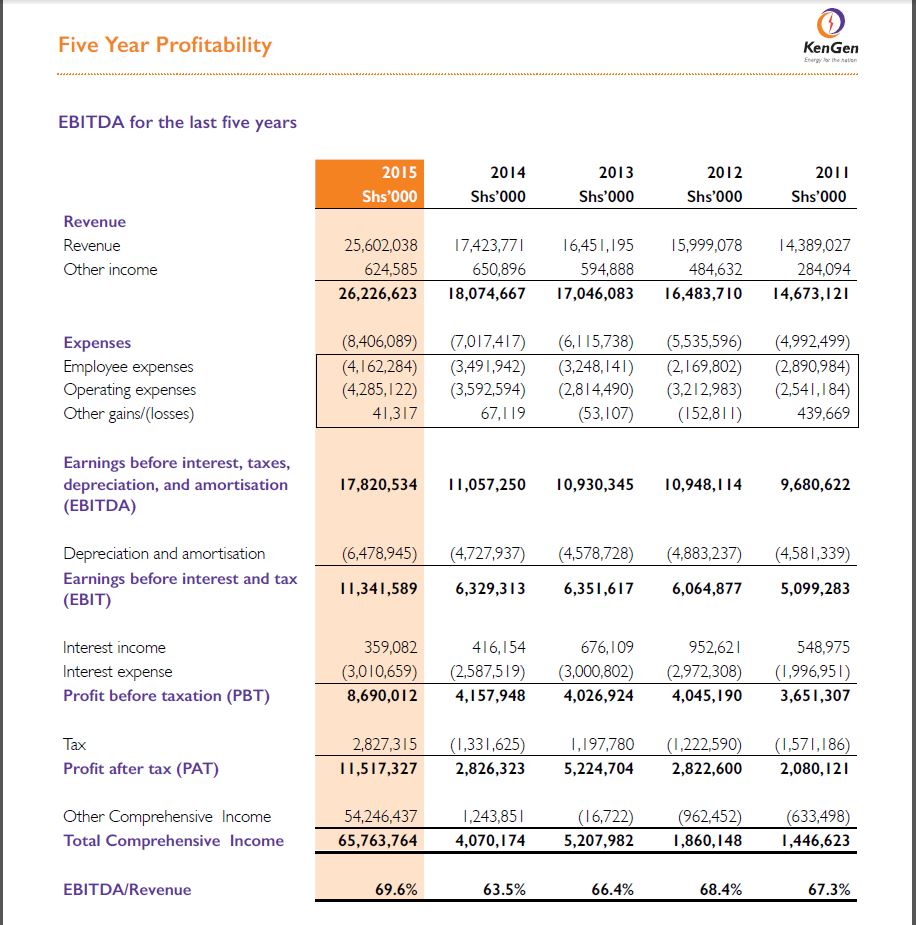

For the fiscal year ended 30 June 2015, Kenya Electricity Generating Company revenues increased 47% to KES25.6B. Which is very commendable.

Net income increased from KES2.83B to KES11.52B. An increase of +307%. This was partly aided by a tax credit of KES 2B and largely driven by capacity growth (Geothermal).

Net income also benefited from Operating Cost decrease of 29% to KES8.41B (expense).

Dividend per share increased from KES0.40 to KES0.65. +63% increase.

Shareholders Analysis

KenGen has a total of 2,198,361,456 shares. Out of these shares around 81% are owned by local institutions, 17% local individuals and 2% foreign investors.

KenGen has a free float of 27.93% equivalent to 614.06 million shares. This is due to the fact that the National Treasury owns 70% of the total shares thus 614 million shares are available to the public.

Top 20 Shareholders

- •CABINET SECRETARY – THE NATIONAL TREASURY – 70%

- •CO-OP CUSTODY A/C 4018 – 0.55%

- •STANDARD CHARTERED NOMINEES A/C 9230 – 0.40%

- •CHASE BANK (KENYA) LIMITED – 0.37%

- •KENYA COMMERCIAL BANK NOMINEES LIMITED A/C 915B – 0.37%

- •CFC STANBIC NOMINEES LTD A/C NR1030682 – 0.35%

- •STANDARD CHARTERED NOMINEES A/C 9098 – 0.35%

- •STANDARD CHARTERED NOMINEES RESD A/C KE11401 – 0.28%

- •STANDARD CHARTERED NOMINEES RESD A/C KE11450 – 0.28%

- •CFC STANBIC NOMINEES LTD A/C R57601 – 0.27%

- •STANDARD CHARTERED NOMINEES NON-RESID A/C 9342 – 0.25%

- •KENYA COMMERCIAL BANK NOMINEES LIMITED A/C 915A – 0.24%

- •STANDARD CHARTERED NOMINEES A/C 9187 – 0.23%

- •NIC CUSTODIAL SERVICES A/C 077 – 0.22%

- •THE JUBILEE INSURANCE COMPANY OF KENYA LIMITED – 0.21%

- •KENYA COMMERCIAL BANK NOMINEES LIMITED A/C 1018C – 0.20%

- •KENSINGTON DEVELOPERS LIMITED – 0.19%

- •STANDARD CHARTERED NOMINEES RESD A/C KE11443 – 0.18%

- •NIC CUSTODIAL SERVICES A/C 045 – 0.18%

- •STANDARD CHARTERED NOM A/C KE12005 – 0.17%

Top 10 Local Individuals

- •PATRICK NJOGU KARIUKI

- •ANDREA LOLLO

- •RAMILA HARJI MAVJI & HARJI MAVJI KERAI

- •ROBERT KAMAU WACHIRA

- •CHANDRAKANT GULABCHAND SHAH

- •JOB KARIRU MURIUKI

- •PETER MUSEMBI MULI

- •RAMABEN SUMANTRAI PURSOTTAM PATEL

- •MAHENDRA KUMAR KHETSHI SHAH

- •MOHAMED ABDI KADIR ADAN

Notable Institutional Investors are Parametric Portfolio Associates LLC, Eaton Vance Management, Old Mutual Global Index Trackers (Pty) Ltd and St. Galler Kantonalbank AG (Private Banking).

Global Competitors

| Company Name | Listing |

| Chorus Clean Energy AG | Frankfurt Stock Exchange |

| Albioma SA | Paris Stock Exchange |

| Federal Hydro-Generating Co RusHydro PAO | Moscow Interbank Currency Exchange |

| Infinis Energy PLC | London Stock Exchange |

| Terna Energy S.A. | Athens Stock Exchange |

| EDP Renovaveis SA | Lisbon Stock Exchange |

| Energiedienst Holding AG | Swiss Exchange |

| Irkutskenergo PAO | Moscow Interbank Currency Exchange |

| Capital Stage AG | Xetra |

| A2A SpA | Milan Stock Exchange |

| Ormat Industries Limited | OTC Markets Group – US Other OTC and Grey Market |

| Polenergia SA | Stockholm Stock Exchange |

| Elektoprivreda Crne Gore A.D. Niksic | Montenegro Stock Exchange |

| Voltalia SA | Paris Stock Exchange |

| Falck Renewables SpA | Milan Stock Exchange |

| Repower AG | Swiss Exchange |

Share Price

KenGen was listed in April 2006 (Nairobi Securities Exchange) and had a subscription level of 333%. We maxed out Kengen’s share price chart and prices almost touched KES 40.00 per share in 2006. Sadly, KenGen has been on a descending trend as shown below and is trading at historical lows. Long Term Investors who have held their positions since 2006 are definitely not the happiest in terms of capital gains and have lost nearly 78% value.

On Friday 11th December 2015, KenGen closed at KES 7.90 up 2.6% week on week. KenGen is down 26.85% YTD.

Flip Side Analysis

KenGen is ultimately a capacity growth story and is currently on track with its set goals. It has a strong asset base in order to develop strategic projects. KenGen has completed the single largest geothermal power plant in the world; (280MW) project in January 2015. Going forward we expect revenues to increase, KenGen is on the verge of a new normal! The impressive 2015 results had not fully taken into account the new power plant (only 6 months) and we expect 2015 revenues to be better.

KenGen plans to exploit fully the Olkaria Geothermal project in 5 years in time.

KenGen is doing a feasibility study on an industrial park and the study is expected to be completed Q1 2016 which will form a basis on configuring the industrial park.

KenGen has also identified a potential Wind Energy site in Meru with a potential of 400MW. Phase 1 they will develop 70-80MW. The deal is in the pipeline and should kick off next year as they are in talks with financiers.

It seems KenGen’s investments are slowly starting to pay off.

In our opinion KenGen is massively undervalued, it has a current P/E ratio of 1.51. It has a book value per share of KES 64.41 (margin of safety). It might take some time before investors start realizing this.

Analysts are giving it a buy recommendation with a short term target price of KES 11.77, a potential upside of 49%.

Your thoughts?