Branch International, a fintech company that pioneered personal loans via smartphones, raised eyebrows early this year when it announced that it was buying Century Microfinance Bank.

The company’s majority acquisition of the microfinance institution regulated by the Central Bank of Kenya made it the first fintech to acquire a regulated bank in the region.

In a statement announcing the deal, the Central Bank of Kenya said the deal would “bring financial services to the emerging markets by leveraging the power of technology.”

In this age of digital services, Fintechs have revolutionized the way people fulfil their banking needs. Even as traditional banking institutions strive to expand their customer base and offer new-age solutions, neobanks—a new entity in the ecosystem—are increasingly becoming prominent in the banking space. NeoBanks operate exclusively online and offer low-cost direct financial services hinged upon the absence of physical branches and their ability to innovate consistently and quickly.

In this article

Branch’s journey to a Neobank

Branch was founded in 2015 by Daniel Jung and Matthew Flannery and the company currently has operations across India, Nigeria, Kenya and Tanzania. Since founding, Branch has disbursed over $600 Million worth of loans to 5 million borrowers around the world.

Before the acquisition, Branch had been a leader in an earlier wave of fintech firms focused on providing access to instant loans across Africa and Asia. The company is backed by global investors ranging from Andreessen Horowitz (who backed Facebook, Twitter and other global platforms early on) to Visa (who understands how to build a global trusted financial service) to the IFC (the private sector investment arm of the World Bank).

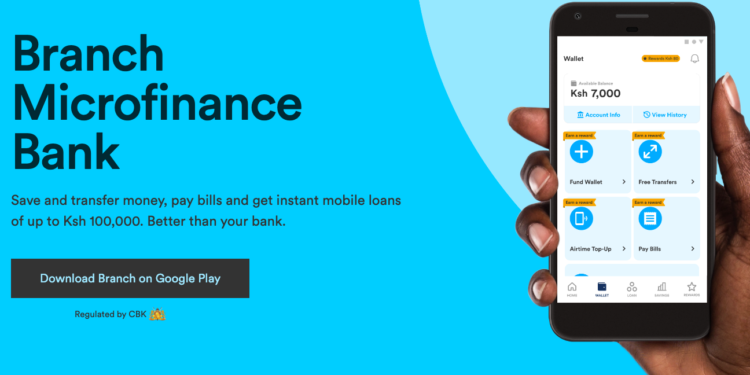

With this acquisition, Branch began reinventing itself as a neobank by offering new products to its clients thereby diversifying its earnings.

The acquisition was also key to Branch’s transformation from a digital-only lending platform into a fully-fledged bank. The company believes it will be better positioned than competitors as it already has an established consumer lending franchise.

Regulatory Clarity

The Central bank of Kenya (CBK) in September 2022 began the process of issuing operating license to mobile lenders to carry out lending business in Kenya. In a statement on September 19, 2022 – the CBK said it received 288 applicants since March this year out of which, only ten were granted the licence. This follows the September 17, 2022 deadline that had been set by the regulator after new regulations under Central Bank of Kenya DCP, Regulations 2022, came into force on March 18, 2022 to provide for the licensing, governance and credit operations of mobile lenders.

By becoming a microfinance bank with its own balance sheet, Branch benefits from regulatory clarity around its operations and this gives a lot of confidence to its customers.

The fintech can now source and originate the loans, assess the credit risk, which adds confidence to the validity of the loans and the interest rate associated with them.

Savings and other services

Over a span of seven years, Branch has evolved from a digital lender, to Kenya’s 1st neobank offering a host of solutions.

Using what it knows about customers’ transaction patterns, the neo-bank can proactively suggest new products and moves that could help them save more effectively, including aligning bill payment days with direct deposit inflow times.

Branch recently began offering its customers a 15% interest on savings per annum which is calculated daily and paid every week. Weekly interest earnings are added to a user’s savings account, and they can withdraw the funds at any time into their Branch wallet.

Branch customers can also send and receive payments from friends and family through their Branch Wallets in addition to easily paying bills and purchase of airtime and data bundles.

Customer’s Expectations

Today’s customers expect a lot more from their banks. They anticipate a full digital experience that engages with them on an individual, personalised basis. NeoBanks such as Branch have excelled in customer experience and are far better at providing tailored products and services than the traditional banks, despite the latter’s advantages in infrastructure and inherited brand recognition.

READ;

Branch International picks Kenya As its Pan-African Digital Bank launchpad

Century Microfinance Bank Acquisition by Branch International gets Treasury Approval