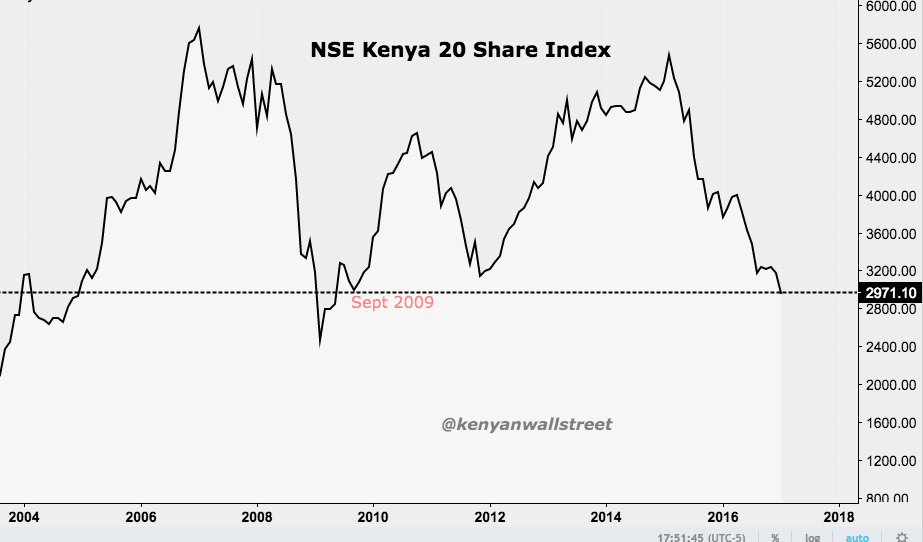

The benchmark NSE 20 share Index on Friday January 13, 2017 lost 168.11 points (5.36%) to close at 2971.10, levels last seen in Sept 2009. All share Index (NASI) ended the week 4.49% lower to stand at 123.94.

The market’s decline extends massive losses from last year when the NSE 20 index and NASI tumbled by 21% and 8% respectively as per our 2016 Market Report. The benchmark is heading toward the lows witnessed in early 2009, just after the height of the 2008 financial crisis.

Since the start of 2017 (the last 11 trading days), NSE Kenya market capitalization has declined by approximately Ksh 136.5 billion to settle at Ksh 1.795 trillion compared to Ksh. 1.932 trillion recorded in the last trading day of 2016.

Banking Sector

Stanbic Bank Kenya closed the week at a three year low of ksh. 65.50 from the highs of Ksh 130 traded in March 2015.

Housing Finance (HF Group), Equity Bank and Diamond Trust Bank (DTB) both fell to levels last seen four years ago on Friday to close at Ksh 11.85, Ksh. 25.75 and Ksh. 117 respectively. Equity and DTB counters have shed by more than 30% over the last one year while HF Group has shed 44.19% over the same period.

Kenya Commercial Bank (KCB Group) closed the week at Ksh. 26.50 which is -34.57% on a 12 month basis.

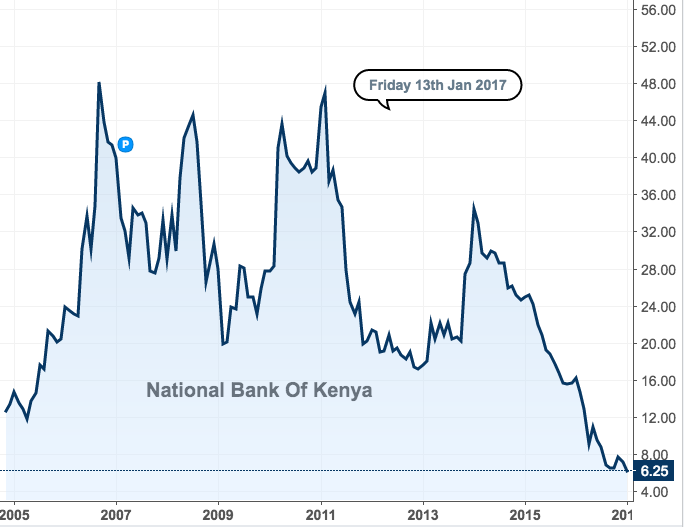

On this sector, National Bank of Kenya has been the worst hit having lost more than 60% of its value over the 12 month period. The counter on Friday closed at a 13 year low of Ksh. 6.45. The huge drop on this counter is partly attributed to negative corporate governance issues facing the lender.

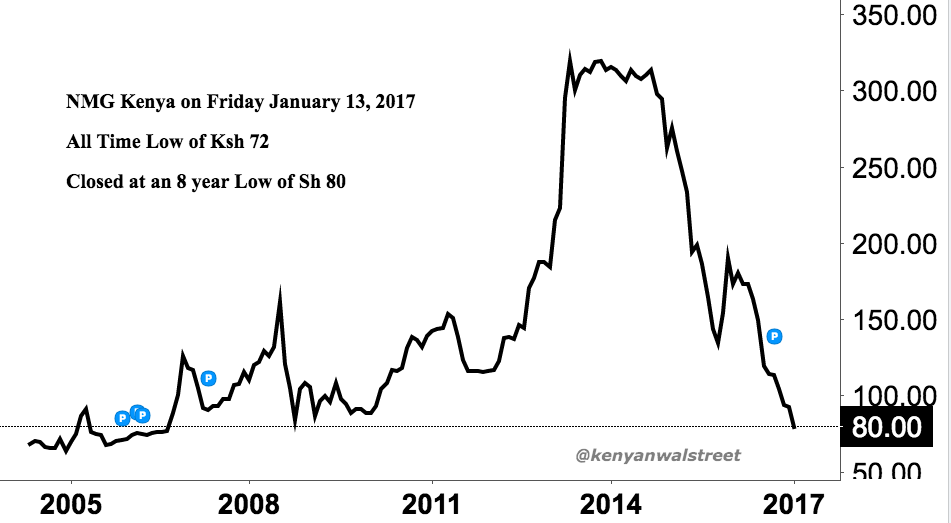

Nation Media Group

Meanwhile, Nation Media Group share Price touched an all time low of Ksh 72 during Friday’s trading session and closed at at an 8 year low of Ksh 80 as shown in the chart below.