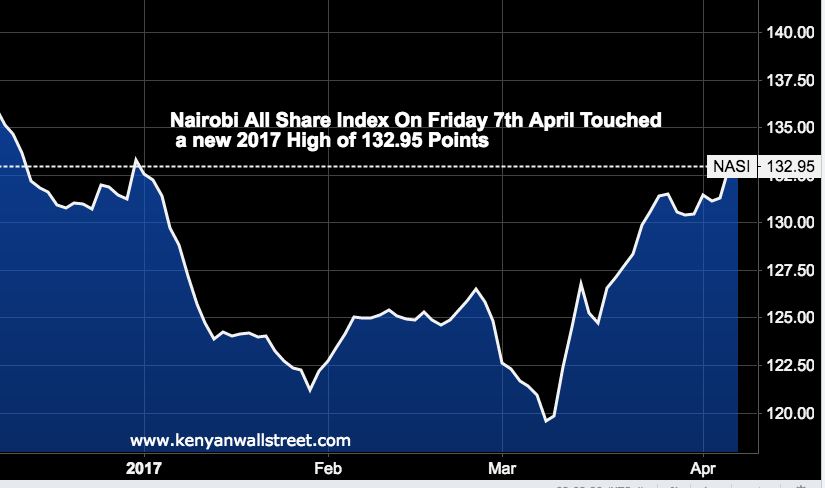

Nairobi All Share Index (NASI) – a weighted index consisting of all the securities on the Nairobi Securities Exchange on Friday’s trading session closed at a new 2017 high of 132.95 points on a decent 11 per cent gain since 8th March 2017.

The gains have been mainly pushed by the Banking stocks which were triggered by comments from the Central Bank of Kenya (CBK) Governor Patrick Njoroge and Treasury CS Henry Rotich that the government was monitoring the impact of the rate cap law situation with a view of reviewing it.

In his State Of the Nation Address on March 15th, President Kenyatta affirmed that the Government was looking into the matter and would make a decision before the elections.

“On the issue of access to credit for SMEs, it is unfortunate that the unintended consequence of the capping of interest rates was a slowdown in lending by our commercial banks. This is an issue that concerns us and is one that I will actively seek to resolve so that credit can start to flow again to the real drivers of our economy.” said President Kenyatta.

Lets have a look at a few top gainers with a significant weight on the NASI.

KCB Group (+ 47%)

Since the beginning of February, KCB Group Share Price is Up by 47 per cent from Sh 23 to Friday’s closing price of Sh 33.75 per share. The lender on 9th March also announced a 50% increase in dividends for the FY 2016.

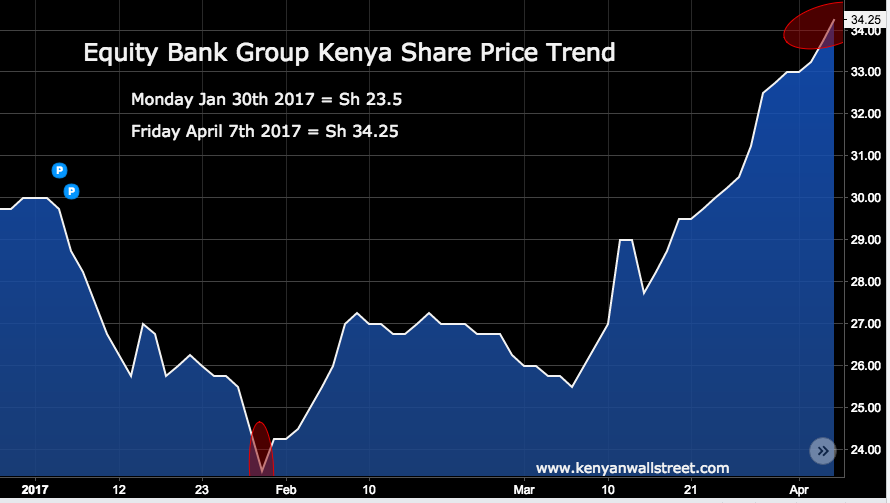

Equity Group (+46%)

Equity Bank (EQTY) Share Price is Up 46 Per cent since January 30th as shown in the Chart Below. From Sh 23.5 to Sh 34.25.

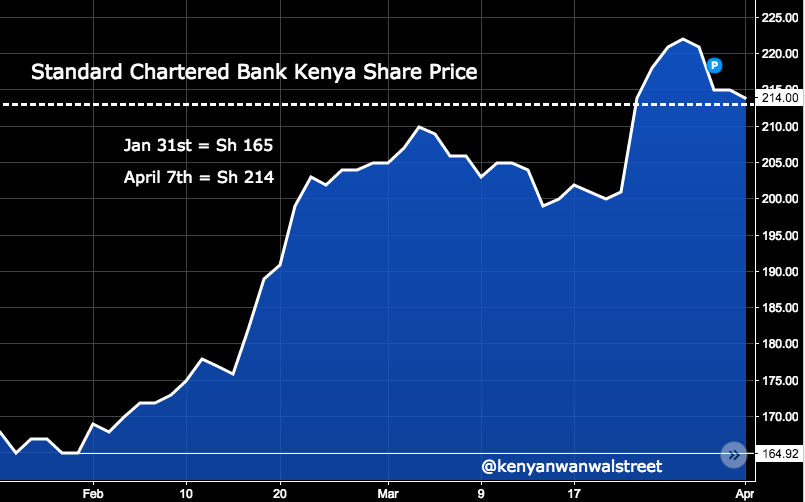

Stanchart Kenya (+30% Since 31st Jan)

Standard Chartered Bank Kenya is among the top lenders that posted impressive FY Earnings for the FY ended 31st December 2016. The Bank’s share Price has also skyrocketed by 30% since 31st January 2016.

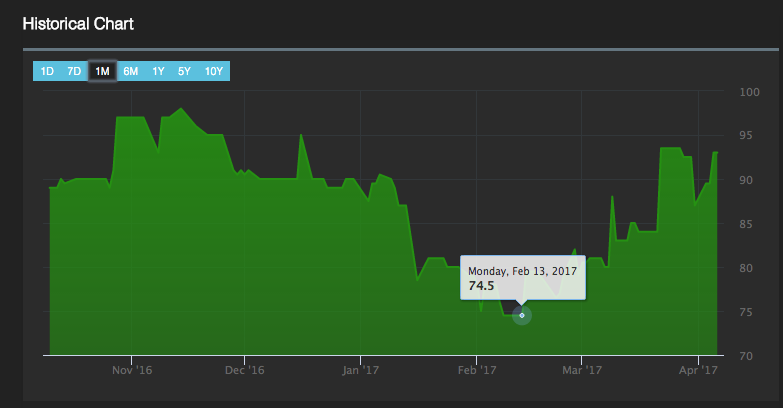

I&M Bank Kenya (+24.8% Since Feb 13)

I&M Bank Share Price has registered a 24.8 per cent growth Since Monday Feb 13th 2017.

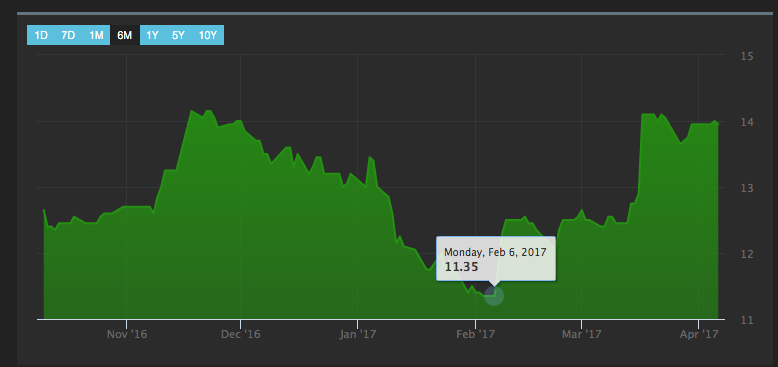

Coop Bank Kenya (+23.4% Since Feb 6)

Cooperative Bank Of Kenya Stock (Coop) on Friday 7th April Closed at Sh 14.00, 23.4% rise since Monday Feb 6th 2017. The Bank posted a 15% increase in Profits Before Tax and recommended a bonus issue of one (1) share for every (5) shares held pending regulatory approval.

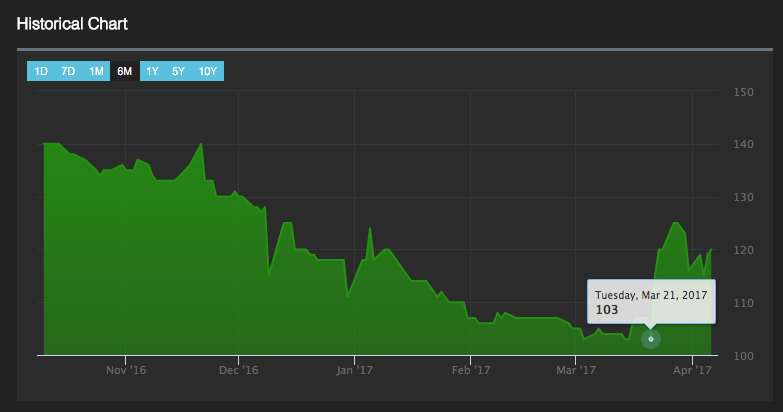

Diamond Trust Bank (+16% Since 21st March)

Diamond Trust Bank Kenya (DTK) is among the lenders that shed a big chunk in market value after the “Rate Cap” bill was signed into law, however, there seem to be a reversal on the counter after the bank announced an increase of 17.1% in Profits After Tax for the full year 2016.

DTB also announced its intention to acquire Habib Bank Kenya Limited.

The Bank’s Share Price has recorded a 16% rise since March 21st when the above material announcements were made public.