The Co-operative Bank of Kenya announced its full year results for the period ending 31 December 2016. Here are our initial impressions:

Total interest income was up by 14.9% to stand at Ksh 42.3 billion in 2016 compared to Ksh 36.8 billion in 2015. This growth was largely driven by a Ksh 3.3 billion increase in loans and advances and a Ksh 2.4 billion increase in interest income from government securities. Effectively, Net interest income was up by 27.1% from Ksh 23.2 billion in 2015 to Ksh 29.5 billion in 2016.

Total Non Interest Income fell marginally by 3.1% from Ksh 13.2 billion in 2015 to Ksh 12.8 billion in 2016. The drop was largely due to a reduction in forex trading income from Ksh 3.2 billion in 2015 to Ksh 1.8 billion in 2016.

Total Operating expenses were up by 15% in the period standing at Ksh 24.6 billion in 2016 compared to Ksh 21.4 billion in 2015.

Profits before tax were up by 15.2% to stand at Ksh 17.7 billion in 2016 compared to Ksh 15.4 billion in 2015. Net profits were up by 8.3% from Ksh 11.7 billion in 2015 to Ksh 12.7 billion in 2016.

Note that Co-operative Bank of South Sudan a Joint Venture partnership with Government of South Sudan (Co-op Bank 51% and GOSS 49%) made a monetary loss of Ksh.498.3 million in 2016 mainly attributable to hyperinflation due to the currency devaluation.

The Bank has retained its dividend at Ksh 0.80 per share the same as the previous financial year. In addition the Directors of the bank have recommended a bonus issue of one (1) share for every (5) shares held pending regulatory approval.

The Bank in a statement noted the challenging environment in the banking business citing the enactment of interest rate caps that have slowed down economic growth. The Bank says it will continue leveraging on its current strong 6.2 Million account-holder base, digital banking focus and multichannel access, innovative financial solutions, and efficient delivery of services to retain market position and deliver business growth and profitability.

In the markets Co-operative Bank closed Thursday’s (16 March 2017) trading session at Ksh 13.00 per share.

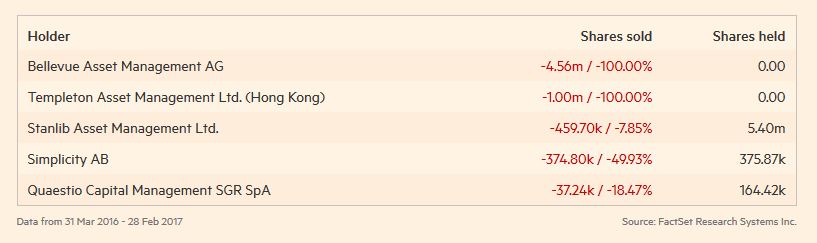

Some of the institutional holders in Co-operative Bank of Kenya are:

- •Parametric Portfolio Associates LLC

- •JP Morgan Asset Management

- •Blackrock Fund Advisers

- •Absa Asset Management

- •Stanlib Asset Management

- •Old Mutual Investment Group

- •OP Asset Management

- •Ashburton Fund Managers

- •Old Mutual Customised Solutions Ltd

- •Mori Capital Management

Note that in 2016 Bellevue Asset Management and Templeton Asset Management reduced their entire holdings in the bank.

Download: Cooperative Bank of Kenya Full Year Results 31 Dec 2016

Related;

Equity Bank Earnings Fall for First Time in a Decade, Bad Loans Up 100%

KCB Group Net Profit Unchanged, Declares 50% Increase in Dividends

Sources: (Cooperative Bank of Kenya, Kenyan Wall Street, FT)