Eastern Africa’s largest manufacturer of cement and cement related products, Bamburi Group, has released its financial results for the full year 2016 reflecting a flat growth in its net profit at Sh 5.9 billion citing intense competition particularly in the individual home builder segment.

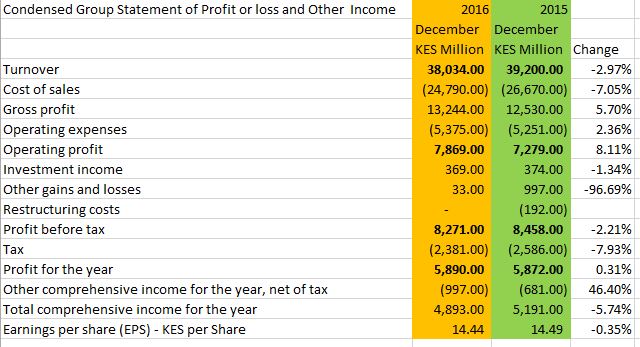

The company’s turnover for the year fell slightly to Sh 38 Billion compared to Sh 39.2 Billion posted in 2015.

“Overall, there was a marginal reduction in volumes into inland Africa export markets and intense competition particularly in the individual home builder segment impacting prices in some markets. This was offset by higher volumes in the infrastructure and contractor segment in the key markets of Kenya, Uganda and Rwanda.” Bamburi noted in a statement.

Operating profits increased by 8% to Sh 7.9 billion as a result of a Sh 2 Billion decrease in cost of sales. Profit before tax was slightly below 2015 at Sh 8.27 Billion from 2015’s Sh 8.46 Billion on account of lower currency gains from holding large foreign cash balances due to stability in currency market in 2016.

“The Group is cognisant of the increased competitive environment and the upward trend in global commodity prices across the region. Notwithstanding, the Group is well positioned to implement appropriate strategies to enhance the Group’s growth and profitability, and will focus on maintaining a superior offer to the market through, innovation and first-rate customer service, while leveraging on its human capital, technical resources and innovative spirit to deliver another year of strong performance” it noted.

Related;

Uchumi Supermarkets posts a Half Year Loss of Ksh 547 Million

KenGen HY Pre-Tax Profit Plunges By 22%

CAPACITY EXPANSION UPDATE

Bamburi said it has commenced Phase 1 of the capacity increase with the project mobilisation complete and excavation work ongoing in both Kenya and Uganda and is confident that both projects will be completed on schedule by the mid 2018.

DIVIDEND

Bamburi shareholders will get a final dividend of Sh6 per share, bringing the total 2016 dividend payment to shareholders to Sh12 per share from Sh 13 in 2015.

CLOSURE OF SHARE REGISTER

The final dividend for 2016 will be paid on 14 July 2017 to members on the register at close of business on 7 April 2017.

CHANGES IN DIRECTORSHIP

The Board of Directors is pleased to announce the appointment of Alice Owuor, Dr Helen Gichohi and Rita Kavashe as Directors of the Company with immediate effect.

Institutional Shareholder Analysis

Top institutional shareholders in Bamburi are:

Norges Bank Investment Management – 3.46M shares (as at 31 Dec 2015)

Aberdeen Asset Management – 1.64M shares (as at 31 Dec 2016)

Parametric Portfolio Associates – 1.25M shares (as at 31 Dec 2016)

Old Mutual Investment Group (Pty) Ltd – 1.00M Shares (as at 31 Jan 2017)

Bellevue Asset Management – 726.7K shares (as at 31 Jan 2017)

Duet Asset Management – 500.0K shares (as at 30 June 2016)

Mori Capital Management – 225.0K shares (as at 31 Mar 2016)

BPI Gest�o de Activos SGFIM SA – 175.3K shares (as at 30 June 2016)

St. Galler Kantonalbank AG (Private Banking) – 30.00K shares (as at 30 June 2016)

Stanlib Asset Management – 12.65K shares (as at 31 March 2016)

Share Price

Bamburi Cement closing price on Thursday March 9 2017 was Ksh 146.00. It is down by 8.8 percent year to date.

Source: (Bamburi Cement, Kenyan Wall Street, FT)