First Published on March 6th, 2023 by Bob Ciura for SureDividend

The appeal of growth stocks is that they have the potential for huge returns. Consider the massive rally by Tesla, Inc. (TSLA); in the past five years, the stock has returned about 785% to shareholders. That’s a lifetime of returns for some investors, and Tesla has done this in a relatively short period of time.

The downside of growth stocks is that volatility can work both ways. Tesla has recently become consistently profitable, but that was not always the case. And the company had a mounting debt load, in addition to share issuances that diluted shareholders to support growth. Growth stocks can generate strong returns but also carry the burden of high expectations due to their sky-high valuations, and Tesla is certainly no different.

In addition, Tesla’s value is tied to its CEO, Elon Musk. The recent drama with Musk and his personal purchase of Twitter has eroded the value of Tesla shares as investors believe he’s distracted from running Tesla.

Plus, Tesla does not pay a dividend to shareholders, which is also an important factor for income investors to consider. As a result, we believe income investors looking for lower volatility should consider high-quality dividend growth stocks, such as the Dividend Aristocrats.

The Dividend Aristocrats is a group of 68 stocks in the S&P 500 Index with 25+ consecutive years of dividend growth. You can download an Excel spreadsheet of all 68 (with metrics that matter, such as dividend yield and P/E ratios) by clicking the link below:

Over time, any company – even Tesla – could make the decision to start paying dividends to shareholders if it becomes sufficiently profitable. In the past decade, other technology companies, such as Apple, Inc. (AAPL) and Cisco Systems (CSCO), have initiated quarterly dividends. These were once rapidly growing stocks that matured, and Tesla could follow the same way one day.

However, the ability of a company to pay a dividend depends on its business model, growth prospects, and financial position. Even with Tesla’s huge run-up in share price, whether a company can pay a dividend depends on the underlying fundamentals. While many growth stocks have made the transition to dividend stocks in recent years, it is doubtful that Tesla will join the ranks of dividend-paying stocks any time soon.

Business Overview

Tesla was founded in 2003 by Martin Eberhard and Marc Tarpenning. The company started out as a fledgling electric car maker, but has grown at an extremely high rate in the past several years. Tesla’s current market capitalization is nearly $630 billion, making it a mega-cap stock.

Amazingly, Tesla’s current market capitalization is almost six times the combined market caps of auto industry peers Ford Motor (F) and General Motors (GM).

Tesla has a growing lineup of different models and price points and is looking into expanding that lineup further to become a full-line automaker. Since going public in 2010 at a split-adjusted price of just $1.13 per share, Tesla has produced almost unbelievable returns for shareholders in hopes of massive future growth, as well as tremendous growth that has already been achieved.

Since then, it has grown into the leader in electric vehicles and business operations in renewable energy. Tesla is slated to produce about $103 billion in revenue in 2023.

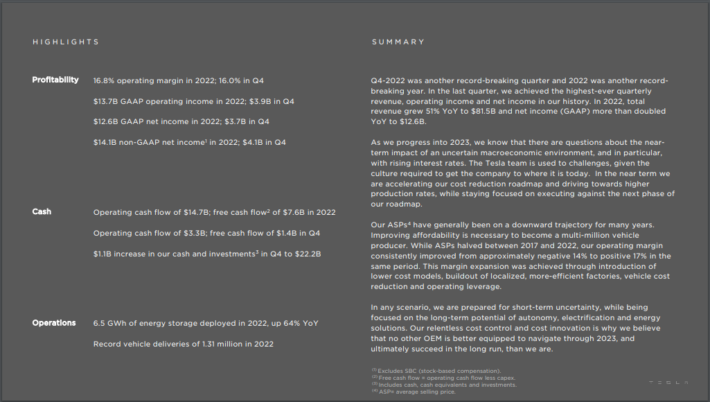

Source: Investor Update

On January 25th, the company reported better-than-expected adjusted earnings-per-share of $1.19 for the fourth quarter. This beat expectations by 8 cents per share. Tesla has exceeded the analysts’ earnings-per-share estimates for eight consecutive quarters, thus confirming its strong business momentum.

Quarterly revenue of $24.32 billion came in in-line with expectations. This was the highest-ever quarterly record. For the full year 2022, revenue rose 51% year-over-year to $81.5 billion and adjusted earnings-per-share increased by 80% to $4.07.

The automotive gross margin of 28.5% for 2022 was down 82 basis points compared to the previous year. The issues causing margin compression should abate in the coming quarters, and we believe gross margins should rise back above 30% in the relatively near future.

Growth Prospects

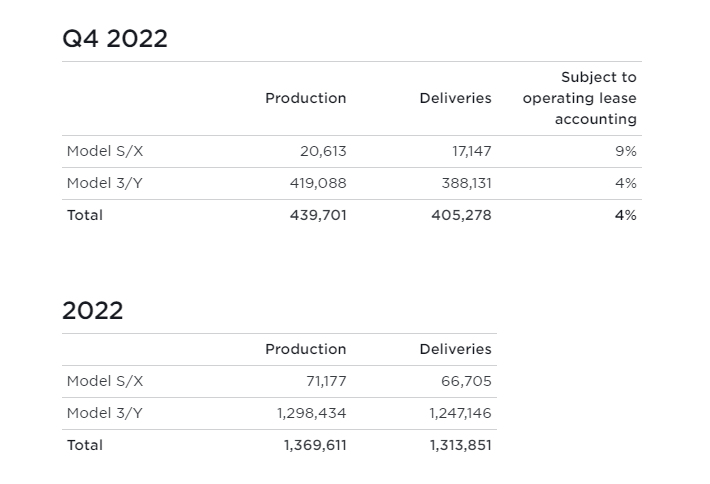

Tesla’s primary growth catalyst is to expand sales of its core product line and generate growth from new vehicles. The company’s S/X platform, which gave it the first bout of solid growth, has faded in popularity, and Tesla is instead focused on ramping up its 3/Y platform.

Indeed, the 3/Y platform accounted for about 95% of all deliveries in 2022.

In addition to that, Tesla is continuing to develop new models, with a pickup truck rumored, a semi-truck, and even a cheaper, more attainable model than the 3. The company has begun delivering its semi-truck as production of that new vehicle begins to ramp up. It will be some time before that’s a meaningful source of revenue, but it’s a totally new product line that should aid future top-line growth.

Tesla is investing heavily in strategic growth through acquisitions as well as internal investment in new initiatives. First, Tesla acquired SolarCity in 2016 for $2.6 billion. The company is also ramping up vehicle production. Tesla now operates “Gigafactories” in Nevada, New York, Texas, Germany, and China, with more to come to support its burgeoning demand.

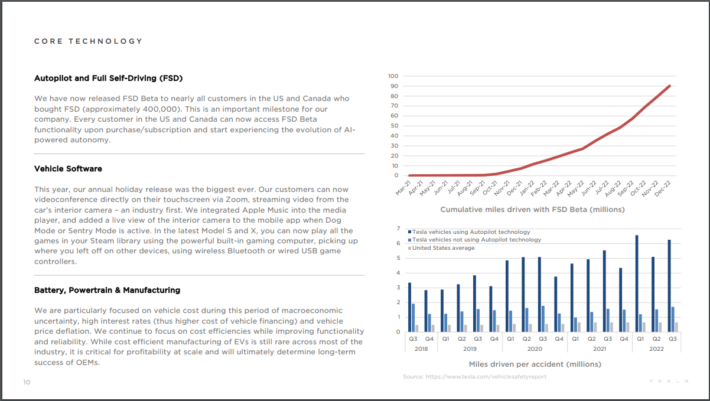

Tesla’s competitive advantage stems mainly from its best-in-class software and other technologies, including full self-driving mode.

Source: Investor Update

The company is also doing its best to reduce bottlenecks in its processes and, hence, delivery times. While these efforts led to a reduction in delivery times in China for its rear-wheel-drive model Y in 2022, as of early 2023, it appears these delivery times have again increased from 1-4 weeks to 2-5 weeks. This could be due to increased demand as a result of recent price cuts.

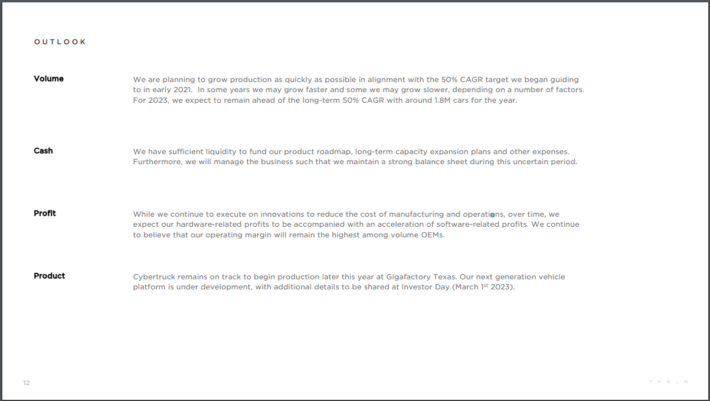

Tesla’s growth in revenue per share has been nothing short of outstanding. It produced nearly four hundred times more revenue per share in 2022 than five years earlier. That level of growth is difficult to find anywhere, which is why Tesla’s shares have performed so well. Whether Tesla can continue to maintain its high growth rate is another question. Management recently stated that it expects to grow vehicle deliveries by 50% per year on average in the upcoming years.

Source: Investor Update

Such a growth rate is undoubtedly outstanding and bodes well for the company’s future potential. Some investors may view the guidance of Tesla as too aggressive, but we note that electric vehicle sales are growing at a breathtaking pace. Electric vehicles are the clear and unwavering path forward for automobiles, and Tesla is the definitive leader in the space.

In addition, more than any other automaker, Tesla has delivered outstanding growth year after year. With an expanding product line and its existing, proven winners, we believe the growth outlook for the company is bright.

Will Tesla Pay A Dividend?

Tesla has experienced rapid growth of shipment volumes and revenue in the past several years. But ultimately, a company’s ability to pay dividends to shareholders also requires success on the bottom line. While Tesla has been the epitome of a growth stock through its top-line growth and huge share price gains, its profitability is still diminutive in relation to its market cap. To be sure, the stock is currently trading at more than 50 times its expected earnings this year.

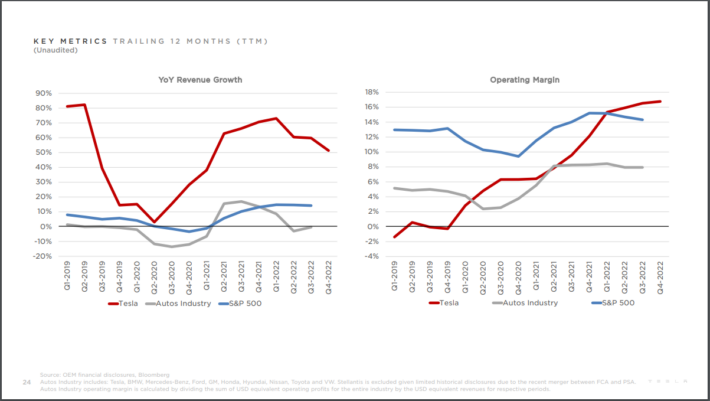

Without reaching steady profitability, a company cannot pay shareholders’ dividends. In fact, consistently losing money means a company will have trouble keeping its doors open if losses persist over time. However, while this used to be an issue for Tesla, those issues seem to have been fixed by ever-rising delivery volumes. We can see below that the company’s operating margins have soared in recent quarters to an industry-leading 16%+.

Source: Investor Update

Tesla lost money since it became publicly traded back in 2010, up until 2020. It goes without saying that a money-losing company has to raise capital to continue to fund operations. To that end, Tesla has sold shares and issued debt to cover losses and fund expansion in recent years, both of which make paying a dividend even more difficult.

However, since 2020, Tesla has rapidly expanded its profitability and produced almost $13 billion in net income in 2022. The company also produced nearly that much in free cash flow, making it much easier to service its debt obligations and avoid future dilutive share issuances.

Furthermore, its interest expense currently consumes less than 2% of its net income, while its long-term debt of $1.0 billion is a small fraction of its earnings. In other words, Tesla has improved its profitability so much that its debt has become essentially negligible. We see the sizable improvement in profitability and free cash flow, as well as the improved balance sheet, as supportive of the company’s ability to eventually pay a dividend.

However, Tesla is still very much in hyper-growth mode, and we expect any dividend that may be paid to be many years away. In other words, it is much more profitable for Tesla to reinvest its earnings in its business than to distribute them to its shareholders.

Even if Tesla decided to initiate a dividend, it would be meaningless for its shareholders due to the stock’s high valuation. For instance, if Tesla decides to distribute 30% of its earnings to its shareholders in the form of dividends, the stock will offer just a 0.6% dividend yield. Such a yield will be immaterial for the shareholders, but the dividend will deprive the company of precious funds, which can be utilized in high-return growth projects.

Tesla’s Stock Dividend

Tesla’s famous CEO, Elon Musk, said in early 2022, that he wants Tesla to “increase in the number of authorized shares of common stock … in order to enable a stock split of the Company’s common stock in the form of a stock dividend.”

Essentially, a stock dividend is where a company splits its stock, and the impact on shareholders is that the company’s value doesn’t change, but the share price is lower because there are more outstanding shares.

Indeed, Tesla implemented a 3-for-1 split on its stock, which came into force on August 25th, 2022. As a result, its outstanding share count rose from 1.155 billion to 3.465 billion post-stock dividends, and the stock price adjusted from about $900 before the split to about $300.

A stock dividend is not necessarily a material event for shareholders because their relative stake in the company remains the same; they have more shares at a lower price. However, investors tend to view stock dividends and splits as bullish events; thus, stock dividends can trigger rallies in the share price. Since the split, shares of Tesla have decreased to just under $200, a decline of just over one third, so the potential split rally did not come to fruition.

Final Thoughts

Tesla had been among the market’s hottest stocks since the start of the pandemic, producing a massive rally that had taken it above a trillion dollars in market cap. Shareholders who had the foresight to buy Tesla near the 2019 or 2022 lows have been rewarded with enormous returns through a soaring share price.

However, investors looking for dividends and safety over the long run should probably continue to take a pass on Tesla stock. The company seems committed to using all the cash flow at its disposal to improve its operations’ profitability and invest in growth initiatives. While there is always a possibility that Tesla’s massive share price rally could continue, it is also possible the stock could fall. Investors should remember that volatility can work both ways, and indeed, Tesla shareholders were reminded of this in 2022.

More defensive investors, such as retirees, who are primarily concerned with protecting principal and dividend income, should instead focus on high-quality dividend growth stocks, such as the Dividend Aristocrats. It is unlikely that Tesla will ever pay a dividend, or at least not for many years.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Top 20 Highest Yielding Monthly Dividend Stocks Now | Yields Up To 21.7%

All 43 Agriculture Stocks List For 2023 | The Best 7 Buys Now