First Published on November 28th, 2022 by Quinn Mohammed for SureDividend

Income investors might be reluctant even to consider buying shares of a company that does not pay a dividend.

On the other hand, capital allocation decisions are not written in stone.

While tech giant Meta Platforms, Inc. (META)–formerly known as Facebook–does not offer a dividend today, we believe it could initiate a dividend in time.

Meta Platforms has grown so large that it is now highly profitable, with tremendous free cash flow and a massive amount of cash on the balance sheet.

As a result, it could join many other technology stocks that have begun paying dividends to shareholders in recent years.

You can download a free spreadsheet of our entire technology stocks list(along with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

This article will discuss Meta Platform’s business model, growth prospects, and why a dividend is not an unreasonable expectation at some point in the future.

Business Overview

Meta Platforms is a social media giant with a market capitalization of ~$289 billion. Facebook is the unquestioned leader in social media.

Its offerings include Instagram, WhatsApp, Messenger, and more.

Facebook began as many start-ups do, with rising revenue but a lack of profitability. However, all that changed when the company effectively monetized its massive user base.

Facebook and its various properties represent massive advertising platforms.

And, given the number of time users spend on the site, Facebook is simply a gold mine for advertising potential. Mobile advertising revenue represents the vast majority of total advertising revenue.

The result is that Facebook is now enormously profitable.

Over the third quarter of 2022, revenue decreased by 4.0% compared to 2021. Earnings-per-share decreased 49% in the third quarter of 2022 compared to a year ago.

Since the fourth quarter of 2021, Meta Platforms has reorganized its reporting segments. The company now has two reporting segments.

Its Family of Apps (FoA) segment includes its traditional social media platforms such as Facebook, Instagram, Messenger, WhatsApp, and other services. In Q3 2022, FoA revenue decreased 3.6% year-over-year to $27.7 billion.

The Reality Labs (RL) segment includes augmented and virtual reality-related consumer hardware, software, and content. In Q3 2022, RL revenue decreased 48.9% year-over-year to $285 million.

Growth Prospects

Facebook’s growth potential remains attractive. While the company is nearing saturation in the U.S., the Facebook community continues to grow.

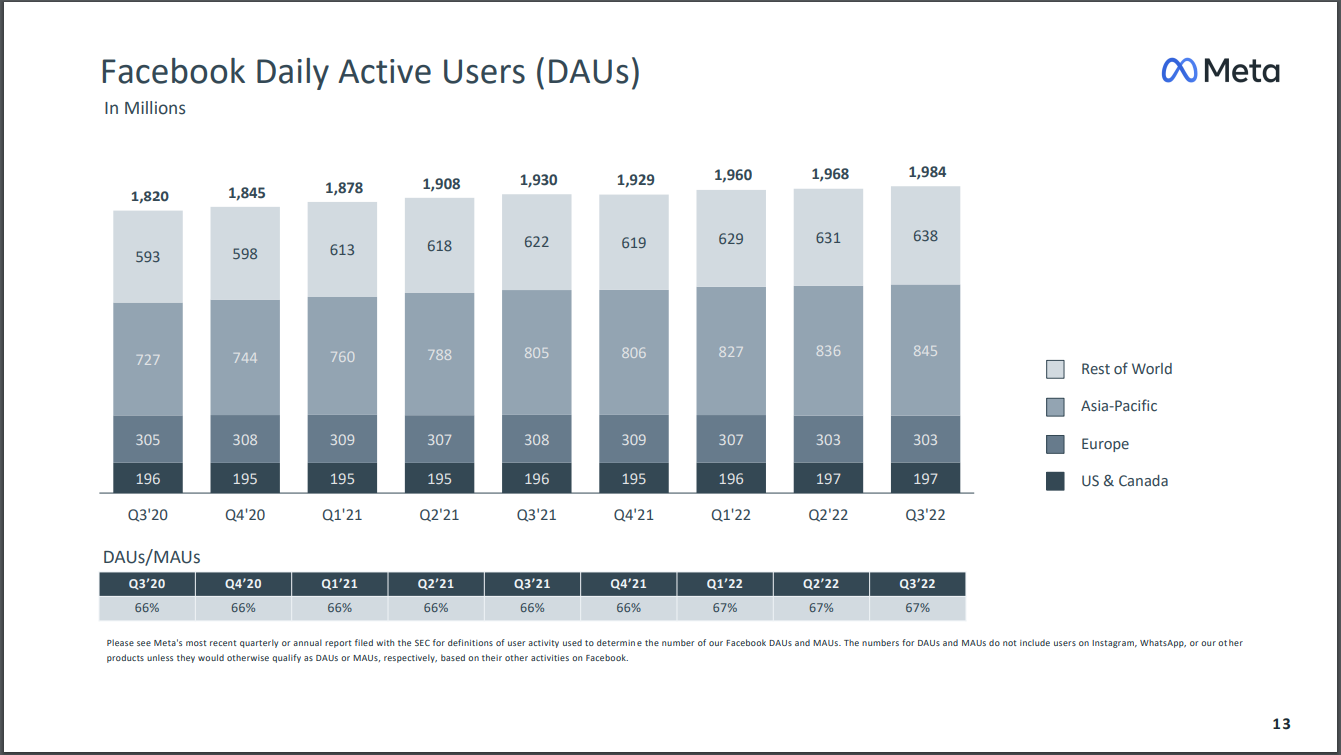

Facebook’s daily active users were 1.98 billion on average at the end of the third quarter, an increase of 3% year-over-year.

At the same time, billions of people worldwide still do not use Facebook or one of its other platforms, leaving a massive global growth opportunity for the company in the years ahead.

To be sure, Meta Platforms will have to dedicate a huge amount of financial resources to obtain this growth. Indeed, 2022 capital expenditures are expected to reach $32 billion to $33 billion.

The company’s massive competitive advantages amplify Meta Platform’s growth potential. Specifically, it has come to dominate social media.

Consumers love social media and appear unwilling to do without it (evidenced by the daily active users who use Facebook daily and every month).

It is challenging for another social media brand to enter the space and successfully take users away from Facebook, Instagram, or its other valuable properties.

In addition, Meta Platforms invests in several new avenues for future growth in virtual reality, artificial intelligence, and the metaverse.

These are exciting potential growth areas for the tech industry, and Meta Platforms is poised to be at the forefront of these new technologies.

Why Meta Platforms Could Pay A Dividend

There are good reasons for a company to announce a dividend.

In addition to improving investor sentiment by rewarding loyal shareholders with dividend income, initiating a dividend payout opens up a new and large group of institutional investors who manage income-oriented funds.

Income investors who previously would not have invested in a non-dividend paying stock, such as Meta Platforms, would likely be enticed by a dividend payout.

Meta Platform’s fundamentals seem to support a dividend payment, as the company is highly profitable.

Based on consensus analyst estimates, Meta Platforms is expected to generate earnings-per-share of $8.96 for 2022.

The company could theoretically announce a significant dividend while leaving plenty of cash flow for reinvestment into growth initiatives.

For example, if Meta Platforms maintained a target payout ratio of 25% of annual EPS, the company could declare an annual dividend payout of ~$2.24 per share based on 2022 EPS estimates.

This would represent a dividend yield of ~2.0% based on the current share price.

While this would certainly not qualify Meta Platforms as a high dividend stock, investors should not expect high yields from the technology sector.

For context, a dividend yield of 2.0% would give Meta Platforms a higher yield than other dividend-paying tech giants such as Apple Inc. (AAPL) and Microsoft (MSFT).

And Meta Platforms could grow its dividend at a high rate each year, particularly with a starting payout ratio of just 25% and the company’s future EPS growth potential.

Initiating a dividend would hardly impact the company’s financial position, as Meta Platforms ended the 2022 third quarter with cash, cash equivalents, and marketable securities of $41.78 billion.

Meta Platforms has a current ratio (which compares short-term assets to short-term liabilities) of 2.6x, which indicates more than enough short-term liquidity.

By virtually any measure, Meta Platforms has massive financial resources and ample liquidity to distribute a portion of its cash flow to shareholders without jeopardizing its current financial position or future growth.

Final Thoughts

A company typically chooses not to pay dividends to shareholders because it simply does not have the financial strength to do so.

Small companies in a high-growth stage, or cyclical companies with inconsistent profitability, must preserve as much cash flow as possible.

Dividend stocks versus growth stocks.

However, Meta Platforms is clearly no longer in its start-up phase. It is a massive company and a cash flow machine.

It also has a fortress balance sheet with a huge amount of cash. Fundamentally, there is little reason for Meta Platforms to not pay a dividend. It has plenty of cash for growth investment and then some.

Dividends have become much more commonplace in the technology sector in recent years.

Meta Platforms does not yet pay a dividend, but investors should not be completely surprised to see a dividend payout announced at some point in the coming years.

Related: