Kenyan government bond sold through the mobile phone platform M-Akiba, which was launched in 2017 has seen only 10,000 retail investors in government bonds, accounting for only 2 per cent of the outstanding holdings of bonds.

M-Akiba which is said to have the potential to reach over 30 million registered mobile money account holders was launched with an aim of broadening investor base and reducing the government borrowing costs, however, this did not happen.

According to Financial Sector Deepening Kenya, ’’Although investment did not meet expectations, the post-issuance study found that the product was fairly successful in bringing a new broad-based retail investor group into the market for government paper: 85 per cent of customers had never bought a bond before and buyers were distributed across virtually all of Kenya’s 47 counties. Most of the investors (84 per cent) really liked the product and were likely to recommend it to someone else and 80 per cent of those who invested were likely to invest again if the product was issued today.’’

Adding that despite not living up to its own ambitions, M-Akiba still stands as the first mobile treasury instrument to be sold in Africa.

‘’Although the first pilot and launch did not achieve the desired outcome, there are significant opportunities to enhance the offering in Kenya and replicate elsewhere drawing on the lessons and recommendations made from the post-issuance study and the lessons learned by the implementers to make it more relevant to the daily reality of citizens aiming to invest in their futures.’’

Before M-Akiba, the minimum investment amount for a bond was Sh50,000 (about US$500) and required a cumbersome process to open up an investment account.

According to FSD, these are Key Reasons for the Failure in Uptake of M-Akiba

- Poor timing – in the two years between the soft launch and product launch, deposit regulations changed, forcing banks to increase interest rates paid on savings from 0% to 7%, thereby diminishing the advantages of the bond. Furthermore, the bond launch coincided with national elections, so media advertising about the product was swamped by election coverage.

- Poor understanding of product – Understanding was poor among those who bought the product: less than 2% knew they needed to call the Nairobi Securities Exchange if they needed their money.

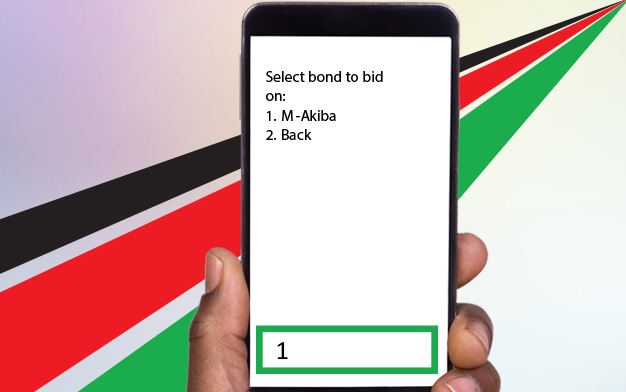

- Confusing purchase process – while registration was simple, the second stage of the process was confusing and gave no clear, immediate instruction for how to complete the purchase.

- Lack of prompts/reminders- over 60% of individuals interviewed did not receive a single reminder message after registering; and 70% of those who registered but didn’t purchase did not know when the investment round was closing.

- Agents focused on registration – when agents visited offices, markets, and groups, there was a marked uptake in registrations. However, the agents did not encourage people to actually invest after registering. In addition, it was difficult for customers to get help from agents when they had follow-up questions after registration.

- Weak customer care practices – the only helpline available to customers, many of whom did not fully understand the product, was a landline, which was difficult to access and confusing, given the mobile nature of the product. Furthermore, when fraudulent messages circulated about the product, there was no easily accessible customer service available to refute them.

- Concerns about minimum investment – some customers felt the KSh 3,000 minimum investment would be better allocated to savings groups or trading opportunities that could provide quick returns or access to credit.