It doesn’t matter how wealthy you are, everyone exists in a world of constrained resources. There is a limited amount of everything in our tangible world: a limited amount of money, food, drops of water in the ocean, and even grains of sand.

Whether you have 100 shillings or 1,000,000 shillings at the end of each month, you have to make decisions on what to spend it on. Will you invest in it in the future? Will you spend it on a night out? Will you buy a new shirt or even a car?

All decisions are made (either consciously or subconsciously) considering economic constraints. Why do some people choose to gamble their money while others choose to invest it?

Investing is a form of gambling – a bet that the future value of an asset exceeds the current value of that same asset. There really isn’t any difference between a gamble and an investment.

Arguably, investing is a form of gambling – a bet that the future value of an asset exceeds the current value of that same asset. There really isn’t any difference between a gamble and an investment. So then, why do some people choose to gamble on a football match or a horse race and others purchase stocks and bonds?

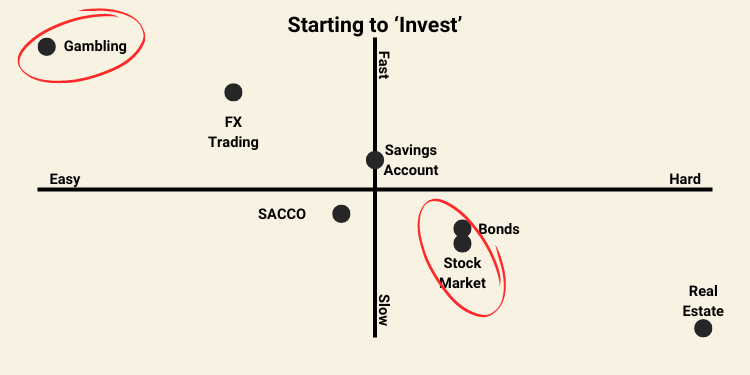

To start placing bets, to gamble, in Kenya, takes less than 5-minutes with only 4 easy steps on your phone. To invest on the Nairobi Securities Exchange (Ticker: NSE), you have to go through a 50+ step process that takes several days and requires a lot more than just a phone.

Gambling companies have far more users and daily volume than the NSE, because there are way too many barriers to entry. It makes sense: we are all seeking the easiest route out. In a world of economic constraints where you want to ‘invest’ in something uncertain, people prefer what is quick and easy over what is complicated and bureaucratic.

If you budget 1,000 KES at the end of each month for ‘investments,’ what are your options?

Given that most forms of ‘investment’ are on the left side of the graph with the majority being on the Easy and Quick quartile, it is no wonder why these do so well. Investing in real estate is much harder and significantly slower than investing in the stock market. So why do people still invest in real estate yet Kenya struggles with developing a culture of retail investment on its stock exchange?

Real estate is tangible and omnipresent in our day-to-day lives. If managed smartly, it can produce cash flow each and every month and historically, when considered in the long-run, real estate almost always increases in value.

What’s Your Risk Appetite?

When you sit down with an investment advisor, one of the first things they will ask you is: “How much risk are you comfortable with?”

Gambling, FX trading, and drinking at the bar are all high risk ‘investments,’ while real estate, SACCOs, and government bonds are considered to be low risk ‘investments.’ Where does the stock market fit into this paradigm?

Certain stocks, particularly those with a high dividend yield are sometimes seen as safer than those with little to no dividend yield, banking solely on the appreciation of the equity.

Then there’s the question of potential returns – the amount of money one expects to receive back for their investment.

Investing in the stock market and gambling both sit in nearly the same spots as they did in the previous graph. Gambling provides fast and high return potential while investing in the stock market provides a slower and lower return potential.

Then, there comes the nature of pack mentality. People naturally gravitate toward other successful people, wishing to employ similar strategies as their counterparts may have used to ‘get rich.’

If I open Instagram or TikTok, I won’t see people talking about making money trading stocks on the NSE, you will see FX traders and “professional gamblers” driving G Wagons, wearing Rolexes, and running for political positions.

FX brokers in particular are known for paying wealthy influencers good money to promote their exchanges. Drive around Nairobi for an hour or two, I guarantee that you will see an Exness or Pepperstone billboard. People invest not in what they know, but what they can see as a viable option.

Where to, Then?

The NSE has some serious work to do if it plans on becoming the premier investment destination in Kenya, East Africa, or even globally.

If you want people to join the market, you need to make it easy to just start. This would require significant changes on the regulatory framework by the Capital Markets Authority (CMA), but it is possible given the technologies and knowledge of today paired with the right political and corporate will.

Kenya needs to cultivate a culture of investing in the stock market. This starts young – when I was in Middle School in coastal Virginia, my eighth grade math teacher made our class compete with one another in the stock market challenge. Not only did this peak my desire to compete with my peers, but it also opened the door for me to the stock market years before I was legally allowed to begin trading real equities.

Other ways to build a culture around the stock market is to tell stories. Something as simple as, “Hey, XYZ Stock shot up 30% today, if you were in for only 1,000 shillings, you could have made 300 just sitting on your b***.”

By solving these two crucial issues, other problems for the stock market could be solved. For example, if retail traders made up even just 10-20% of the entire market capitalization of the exchange, the short-term and active traders would help bring the much needed concept of “volume” back to the market.

Insiders within Kenya’s financial industry say that the main reason why there have been no new listings lately is because of volume. Believe it or not, there are some equities that have ZERO shares traded each day.

Intentionally cultivating and building a community of active, retail traders on the NSE possess the potential to drastically change the state of the market, and with it, fortunes.

More investors could begin to pile on. New companies could begin to explore listing on the exchange again. Market makers could again become interested in the exchange. This could create an upward snowball effect that not only helps the Republic of Kenya grow stronger, but it can help build wealth and even change the course of history.

So looping back: “Why is gambling easier than investing in Kenya?”

There is no easy answer but it is because they know what the people want. Easy, fast, and endorsed by the ‘wealthy.’