Kenya would benefit more from reducing the differences in VAT rates than in raising the standard 16% rate to 18%, a recent policy simulation by the Kenya Institute for Public Policy Research and Analysis (KIPPRA) shows.

- •In the simulation, KIPPRA tested the outcomes of increasing the rate to 18%, reducing it to 14%, and lowering VAT rate differentials by 25%.

- •The dynamics between increasing or lowering the standard VAT present a double edged sword where more revenue to the government undermines household welfare.

- •VAT contributes 30% of Kenya’s total tax revenues, with its share of GDP remaining fairly consistent for the last decade.

While increasing VAT can raise more revenue, a reduction could also improve revenue if businesses proportionately reduce prices, in turn increasing consumer spending. “Tax revenue will increase if the reduction in tax rate is accompanied by enhanced compliance and expanded tax base,” KIPPRA noted in the report.

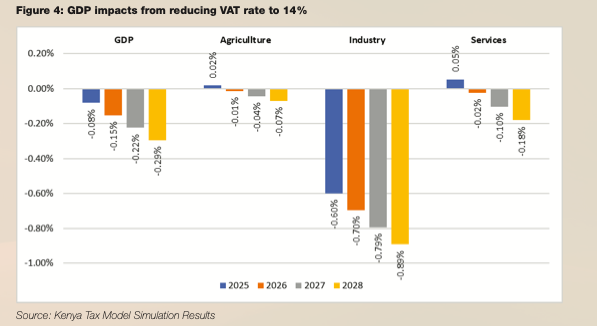

KIPPRA’s simulation shows that lowering VAT to 14% would reduce government revenue by 3.53% in 2025 and by an average of 3.67% in 2026-2028. It would slightly lower GDP in 2025.

VAT differential rate is the difference between the standard 16% and the actual product level VAT rate calculated from collections.

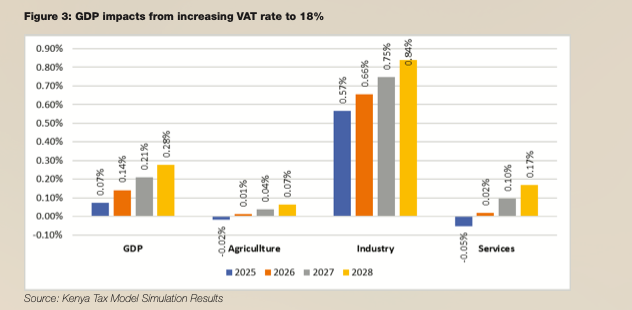

In turn, raising the VAT rate to 18% would increase government’s revenue by 3.49% in 2025 and 3.64% between 2026 – 2028.

It would increase total GDP by 0.07% in 2025 and drive growth in manufacturing and infrastructure investment, though agriculture and services GDP see small initial declines before recovering by 2028.

According to the report, raising the VAT rate will increase poverty in the short term, particularly in urban areas, as poorer households struggle with reduced incomes and higher prices. Urban households would struggle to substitute processed vatable products with non-market products such as fresh produce.

“With more tax revenue, the government can mobilize resources to finance key infrastructure projects that serve to crowd-in private investments by enhancing the business environment and increasing demand for investment goods produced locally,” KIPPRA added.

More investments in production of capital goods would, however, lower the demand for labour. Over time, investments funded by the additional VAT revenue help create jobs and reduce poverty levels. Lowering VAT has the opposite effect, improving household welfare, poverty levels, and boosting food security.

Reducing differences in VAT rates across goods and services by 25% would increase government revenue by 0.63% in 2025 and an average increase of 0.64% in subsequent years. Such a reduction in VAT rate differentials also modestly increases overall GDP, particularly in industry and services, while agriculture GDP experiences a temporary decline.

“To address the challenge of sector aggregation, which emanates from VAT treatment of the different sectors resulting in VAT rate differentials, there is a need to rationalize VAT expenditures based on evidence of their solid effectiveness in promoting investments and social protection,” KIPPRA said in the Policy Brief.

The simulation found that reducing the VAT differential would have a more positive impact on government revenues than raising the standard rate.