“Broadly, the Finance Bill 2024 continues the trend witnessed last year with new taxes as well as increases in existing taxes as the Government attempts to collect more.

However, these measures that increase the tax burden raise significant concerns as they will have the impact of reducing purchasing power and increasing the cost of doing business which will be negative for the mwananchi and the economy at large. The frequent changes in tax policy also create more risks for businesses and make it costlier for taxpayers to comply and does not augur well for our country.”

–Fredrick Omondi, Deloitte East Africa Tax and Legal Leader

“Despite the target for Kenya to become less debt-reliant, the proposed imposition of levies on essential household items, against the backdrop of inflation-impacted salaries and wages, would result in a decline in private consumption.

With prices of household necessities estimated to increase by as much as 80%, we expect to see a re-prioritisation of household expenditure away from non-essential consumption, thereby negatively impacting the forecasted 5.0% growth in GDP.”

–Gladys Makumi, Deloitte East Africa Financial Advisory Leader.

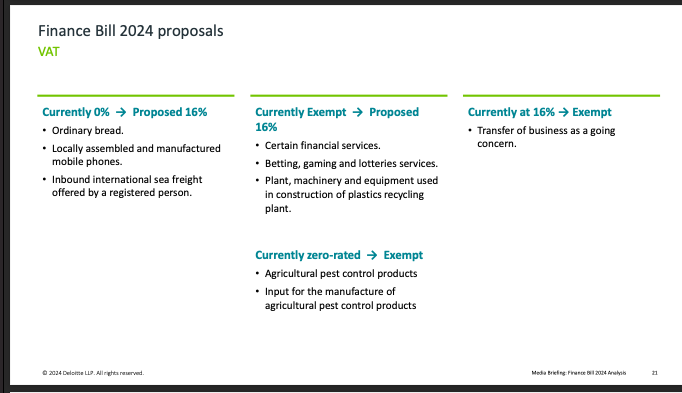

Value Added Tax

“The proposed change of VAT rate on the supply of bread from zero rate to VATable will increase the price of this product which is a staple food for the ordinary Kenyans, and it is expected that there will be a lot of push back from the public.

The proposal to change the VAT status of ordinary bread has on several occasions found its way into the previous Finance Bills and subsequently dropped once the respective Finance Acts are enacted.”

–KPMG Kenya

“The introduction of Excise Duty on palm oil, sunflower-seeds, safflower and cotton-seed oil, other vegetable or microbial fats and oils, margarine, edible mixtures or preparations of animal or microbial fats or oils or of fractions of different fats or oils of Chapter 15, other than edible fats and oils or their fractions of heading 15.16 may be intended to increase government revenue, however this will increase the cost of the vegetable oil products and the general population may seek an alternative source. e.g. Beef tallow.”

-KPMG Kenya

VAT Refunds

The proposals would:

- • (a) align the claim of refund from excess withholding VAT to that from zero rating under the VAT Act as opposed set off or claim of refund under the Tax Procedures Act

- •(b) exclude manufacturers under official aid funded project approved by the Cabinet Secretary responsible for matters finance from the VAT refund regime.

- •This would be disadvantageous as supplies to such project are exempt from VAT and the manufacturers would ordinarily not be eligible to claim input VAT on the same

(c) the requirement to lodge VAT refunds applications within 24 months from the date the tax becomes due and payable would no longer be applicable and taxpayers would be able to lodge the application any time and

- •(d) the provisions on full input VAT credit that had been automatically available for taxpayers where in case of mixed supplies, the value of the taxable supplies was more than ninety percent (90%) would no longer be applicable.

Conversely the provision of disallowance of the whole input VAT where in case of mixed supplies, the value of taxable supplies is less than ten percent (10%) would no longer apply. Taxpayers making mixed supplies would be allowed to claim the input tax attributable to taxable supplies regardless of the ratio of their supplies.

–Bowmans

The objective of the proposed amendment is to align the VAT provision relating to applying for refunds with the provision of the TPA.

Currently, the VAT Act provides that an entity with excess input VAT from supplying zero-rated supplies may apply for a refund within 24 months. This provision is not consistent with the provisions of the TPA which provides that a taxpayer may apply for a refund of overpaid VAT refund with 6 months.

If this proposal is adopted, the administration of VAT refunds will be aligned. More importantly, taxpayers qualifying for a VAT refund claim resulting from zero-rated supplies will be required to lodge the claims in a timely manner to avoid losing out on the pay-out of VAT refund claims.

-KPMG Kenya

Motor Vehicle Tax

“In our view, the motor vehicle tax will be applicable on the insurable amount which is largely based on the value of the motor vehicle as determined by a third-party qualified valuer. It will be interesting to see the Commissioner’s guidelines on the valuation of motor vehicles, especially for third-party insurance policy covers. However, this comes against the backdrop of revised insurance premium rates and high fuel prices, inevitably shoring up the cost of operating motor vehicles in Kenya.

This will have a negative impact on the transport and logistics industry who may opt to pass through the additional cost to their customers thus escalating cost of living through multiplier effect. It is also important to note that the motor vehicle tax, unlike advance tax on commercial vehicles, cannot be offset against income tax payable.”

-KPMG

“The proposed tax would result in double taxation for commercial vehicles which are already subject to advance tax under section 12A of the ITA. The proposed tax is also likely to discourage motor vehicle owners from taking comprehensive insurance, noting that the high premium rates will be increased by a further 2.5%.

If this proposal is passed into law, the tax is likely to have a significant impact on insurance penetration in Kenya (currently estimated at 3% and is one of the lowest in the region), as well as increase the cost of doing business for insurance companies, as insurers will be required to invest in systems recongfiguratins and additional personnel to handle the compliance aspects.”

-Anjarwalla & Khanna (ALN) Kenya

The proposal is aimed at expanding the tax base, and it would also bring some informal sectors which have historically been hard to tax sectors such as the public transport industry within the taxation regime. This proposal is in line with the government’s Medium – Term Revenue Strategy to raise Government revenue.

This proposal will lead to an increased administrative and compliance burden for insurers who will be required to collect and remit the motor vehicle tax within five (5) working days after the issue of a motor vehicle insurance cover.

–Bowmans

Removal of Withholding Tax Threshold

“This (the proposal to delete the minimum threshold for withholding tax) means that any payments for management, professional, or training fees to resident entities will be subject to a 5% withholding tax, regardless of the amounts paid. This will increase the cost of compliance since it will be administratively onerous to implement. Additionally, this proposal will have a negative cash flow impact especially for small traders.”

-KPMG Kenya

Deferment of Foreign Exchange Loss or Gain

This proposal comes barely a year after the Finance Act 2023 capped the deferment and claim of foreign exchange losses to five years. If passed, this will negatively affect taxpayers who are not able to claim foreign exchange losses within the three-year period.

Further, this annual change in laws and especially provisions that have only been in force for a short period creates uncertainty within the Kenyan tax regime and further impacts the ease of doing business in Kenya.

-Bowmans

Minimum Top Up Tax

With the proposed introduction of MinimumTop Up Tax in Kenya, mergers and acquisition transactions with Kenyan targets would need to be structured carefully to cover the potential impact of an acquirer making the target a covered person by virtue of the target being part of the group of the acquirer post completion.

-AJN Kenya

This proposal, which provides for the introduction of a MTT on covered persons in Kenya, seems to be aligned to the Global Anti-Base Erosion (GloBE) Model Rules under Pillar Two of the Organization for Economic Cooperation and Development (OECD) Inclusive Framework two-pillar proposal to address the tax challenges arising from digitalization of the economy. The GloBE Rules provide for source countries to introduce a miminum tax to be included in the domestic law of a jurisidiction, which gives taxing right to either the source or parent entity jurisdiction to ensure that multinational entities are subject to a minimum tax rate of 15%.

-KPMG Kenya

Income Tax-Corporation Tax

The proposed effective tax rate of 6%, will substantially increase the tax on from income generated through digital marketplaces, currently subject to tax at 1.5% under the Digital Services Tax (DST) regime.SEP offers alternative nexus rules to tax the profits rather than tax the gross turnover as currently determined under Digital Services Tax (DST).

-KPMG Kenya

Advance Pricing Agreement

“The proposed APA legislation will allow multinational entities to reach agreements with the Commissioner regarding the pricing of related party transactions, especially for complex transactions where traditional methods might pose challenges and have a high risk of transfer pricing disputes arising in future.

While the proposed provision is commendable and offers tax certainty, we note that it only covers unilateral APAs (i.e. entered between the Kenya Revenue Authority and a taxpayer). This may lead to double taxation where another jurisdiction affected by the controlled transactions covered by the APA rejects the results of the APA concluded in Kenya.”

-KPMG Kenya

If well implemented, the APA process will provide certainty on the operation of MNEs by enabling such companies to enter into binding agreements with the revenue authority on the determination of transfer prices and reduce tax disputes.

APAs contrasts with traditional audit techniques that is used by the revenue authority to examine whether transactions, which have already taken place, have been priced appropriately. The later approach has resulted in protracted audits on the operations of MNEs in Kenya with some transfer pricing audits taking between 2-5 years to resolve.

–Doris Gichuru, Deloitte East Africa Tax and Legal Partner