The Single African Air Transport Market (SAATM) is a flagship project of the African Union Agenda 2063, an initiative of the African Union to create a single unified air transport market in Africa,

- •SAATM seeks to advance the liberalization of civil aviation in Africa, transforming it into a single market by deregulating air services and opening regional air markets to transnational competition.

- •For decades, air travel within Africa has been constrained by a rigid point-to-point model. Direct flights between African countries are few and often expensive, deterring both business and leisure travel.

- •The SAATM seeks to dismantle these barriers by allowing airlines the fifth freedom of traffic rights. This essentially permits them to operate flights that pick up and drop off passengers in third-party countries not their own.

To date, since its launch in 2018, 37 countries have signed up to the SAATM:Benin, Botswana, Burkina Faso, Cabo Verde, Cameroon, Central African Republic, Congo Brazzaville, Cote d’Ivoire, Egypt, Ethiopia, Equatorial Guinea, Gabon, Gambia, Ghana, Guinea (Bissau), Guinée, Kenya, Lesotho, Liberia, Mali, Morocco, Mozambique, Namibia, Niger, Nigeria, Democratic Republic of Congo, Rwanda, Sénégal, Sierra Leone, South Africa, Swaziland, Chad, Togo, Zimbabwe, Angola, Zambia, Sao Tome & Principe.

These countries represent over 80% of the existing aviation market in Africa, and 67% of the AU member States.

SAATM’s Objectives

- •The SAATM is expected to enhance air connectivity across the continent, thereby reducing the journey and waiting times for most passengers by more than 20%.

- •Induce competition of air services resulting in fare reduction, and contribute to the growth of the Tourism industry in Africa and job creations in both sectors.

- •The SAATM will eliminate the need for separate Bilateral Air Service Agreements (BASAs) between individual countries.

- •SAATM will ensure aviation plays a major role in connecting Africa, promoting its social, economic and political integration and boosting intra-Africa trade and tourism as a result.

An IATA survey suggests that if just 12 key Africa countries opened their markets and increased connectivity, an extra 155,000 jobs and US$ 1.3 billion in annual GDP would be created in those countries.

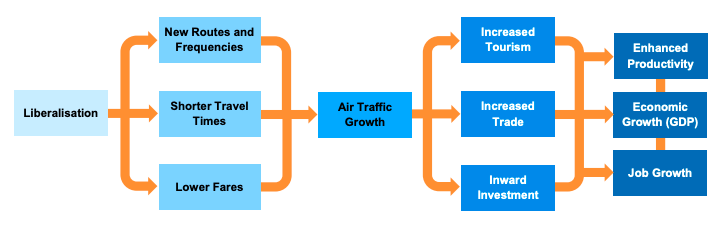

Because liberalisation can lead to increased air service levels and lower fares, it will in turn stimulates additional traffic volumes, facilitate tourism, trade, investment and other sectors of the economy, and bringsabout enhanced productivity, economic growth and increased employment.

There is considerable evidence that liberalisation of international air markets has provided substantial benefits for passengers and for the wider economy.

For example, one study of the EU single aviation market found that liberalisation had greatly increased competition on many routes, had resulted in many more new routes operating, and had led to a 34% decline in discount fares in real terms.

Furthermore, other studies have demonstrated a link between increased air traffic and growth in employment and Gross Domestic Product (GDP). For example, one study estimated that each 10% increase in international air services led to a 0.07% increase in GDP, which can translate into millions (or even billions) of dollars of incremental GDP.

History of Liberalisation in Africa

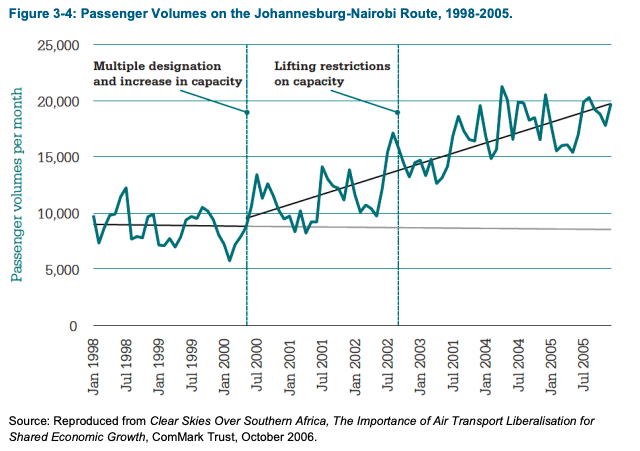

In 2000, South Africa and Kenya agreed to a more liberal air service agreement bilateral between the two countries. The liberalisation consisted of multiple designations (allowing a number of airlines to operate between the countries), and increasing the number of daily flights from 4 to 14.

In 2003, the agreement was further liberalised, removing all restrictions on capacity. After liberalisation, passenger volumes on the main route between the two countries, Johannesburg-Nairobi, increased by 69%.

SAATM Implementation by African Countries

Where African nations have liberalised their air markets, either within Africa or with the rest of the world, there have been substantial positive benefits, for example:

- •The agreement of a more liberal air market between South Africa and Kenya in the early 2000s led to 69% rise in passenger traffic.

- •Allowing the operation of a low cost carrier service between South Africa and Zambia (Johannesburg-Lusaka) resulted in a 38% reduction in discount fares and 38% increase in passenger traffic.

- •Ethiopia’s pursuit of more liberal bilaterals (on a reciprocal basis) has contributed to Ethiopian Airlines become one of the largest and most profitable airlines in Africa. Research has found that on intra-African routes with more liberal bilaterals, Ethiopians benefit from 10-21% lower fares and 35-38% higher frequencies (compared to restricted intra-Africa routes).

- •The 2006 Morocco-EU open skies agreement led to 160% rise in traffic and the number of routes operating between points in the EU and points in Morocco increasing from 83 in 2005 to 309 in 2013.

Despite the optimistic outlook, the journey towards a fully integrated African airspace is not without its hurdles.

While the African market has much economic potential, there are considerable challenges that need to be addressed. These include high user charges and taxes, inadequate airport infrastructure, unfavourable regulatory environment, undercapitalization of African airlines, and insufficient management expertise.

These factors, amongst others, have contributed significantly to the low profitability of African airlines.

Further, SAATM has encountered significant challenges and criticism from certain African governments and airlines. They argue that the agreement could result in a scenario where a few major airlines dominate the market, potentially stifling competition.

Nevertheless, fifth freedom traffic capacity in Africa has increased from 15% in 2018, to 19% in 2023.

Africa today accounts for under four percent (4%) of the global world aviation traffic but with over a billion persons, the share of African traffic should increase to more than 10% with a fully operational single African air transport market.

See Also: