This week volume soared with 172,465,600 shares traded as compared to the election week’s 74,601,200 (+131%). Total turnover also increased to Kshs. 4,045,914,756 from Kshs. 2,088,058,798 (+94%). All the main indices closed in the green. NSE 20 climbed to 3992.76 (+0.40%), the broad NASI acclimatised at 165.20 (+0.12%) and the NSE 25 also stepped up to 4413.94 (+0.29%). The NSE 20 and NSE 25 touched highs not reached in over two years, during the week, closed lower but still maintained the same records, albeit less dazzling. The broad NASI touched a 27-month high of 168.81 on Monday August 14th 2017, as it became clear that the incumbent President secured a victory. While the market suffered from a correction over the last three days of the trading week, it was just volume normalizing as the bears succeeded over the bulls.

The opposition decision to challenge the 2017 presidential election results was akin to a red cloth being waved at the bulls. However, it came as a relief to those dreading mass action, which would have been the same as sanctioning violence, considering the thin tempers some deviants possess.

Telecommunications Sector

Safaricom Kshs. 24.25 (-1.02%) emitted a low signal with only 38,564,700 shares traded. Despite this volume being better than the previous week’s 23,042,000, the average volume over the previous 8 weeks (excluding these two weeks) is 64,659,100 shares. Fund managers and other big money buyers have accumulated this counter for the past one year, mainly at prices below Kshs. 20. The problem with a further rally is the ample supply at current levels, whereby the above-mentioned investors can receive a gross return of almost 28% if they bought at Kshs. 19. Late February and early March also saw some huge panic selling as news of a potential government enforced separation of Mpesa from Safaricom emerged. The ticker touched a one-year low of Kshs. 15.90 on March 9th 2017. Nonetheless, a high target of Kshs. 26 is not akin to putting a man on Mars!

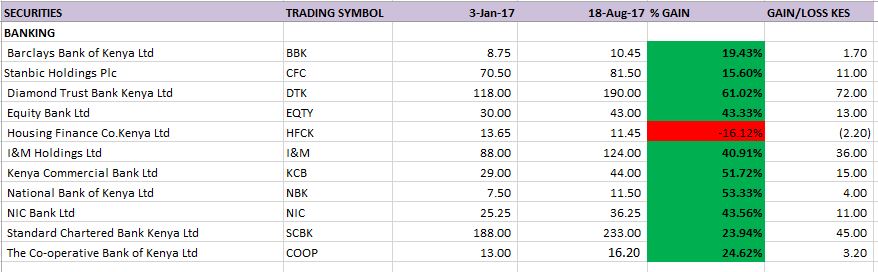

Banking Sector

Equity Bank Kshs. 43 (+0.58%) led the sector movers with a healthy motion of 21,882,100 shares. Its half year results are overdue but a profit drop is imminent. The tier one lender has recorded a decline of 6.1 percent in net profit to Sh 4.8 Billion for the first three months of 2017. The decline was attributed to reduced interest income on customer loans following the rate cap which came into effect in September last year. If I was a rally driver, I’d go short on this counter but I would crash if the above-mentioned profitability constraint was lifted by Parliament.

Co-operative Bank Kshs. 16.20 (+0.31%) recorded a surge during the week, touching a high of Kshs. 18 on August 15th 2017. It came tumbling down as its half year 2017 results emerged. Profit before tax and exceptional items dropped to Kshs. 9,177,121,000 from Kshs. 10,348,456,000 (-11.3%) while EPS took a plunge to Kshs. 1.13 from Kshs. 1.52 (-25.66%) in a similar period. However, renowned financial analyst Aly Khan Satchu was positive on the disclosures: “Better than respectable Earnings in a challenging environment and they have a largely captive Customer Base which is a significant area of leverage.”

KCB Kshs. 44 (+1.15%) saw the exchange of 10,029,700 shares. The Kshs. 1 (+100%) dividend books closure date of 4th September 2017 is distant enough to avail some headroom to this brilliant tier 1 performer. Moody’s Investors Service in its latest assessment of KCB released late July said although Kenyan banks will continue to face challenges in the months ahead, with muted loan growth and mounting asset quality pressure, KCB is expected to maintain healthy profits and strong capital buffers which provide substantial protection against downside risks and help support the bank’s credit quality. The first half numbers indicate that non-branch channel systems—Mbenki, KCB M-PESA, Mobi and payments— accounted for 86% of KCB’s total transactions.

HFC (Housing Finance) Kshs. 11.45 (-1.29%) pushed 1,987,500 shares. The mortgage lender’s share price hit a high of Kshs. 13.40 on August 15th 2017, plummeting to current levels on horrifying results. The integrated financial and property services provider posted a half year after tax profit of Kes 159 million for the period ending June 30, 2017, representing a 74% decline compared to a similar period in 2016. “The drop in our performance is as a result of the prevailing impact of the interest rate capping law and the unfavourable macroeconomic environment that resulted in a significant drop in interest related income and an increase in interest related expenses,” said HF Group Managing Director Frank Ireri, maintaining his standard explanation. While the mid-sized bank has a dim outlook in the near future, it may be a good buy after the enforced regulation of interest rates is scrapped, and the full year results for the year ended December 2017 are reported, which will definitely be profit warning laden. On a year-to-date basis HFC is the only banking counter in the red zone (-16.12%).

Commercial and Services

Deacons Kshs. 4.40 (-5.38%) saw the barter of 368,500 shares as the imminent correction occurred. Speculative buying on Centum’s entry occurred without paying heed to the fact that the clothing and apparel retail chain posted an operating loss of Ksh 385 Million in the financial year ending 31 December 2016 compared to an operating profit of Ksh 141.6 Million made in 2015. The company in its statement mentioned that the business recorded positive results in H1 of 2016. However, H2 2016 results were affected by several factors negatively impacting the peak trading season that resulted in suppressed sales and margins. Existing malls registered lower footfall and new retail property registered lower purchase conversion rates that led to cannibalization. The retailer further blamed the interest rate cap on bank lending that led to a further reduction in liquidity in the market, thereby decreasing customer spend and store productivity.

Kenya Airways Kshs. 4.95 (+7.61%) gained some altitude with heavy passenger load factor, although easing marginally towards the end of the week.

Nation Media Group Kshs. 114 (-2.56%) flipped through 325,300 shares. The media giant recommended an interim dividend of Kshs. 2.50, unchanged from the previous period. Books closure is stated as 15/09/2017.

Uchumi Kshs. 3.95 (-5.95%) retreated on heavy volume, as demand evaporated.

Construction and Allied

Athi River Mining Kshs. 20.75 (-1.19%) moved 1,387,400 shares while Bamburi Cement Kshs. 199 (+3.11%) gained on thin volume.

Energy and Petroleum

Kenolkobil Kshs. 15.45 (-4.33%) saw the exchange of 19,287,600 shares. The oil products distributor’s share price nudged a high of Kshs. 16.75 during the week. The interim dividend books closure date of 25/08/2017 gives it the entire trading week ahead to reverse losses.

Insurance

CIC Insurance Kshs. 6.25 (+11.61%) saw new buyers lay claim over 7,159,600 shares. The ticker kissed a mind numbing high of Kshs. 7.10 during the week. The return in 2017 has been 56% from an entry price of Kshs. 4 on January 3rd 2017. With a PE ratio of 89.29, this is a breathtakingly expensive share. I suspect it is favoured due to its lower price, liquidity and overall strong earnings capability (despite some hiccups).

Britam Kshs. 15.15 (+1.68%) traded 2,078,600 shares while Liberty Kenya Holdings Kshs. 13.95 (+3.33%) moved 6,162,400 shares. Investors are expecting strong half year results and perhaps even some surprise dividends.

Investment Services

NSE Kshs. 23.75 (+13.10%) saw 402,700 shares meaningfully enter and exit the board. The trade facilitator’s half year 2016 profit before tax fell by 51% to Kshs. 107,650,000 from Kshs. 218,740,000. Its financial year 2016 results, which were preceded by a profit warning, disclosed a profit before tax of Kshs. 233,115,000 from Kshs. 381,494,000 (-38.9%). With the current bull run that the market has been taking, the profits are likely to be very good this period.