First Published on July 23rd, 2022 by Felix Martinez for SureDividend

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 1.38 million Verizon Communications Inc. (VZ) shares for a total market value exceeding $61.34 million. Verizon Communications Inc. currently constitutes over 0.02% of Berkshire Hathaway’s investment portfolio.

This article will thoroughly examine Verizon Communications Inc.’s prospects as an investment today.

Business Overview

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

Verizon has now launched 5G Ultra-Wideband in several cities as it continues its rollout of 5G service. Customers in parts of Atlanta, Dallas, Detroit, Indianapolis, Omaha, and Washington, D.C. could access the company’s 5G network. Verizon is the first of the major carriers to turn on the 5G service.

On July 22, 2022, the company reported the fiscal year’s second-quarter and first six months results. Revenue was flat year over year (YoY) at $33.8 billion for the quarter compared to the second quarter in 2021. Earnings came in at $1.24 per share, a decrease of 11.4% compared to the $1.40 per share the company made in 2Q201.

For the first six months of the year, revenue is up 1.1% compared to the first six months of 2021. However, earnings are down 12.7% for the first six months compared to last year’s period. Reported net income of $5.3 billion decreased 10.7% from second-quarter 2021, and adjusted EBITDA of $11.9 billion, down 2.6% YoY.

The company had a net addition of 268,000, including 256,000 fixed wireless net additions. Total broadband net additions increased by 39,000 from first-quarter 2022, and fixed wireless net additions increased by 62,000 from first-quarter 2022.

The company’s total wireless service revenue of $18.4 billion for the wireless segment is a 9.1% increase yearly. Also, the total retail postpaid churn of 1.03%, and retail postpaid phone churn of 0.81%. Overall, postpaid phone net additions were 12,000.

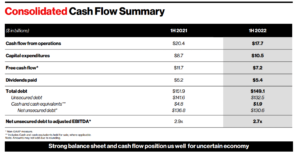

The cash flow from operations was down for the year’s first half from $20.4 billion to $17.7 billion. While capital expenditures were up $2.4 billion to $10.5 billion in the first half. Thus, Free cash flow for the quarter was down from $11.7 billion to $7.2 billion for the first half of the year.

Growth Prospects

Over the past ten years, the company has been growing earnings at a Compound Annual Growth Rate (CAGR) of 10.8%. In addition, over the past five years, the company has been growing earnings at a CAGR of 9.6%. These are excellent growth rates for a mature company like Verizon, but we think a growth rate over the next five years of 4% is expected due to the company’s guidance of low-single-digit earnings growth.

We expect Verizon will regularly lose postpaid wireless market share over time as it focuses on moving customers to top-tier fee plans. With the Tracfone acquisition, we consider Verizon might be a giant player in the pay-as-you-go marketplace. However, we don’t count on this business growing swiftly as the company targets the higher end of the market.

The company expects the total wireless service revenue to grow by 8.5% – 9.5% for the year compared to last year. However, the company did lower its earnings guidance from $5.40 – $5.55 per share to $5.10 – $5.25 per share for the year. At the midpoint of $5.17 per share will be a decrease of 4.1% compared to FY2021 earnings of $5.39 per share.

Competitive Advantages & Recession Performance

One of Verizon’s key competitive advantages is that it is often considered the excellent wi-fi provider within the U.S. this is evidenced by the agency’s Wi-Fi internet additions and very low churn rate. This reliable service allows Verizon to preserve its consumer base in addition to delivering the organization the possibility to transport clients to higher-priced plans.

Verizon is also rolling out 5G service, which will give it an advantage over other carriers. Another advantage for Verizon is the stock’s ability to withstand a downturn in the market.

For example, during the great recession, the company’s earnings grew 8% in 2008 and only fell 6% in 2009. The share price of the stock was relatively flat in those years. Verizon was also increasing its dividend during this time. In 2008, the dividend grew by 6.7%, and in 2009 it grew by 6.1%.

During the COVID-19 pandemic, earnings grew 2% in 2020 and 10% in 2021. Thus, these two events show the company’s strength during a recession or downturn.

Valuation & Expected Returns

The company is trading much lower because of the second quarter earnings report. Right now, the company looks to be significantly undervalued. Earnings are expected to be $5.17 per share for 2022. Over the past ten years, the company had an average PE ratio of 14x.

Today’s price of $44.45 per share and the expected earnings of $5.17 per share give us a PE ratio of 8.6x. If the company reverts back to a fair PE of 13x earnings, the stock price will be $67.21. based on the current stock price, this will give an investor a potential 51.2% return.

This does not include the highly safe dividend yield of 5.76%, much higher than the company’s five-year dividend yield average of 4.5%. The dividend payout ratio is a little over 50%. Thus, the dividend is safe for the foreseeable future.

Final Thoughts

Verizon is one of dividend growth investors’ and income investors’ favorite stocks because of the high safe growing dividend. The company is significantly undervalued because of the most recent price drop after the company earnings report. If you are a long-term investor looking for a safe, growing income, Verizon is the place to be. We rate the stock a Buy at the current price.

This article was first published by Felix Martinez for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Warren Buffett Stocks: Snowflake Inc.

Warren Buffett Stocks: T-Mobile US Inc.