Published on June 17th, 2022 by Bob Ciura for SureDividend

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned just over 890 million shares of Apple Inc. (AAPL), for a market value exceeding $155 billion. This makes Apple the top holding for Berkshire Hathaway by far. Apple currently constitutes over 42% of Berkshire Hathaway’s investment portfolio.

This article will analyze the tech giant in greater detail.

Business Overview

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today the technology company designs, manufactures, and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV. Apple also has a services business that sells music, apps, and subscriptions. With a market cap of $2.1 trillion, Apple is a mega-cap stock.

On April 28th, 2022, Apple declared a $0.23 quarterly dividend, marking a 4.5% year-over-year increase. Also on April 28th, 2022, Apple reported Q2 fiscal year 2022 results for the period ending March 26th, 2022. (Apple’s fiscal

year ends the last Saturday in September).

For the quarter Apple generated revenue of $97.278 billion, an 8.6% increase compared to Q2 2021. Product sales were up 6.6%, led by a 5.5% increase in iPhones (52% of total sales). Service sales increased 17.3% to $19.8 billion and made up 20% of all sales in the quarter. Net income equaled $25.01 billion or $1.52 per share compared to $23.63 billion or $1.40 per share in Q2 2021.

Growth Prospects

In the 2012 through 2021 stretch, Apple grew its earnings-per-share by 15.1% annually. Naturally this is an attractive growth rate, although it is lower than the growth rates Apple produced in the years prior to 2012. The larger the bottom line gets, the harder it becomes to grow at a very fast pace.

Going forward Apple’s earnings growth will be driven by several factors. One of these is the ongoing cycle of iPhone releases, which creates lumpy results. In the long run Apple should be able to grow its iPhone sales, albeit in an irregular fashion.

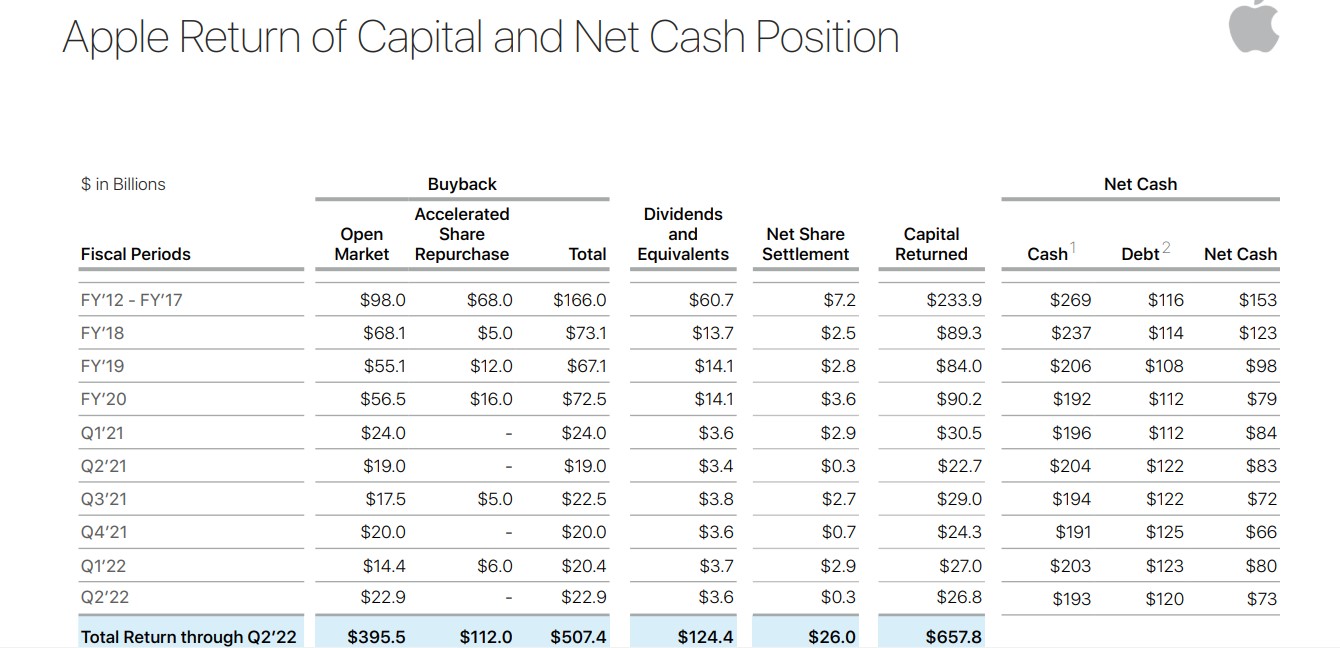

Another factor that has played a role in the past is the shrinking share count. Due to its immense cash flows Apple can repurchase hundreds of millions of shares. Apple should continue to lower its share count, further boosting EPS.

Indeed, the following table shows the huge level of cash returns through dividends and buybacks in the past decade.

Source: Investor Presentation

Moreover, in emerging countries where consumers have rising disposable incomes, Apple should be able to increase the number of smartphones it is selling in the coming years.

In addition, Apple’s Services unit which consists of iTunes, Apple Music, the App Store, iCloud, Apple Pay, etc., has recorded a significant revenue growth rate in recent years. Services revenues grow at a fast rate and produce high-margin, recurring revenues.

Over the next five years, we project Apple could generate 7% annual EPS growth.

Competitive Advantages & Recession Performance

As the world’s biggest technology stock by market cap, Apple possesses many competitive advantages. First, Apple’s brand is admired around the globe, and together with Samsung the company basically earns all the profits in the

top end smartphone market.

In addition, Apple’s Services will bring in an increasing stream of recurring revenues. During the last financial crisis Apple’s profits rose, but that was during the hyper-growth phase. Since Apple is still highly dependent on sales of relatively high-cost smartphones, a major economic crisis could hurt its profits.

Apple’s phenomenal balance sheet is an additional competitive advantage. As of the most recent report Apple held $51.5 billion in cash and securities, $118.2 billion in current assets and $350.7 billion in total assets (of which an additional $141.2 billion are non-current securities) against $127.5 billion in current liabilities and $283.3 billion in total liabilities.

Such a huge cash pile allows Apple to be more aggressive in pursuing acquisitions or investing in organic growth opportunities.

Valuation & Expected Returns

In the 2011 through 2016 stretch shares of Apple routinely traded with an average price-to-earnings multiple between 12- and 13-times earnings. In the years since the earnings multiple has expanded tremendously. With shares now trading at 21.2 times expected 2022 EPS, we believe there is the potential for a valuation headwind in the years to come.

Our fair value estimate for Apple stock is 18. If the stock retraces to this P/E multiple, it would reduce annual returns by 3.2% per year through 2027.

This view could be too conservative if the valuation remains elevated, but we are not yet ready to make that leap and instead forecast a high-teens multiple. While the dividend yield is not spectacular, it is very well covered with the propensity to grow over time.

Apple started paying a dividend in 2012. Since then, the dividend has been increased regularly, but more or less in-line with the company’s earnings-per-share growth, which is why the dividend payout ratio has remained low. Apple’s projected dividend payout ratio for 2022 is just 15%. This, coupled with the company’s enviable balance sheet, makes Apple’s dividend look quite safe.

And, Apple should have no trouble continuing to increase its dividend each year. Shares currently yield 0.7%.

Separately, we expect 7% annual EPS growth over the next five years. Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 4.5% per year over the next five years. This makes Apple a hold, but not a buy right now due to valuation concerns.

Final Thoughts

Apple stock has had an amazing run over the past several decades, and is now the world’s largest stock by market cap. While the company can continue to grow earnings over the next several years, we do not believe this is the right time to buy the stock due to its elevated valuation and depressed dividend yield.

Apple stock remains a solid holding for dividend growth investors, but prospective buyers should wait for a further pullback.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

3 Top Stocks for Dividends Every Calendar Month

Snowball Effect Investing | Compound Your Wealth Like Warren Buffett

3 Undervalued Blue Chip Stocks For Safe Dividends

4 Consistently High Paying Dividend Stocks With Growth Potential