Tanzanian-focused flake graphite development company Volt Resources Limited (ASX: VRC) announced that it will proceed with the issue of US$40 million in structured debt funding.

Volt has engaged Exotix Capital to undertake the Tanzanian Bond issue to raise the required funding for the development of Stage 1 of the Bunyu project.

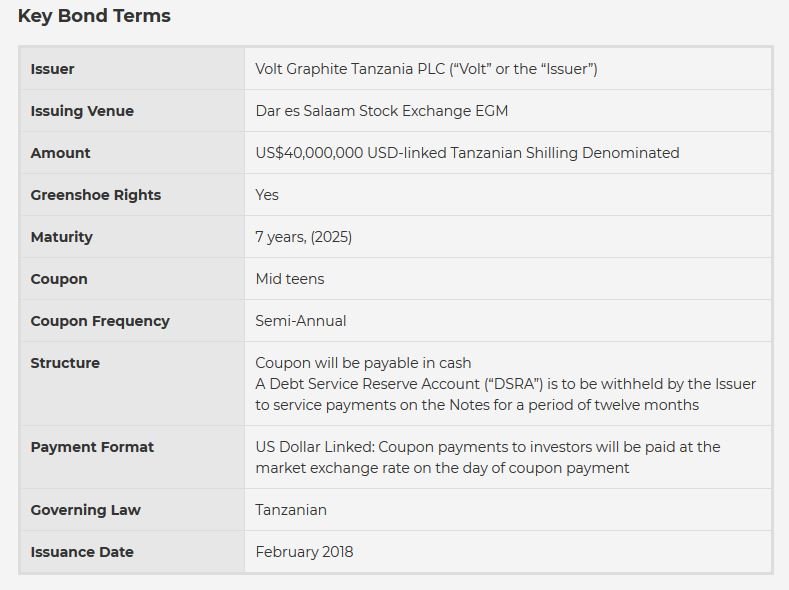

Following recent meetings with targeted investment groups in Tanzania, Uganda and Kenya, Exotix has recommended Volt proceed with a formal bond prospectus process and listing of the bonds on the Dar es Salaam Stock Exchange (“DSE”) in Tanzania. Volt and Exotix have sized the debt transaction at US$40 million on the key terms set out below which will allow net project development and working capital funding of ~US$31 million after taking into account a Debt Service Reserve Account (DSRA) and costs of the issue. The facility interest and bond maturity payments can be serviced by projected project cash flows.

Importantly, the US$40m debt sizing allows meaningful participation from Tanzanian and Ugandan Pension Funds combined with other investment groups seeking fixed income investments.

This funding pathway provides for local investment in the largest graphite project in Tanzania and one of the largest in the world. With local job creation and skills acquisition, local business opportunities and significant export revenue for Tanzania, the Bunyu Graphite Project provides Tanzania with the opportunity to become a significant part of the global new energy sector.

Volt’s Bunyu Graphite Project can produce graphite suitable for battery anode production, flame retardant building material uses, the developing graphene industry and traditional markets including refractories.

Source: Volt Resources