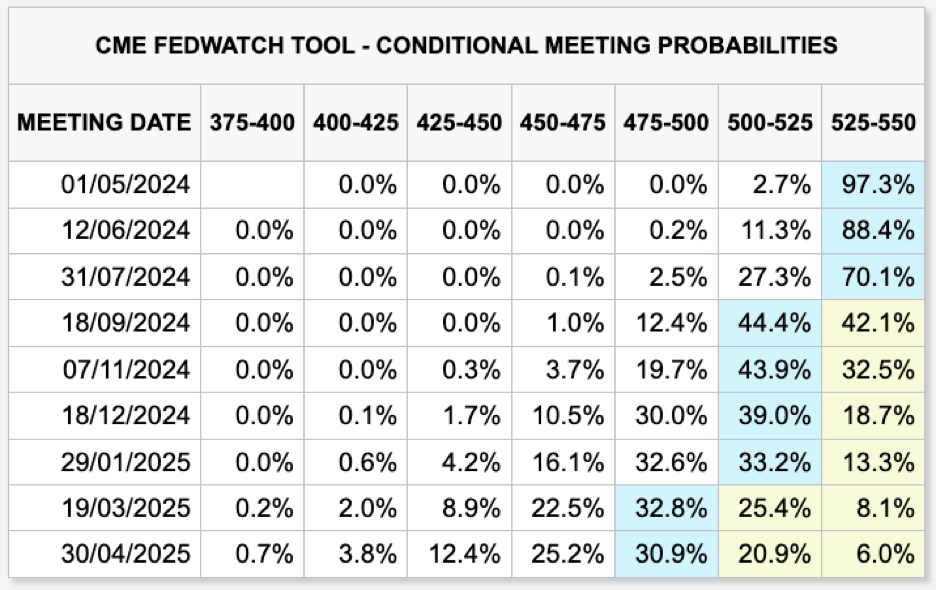

Last week, the US Federal Open Market Committee (FOMC) decided to keep interest rates steady, which was highly anticipated and had significant potential to impact financial markets. Prior to the decision, the probability of a rate cut at the May meeting had fallen sharply to just 2.7%, according to the CME Fedwatch Tool, and a hold was widely expected.

Source: www.cmegroup.com, Apr 30 2024.

In addition to the interest rate decision, the markets were also focused on the release of the April ADP employment change and April’s NFP data. Anticipating these employment reports led to volatile price action, as traders and investors assessed their potential impact on the economy.

The much anticipated US Non-Farm Payroll (NFP) for April 2024 showed that the US economy added 175,000 jobs, a slowdown from March’s revised figure of 315,000 and below the expected 243,000. This marks a significant deceleration from the first quarter’s brisk pace and the 12-month average of 242,000 jobs per month. Recent PMI and GDP data suggest a potential slowdown in US economic activity. Despite this slowdown, there’s been an uptick in prices, as indicated by the previous resilient PCE Price Index reading.

Amid turbulent markets—fueled by escalating geopolitical tensions, persistent inflation, and milestones such as all-time highs for Gold and the Nasdaq100—traders and investors globally have been keenly anticipating the US earnings season.

Last week, mega-cap corporations such as Apple (AAPL), Amazon (AMZN), and Berkshire Hathaway (BRK) released their earnings reports. These financial disclosures offered crucial insights into how high inflation is affecting consumer spending, aiding traders and investors in making informed decisions.

The performance of key players has been mixed. Tech giants like Google (GOOG), Microsoft (MSFT), and Netflix (NFLX) surpassed market expectations. Conversely, Tesla (TSLA) reported lower earnings; however, its stock found support after the company announced new initiatives, including plans for more affordable cars, an expansion into robotaxi services, full self-driving (FSD) capabilities, and intellectual property growth, all aimed at strengthening its position against the burgeoning low-cost EV competition in China.

Earnings announcements often impact the direction of major indices like the Nasdaq100 and S&P 500. Additionally, the focus on AI and data centre investments by companies like Google (GOOG) and Microsoft (MSFT) highlights the importance of staying ahead in technology to thrive in a rapidly evolving market.

Source: www.exness.com, US 500 (S&P500), Exness Webterminal, May 7 2024.

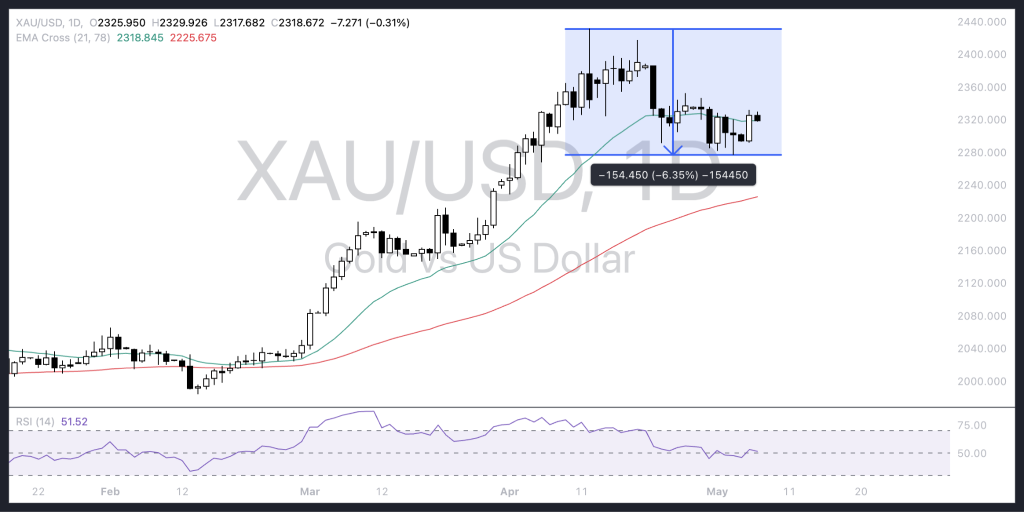

Gold prices finished the week lower, erasing prior-weeks gains, but remained well off the week’s lows. Bullion prices declined more than 5% from the record high as the Middle East geopolitical tensions shifted tone, and traders focused on key US economic data.

Source: www.exness.com, XAUUSD (Gold), Exness Webterminal, May 7 2024.

Trading US stocks & Indices, Commodities such as Gold and currencies is possible for Kenyan residents through Contract for Differences (CFDS), offered by locally licensed multi-asset broker Exness. Using CFDs, traders and investors can profit from upward and downward price movements without owning the underlying asset.

It is crucial to note that trading carries a high level of risk, and amplifying positions through leverage increases the potential for both profits and losses. However, by staying informed, making strategic investments, trading decisions focused on risk management, traders and investors can set themselves up for success in today’s dynamic economic landscape.

Traders should remain vigilant in their market analysis and take advantage of the opportunities presented by the current economic conditions.

Terence Hove is a Senior Financial Market Strategist at Exness.