Listed miller Unga Group Plc has posted a profit for the year ended June 30, 2025, reversing two years of heavy losses.

- •Net earnings rose to KSh 222.1 million compared with a KSh 669.6 million loss in FY2024.

- •The turnaround was driven by stronger sales, lower finance costs, and tighter cost controls.

- •Despite the rebound, the board withheld a dividend to preserve liquidity and rebuild the balance sheet.

Revenue rose 10% to KSh 26.13 billion from KSh 23.70 billion.

Operating profit was KSh 704.1 million, compared with a KSh 275.6 million loss a year earlier.

Finance costs eased to KSh 394.6 million from KSh 559.4 million, helping profit before tax recover to KSh 340.8 million from an KSh 805.0 million loss.

Management cited lower interest rates, stable weather, and operational efficiency as key factors. Investments in customer engagement and energy-saving initiatives such as solar power also supported results.

Equity attributable to shareholders rose to KSh 3.49 billion, while total assets stood at 11.08 billion, slightly lower than FY2024.

FY2025 vs FY2024 Key Metrics

| Metric | FY 2025 | FY 2024 | Change YoY |

|---|---|---|---|

| Revenue | 26.13Bn | 23.70Bn | 🟢 +10.2% |

| Operating Profit/(Loss) | 704.1Mn | (275.6Mn) | 🟢 Turnaround |

| Share of Profit from Associate | 29.2Mn | 16.8Mn | 🟢 +74.0% |

| Finance Income | 2.1Mn | 13.3Mn | 🔴 -84.3% |

| Finance Costs | (394.6Mn) | (559.4Mn) | 🟢 -29.5% |

| Profit/(Loss) Before Tax | 340.8Mn | (805.0Mn) | 🟢 Turnaround |

| Income Tax | (118.8Mn) | 135.4Mn | 🔴 n/m |

| Net Profit/(Loss) | 222.1Mn | (669.6Mn) | 🟢 Turnaround |

| EPS (Shs) | 1.73 | (5.94) | 🟢 Turnaround |

| Total Assets | 11.08Bn | 11.29Bn | 🔴 -1.9% |

| Shareholders’ Equity (Parent) | 3.49Bn | 3.35Bn | 🟢 +4.1% |

| Non-Controlling Interest | 1.85Bn | 1.75Bn | 🟢 +5.4% |

| Closing Cash Balance | 190.0Mn | 251.0Mn | 🔴 -24.3% |

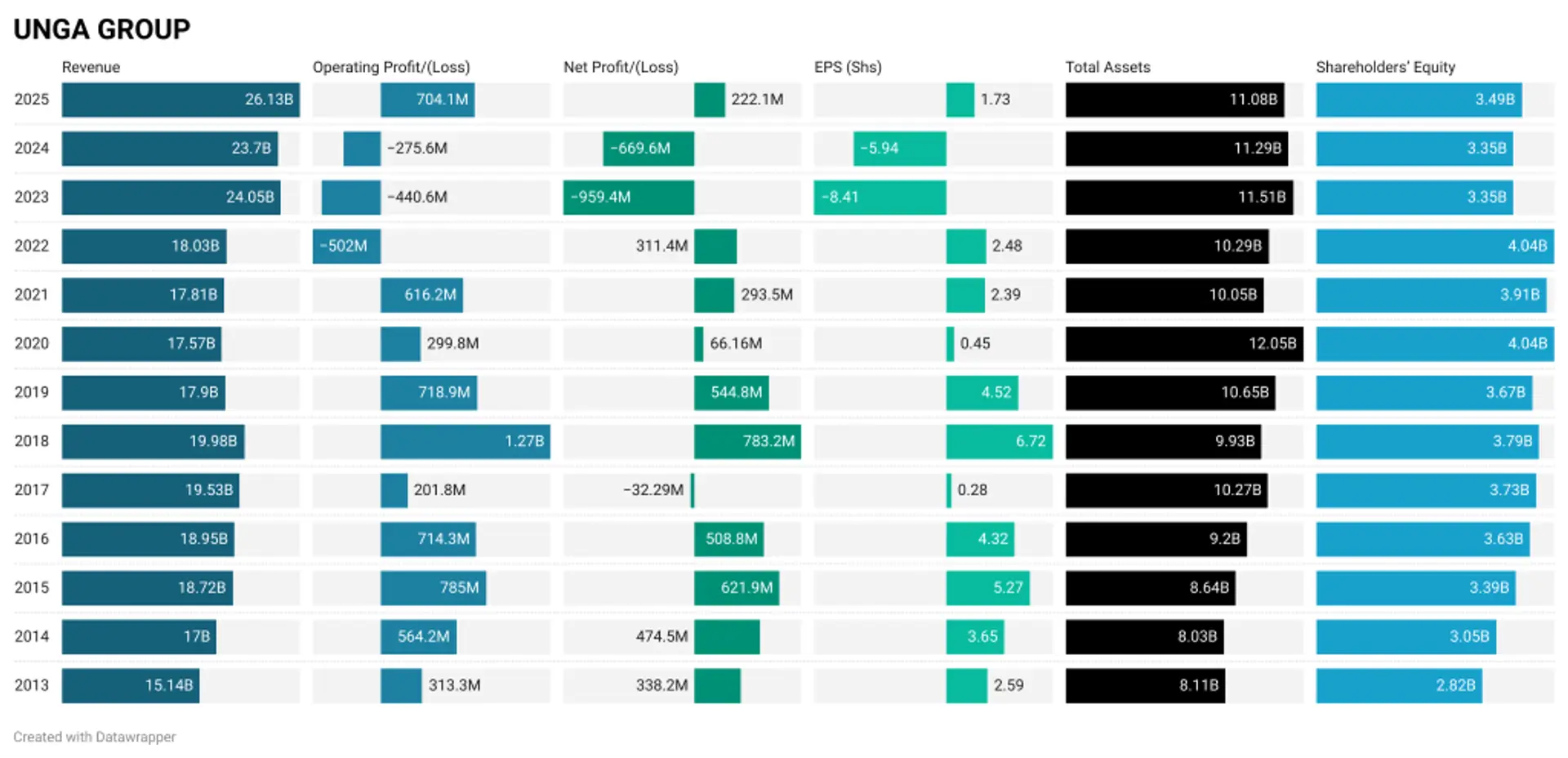

2013–2025 Financial Trend

Between 2013 and 2025, revenue expanded from KSh 15.1Bn to KSh 26.1Bn, a compound annual growth rate of about 5%.

- •Profitability was steady through 2016, collapsed in 2017, then rebounded in 2018–2019 with record earnings before slipping into losses in 2023 and 2024. FY2025 marks a return to profit.

- •Assets peaked at KSh 12.05Bn in 2020 but have since flattened around 11Bn.

- •Equity rose to KSh KSh 4.04Bn in 2020 before eroding to KSh 3.49Bn in 2025.

- •EPS peaked at KSh 6.72 in 2018 before plunging into deep negatives in 2023–2024, now recovering to KSh 1.73.

Unga says it remains cautious on global risks such as currency swings and supply chain pressures. Its strategy focuses on customer experience, brand strength, and expanding food and animal feed offerings. The challenge is to sustain profitability while restoring the capital base after years of volatility.