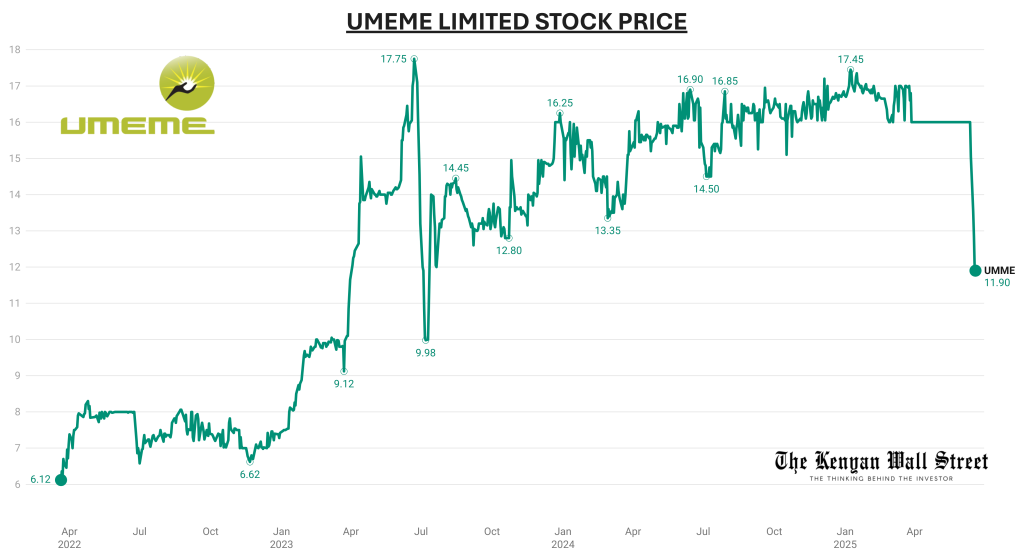

Umeme Limited, formerly Uganda’s largest electricity distribution company and a cross-listed entity on both the Uganda Securities Exchange (USE) and the Nairobi Securities Exchange (NSE), has seen its stock drop 25.6% since trading resumed on 14 June 2025.

- •The drop comes after a two-month suspension tied to the end of its 20-year power distribution concession with the Government of Uganda. Shares fell from KSh 16.00 on 28 March to KSh 11.90 by 19 June.

- •The plunge was further triggered by the release of Umeme’s FY2024 results, which revealed a Ushs 511 billion net loss and no final dividend. Investors remain cautious amid ongoing uncertainty around the unresolved US$ 292 million Buyout Amount, which Umeme is pursuing through international arbitration.

With the company no longer generating operating income post-concession, sentiment has turned defensive.

Now trading again on both the NSE and USE, Umeme’s valuation depends largely on the outcome of arbitration. If successful, the company could recover up to Ushs 1.05 trillion, unlocking value for shareholders. However, the payout’s timing and structure remain uncertain, keeping investor confidence muted.

Umeme’s transition from operator to litigant now defines its corporate outlook as its ongoing case against Uganda stands as a high-stakes example of legal risk in public-private energy infrastructure projects.

Meanwhile, the broader NSE market has also retreated after an exceptional rally last week. The NASI closed at 144.62 on 19 June, slightly up 0.17% from the day before, but still below last Thursday’s peak of 147.83. The pullback reflects mild profit-taking after three consecutive sessions of gains earlier in the month.