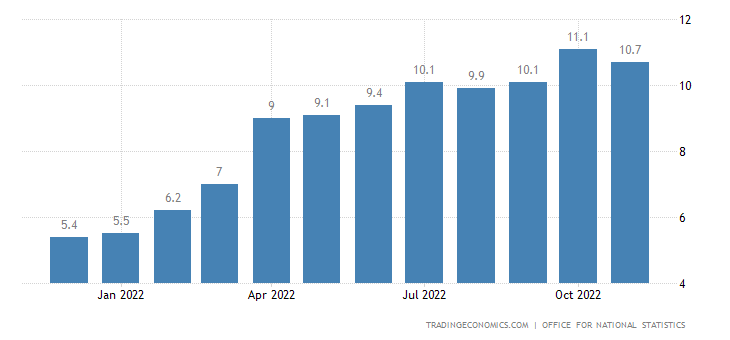

The annual inflation rate in the UK eased to 10.7% in November of 2022 from 11.1% in October which was the highest since October 1981.

The UK Figures came below market forecasts of 10.9%, with the largest downward contribution made by transport (7.2% vs 8.9%), particularly motor fuels (17.2% vs 22.2%) and second-hand cars (-5.8% vs -2.7%).

Prices also slowed for clothing and footwear (7.5% vs 8.5%), recreation and culture (5.3% vs 5.9%), and communication (2.6% vs 3.2%).

On the other hand, prices in restaurants and hotels rose at a record 10.2% (vs 9.6%), mainly pushed by alcohol served in restaurants, cafes and pubs.

Food inflation, meanwhile, edged higher to 16.5% from 16.4%, hitting the strongest since 1977, led by the cost of bread and cereals.

Housing rentals increased by 4.5%, slightly above 4.3% in October.

Compared to the previous month, the CPI increased by 0.4%, well below the 2% jump in October.

The Bank of England is widely expected to deliver the ninth hike in a row as policymakers try to tackle rampant prices.

Economists expect the BoE will lift its key lending rate from 3.0% to 3.5% on Thursday, further squeezing consumers with rising loan costs.

See Also: