After its 20-year concession expired late last month, Uganda is now at a legal juncture with Umeme Limited, its biggest electricity distributor for two decades, over a contentious $234 million buyout.

- •Umeme formally returned control of the power distribution network to the Uganda Electricity Distribution Company Ltd (UEDCL) on March 30, 2025.

- •The business accused the Ugandan government of underpaying the agreed-upon exit compensation in a formal dispute that it filed a few days later.

- •This is more than just a numerical battle as it serves as a test case for how governments manage the termination of public-private infrastructure contracts and whether investor confidence endures.

How We Got Here: The Umeme Story in Brief

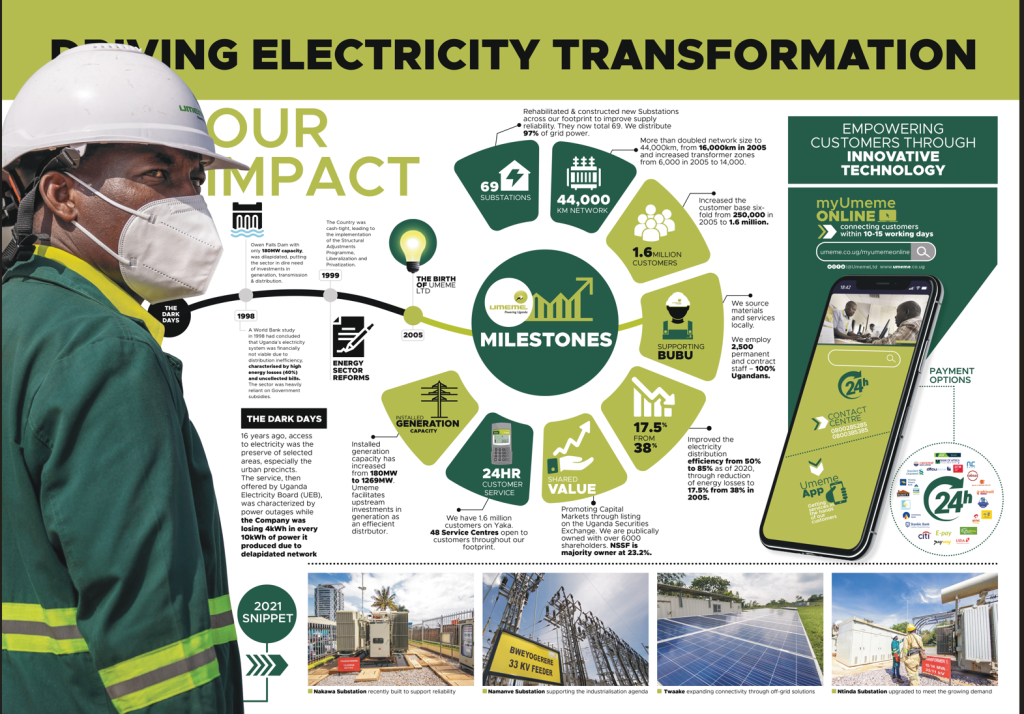

When Umeme secured a 20-year concession to run Uganda’s deteriorating national electricity distribution network in 2005, the company’s journey officially started. Umeme’s tasks included modernizing the grid, reducing losses, and strengthening ties with customers.

Here’s a quick look at the before and after:

| Metric | 2005 | 2024 |

|---|---|---|

| Network Coverage | 16,000km | 44,000km |

| Transformers | 6,000 | 14,000 |

| Customers | 250,000 | 1.6 million |

| Substations | — | 69 |

| Power Losses | 38% | 17.5% |

| Grid Efficiency | 50% | 85% |

Where It Turned: Politics, Tariffs, and Tough Terms

Despite its operational success, Umeme had a difficult 20-year journey. Beginning in 2013, the country’s parliament begun voicing concerns regarding the terms of the contract, particularly the concession’s 20% guaranteed return on investment.

Households and businesses alike were frustrated by the comparatively high electricity rates. The agreement was publicly denounced by President Museveni in 2018 as being “too expensive” for Ugandans.

The government formally informed Umeme in 2022 that it would not be renewing its contract, citing the need to regain national control and lower electricity costs.

The Buyout Breakdown: Clash of Valuations

Uganda is required to reimburse Umeme for unrecouped investments upon exiting under the terms of the 2005 concession. Now, however, the two sides are at odds over the amount—by over $100 million.

| Party | Claimed/Approved Amount | Basis |

|---|---|---|

| Umeme | $234 million | Internal audited books |

| Ugandan Govt | $118 million | Auditor General valuation |

| Paid | $118 million (Mar 31) | Initial disbursement |

| Dispute | $116 million gap | Subject to arbitration |

“The Auditor General has audited and determined $118 million as the buyout amount.”

Uganda Energy Minister Ruth Nankabirwa

Umeme began a 30-day window for resolution on April 11, 2025, when it sent the Ministry of Finance a Notice of Dispute. According to the terms of the contract, if no agreement is reached, the matter is sent to London for arbitration.

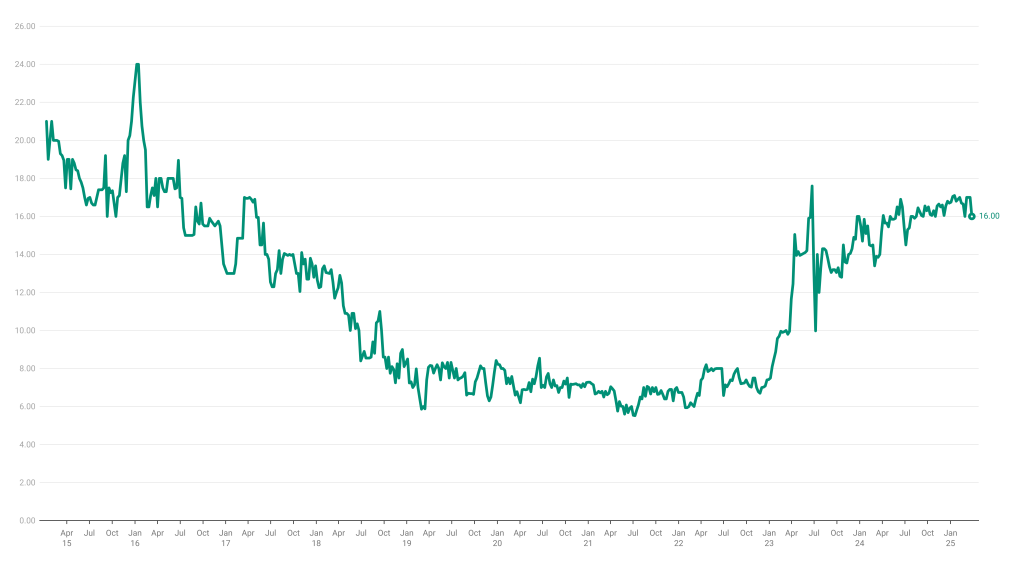

Shareholder Fallout: Trading Suspended

Umeme is listed on the Nairobi Securities Exchange (NSE) as well as the Uganda Securities Exchange (USE).

Trading in Umeme shares was halted after the dispute, leaving investors in a precarious situation, including Uganda’s own National Social Security Fund (NSSF). More than 23 percent of Umeme’s stock is owned by NSSF.

| Major Shareholders (2024) | Ownership |

|---|---|

| NSSF Uganda | 23.2% |

| Allan Gray (SA) | 14.8% |

| Umeme Staff ESOP | 5.7% |

| Retail & Institutional Investors | 56.3% |

The resolution of this dispute will determine whether shareholders receive any final payouts—or are left with a painful write-down.

What Next for Uganda’s Power Sector?

The national electricity network is operated by UEDCL as of April 2025. The government intends to either maintain UEDCL’s authority (renationalization) or use a different model in which the state maintains majority control and bring in a new private partner.

Officials maintain that service delivery will not stop as the majority of Umeme’s former employees have already joined UEDCL and the state-owned entity has already taken over operations.