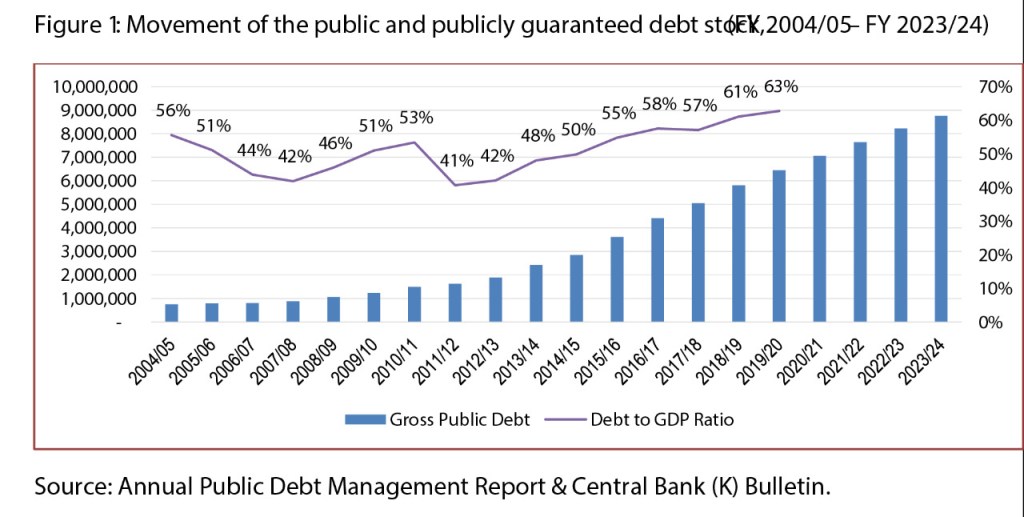

The National Treasury should spend within its means to reduce pressure from the mounting debt. Treasury CS, Ukur Yattani stressed the need to retain austerity measures beyond the current financial year. In 2019, Kenya’s public debt hit Ksh6 trillion, tripple the amount of government debt when the current government took office in 2013.

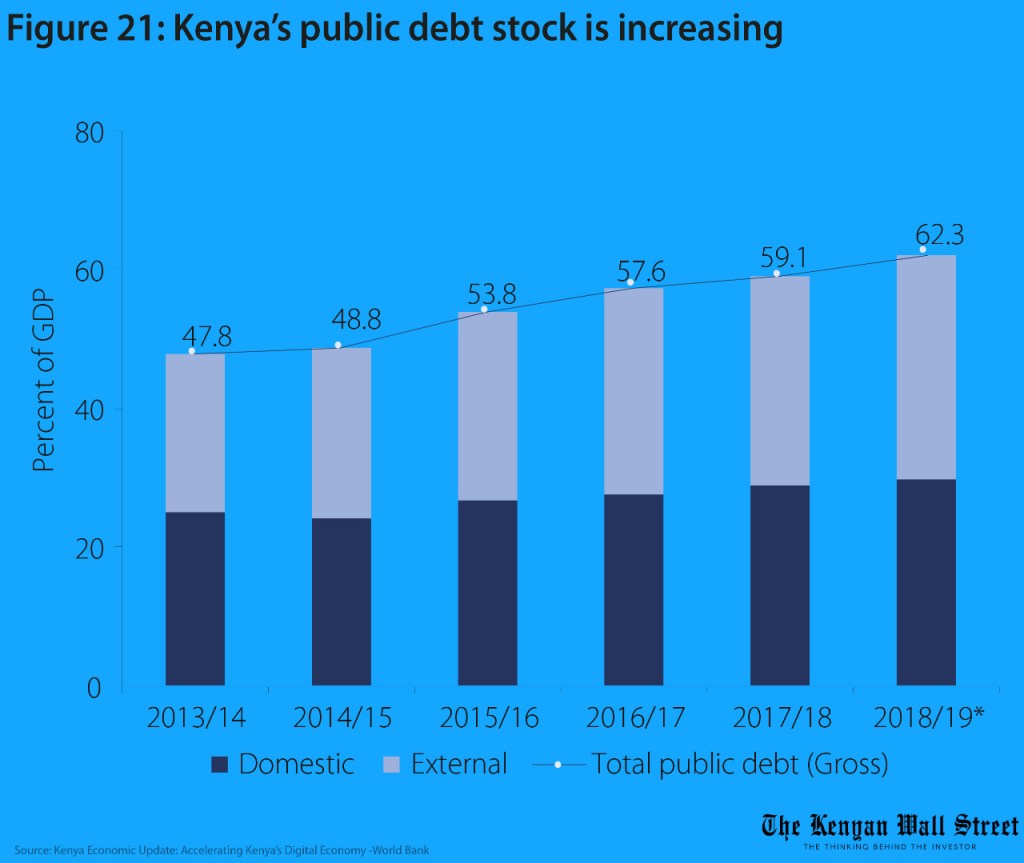

Kenya’s budgetary needs have grown steadily partly due to huge infrastructural projects such as the Standard Gauge Railway. However, revenues have stagnated thus failing to meet infrastructural and recurrent expenditure needs. Therefore, the government has been borrowing from the domestic and external markets to finance these projects.

Central Bank data shows that in September 2019, total debt stood at Ksh5.9 trillion comprising of Ksh2.8 trillion in domestic debt and Ksh3.1 trillion in external debt.

Domestic Debt

Treasury has been borrowing from the domestic market through treasury bills and bonds. Treasury bills are short term debt instruments with maturities of 91, 182 and 364 days while treasury bonds are medium to long term debt instruments with maturities greater than one year. As at the end of 2017/18, the composition of government securities was Ksh 878.6 billion for treasury bills and Ksh 1.511 trillion for treasury bonds.

READ ALSO: Treasury to Cut Spending Due to Declining Revenues

Kenya’s Public Debt Hits KSh 6 Trillion

Treasury bills and bonds help to bridge the budget deficit and are used in financing government projects.

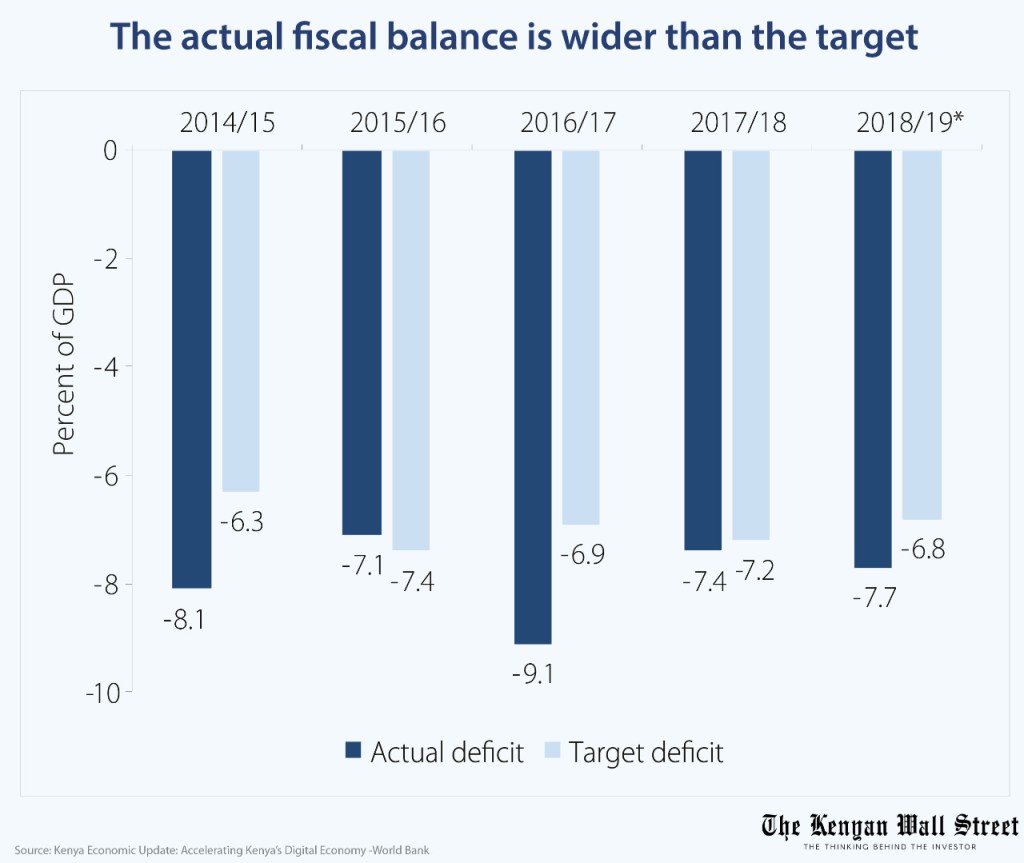

According to Parliament budget office “Increased borrowing from the domestic market has been necessitated by a widening fiscal deficit. Net domestic financing rose from Ksh 167 billion in 2012/13 to Ksh 251 billion in 2014/15 then dropped to Ksh 202 billion because of reduced fiscal deficit.”

CS Yattani stresses that his team is keenly examining the size and nature of public debt with a view to re-profile the outstanding debt and improving overall debt management.

In the near term, there will be increased debt principal and interest repayments that are likely to consume a huge chunk of government revenues.

Treasury CS Yattani will release the revised Medium Term Debt Management Strategy which we hope will reduce borrowing and prioritize loan repayment.

RELATED

Kenya to Refinance its Commercial Debt

Senate Committee Approves Treasury’s KSh 9 Trillion Debt Ceiling