LISTEN TO ARTICLE

The government is seeking to raise Ksh250 million through the issue of the forth M-Akiba bond since the mobile-based facility was launched in March 2017. The last M-Akiba bond was issued in March 2019 and it raised Ksh197 million against the KSh250 million treasury aimed to collect.

Speaking during the M-Akiba 2 launch, the Chief Executive officer at CDSC Rose Mambo said, “CDSC as the M-Akiba agent for the Government of Kenya will continue to perform her role of the issuing and paying agent for the bond.” The Executive assured investors that they have installed advanced systems to ensure the safety of clients’ information and quick settlement of transactions.

M-Akiba was launched in March 2017 with the aim of attracting retail investors in to the bond market. More than 450,000 investors have invested through the mobile platform since its inception. The last two issues were undersubscribed.

Nairobi Securities Exchange boss, Mr. Geoffrey Odundo said, “The Exchange is keen and committed to enhancing growth among local retail bond investors through M-Akiba. The NSE will continuously provide a world class trading facility to facilitate the listing and consequent trading of the bond.”

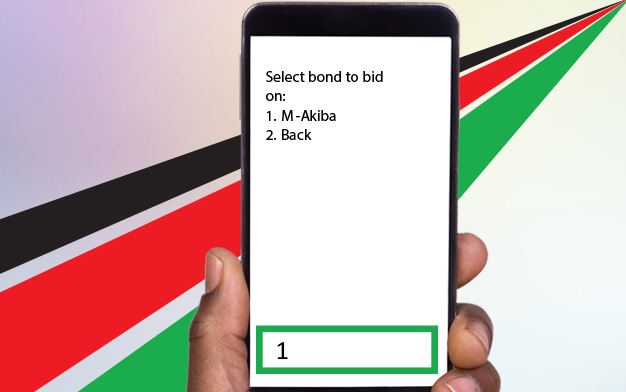

Investors can put in a minimum investment of Ksh3,000 into the government security. The mobile-based bond will be on sale for 11 days from 27th May to 7th June.

M-Akiba investors will earn tax-free interest of 10 percent per annum on their investments. Interest payments will be done every six months and the bonds will mature in 15 months on 7th September 2020.