Credit rating bureau TransUnion Kenya has partnered with analytics software firm – FICO – to enhance its risk assessment framework, enabling lenders to more accurately predict default probabilities and extend financial inclusion to “invisible” borrowers.

- •The collaboration will integrate FICO’s scoring models with TransUnion’s CreditVision, which analyses over 145 data sources, to refine the precision of credit risk evaluation in Kenya’s rapidly evolving lending landscape.

- •More than 95% of loans granted in the country are digital, which has increased the reach of credit for many and changed credit assessment processes.

- •19 lenders have confirmed interest in adopting the FICO score, with 77 others still evaluating its implementation.

“Our partnership with FICO scores is complementary. A lender who is already using TransUnion scores may also decide to adopt FICO scores for a particular segment of their credit-client base,” Morris Maina, CEO of TransUnion Kenya, told The Kenyan Wall Street.

Credit scoring models have relied heavily on a borrower’s financial position and present consumer behavior, often overlooking past consumption trends and potential future credit posture. This limitation has led to skewed assessments, with lenders either extending credit to high-risk borrowers or excluding deserving ones.

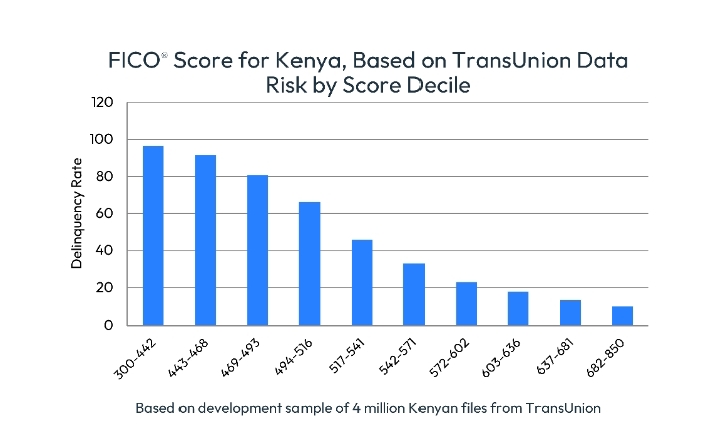

FICO, which has refined its credit risk models based on experience in over 40 markets, underpins 90% of lending decisions in the US. Its credit scoring system ranges from 300 to 850, with lower scores signifying a higher probability of default. This categorization allows lenders with varying risk appetites to determine prudent lending thresholds.

“Once you enhance predictability at the point of acquiring a client, it ensures you manage your risk; the biggest value that any lender would wish to have,” Maina concluded.

“A lender utilizing the FICO score has the clear ability of knowing where they should cut off, in terms of the consumers they lend to and those they should not lend to. What this means is, they have the ability to maintain or lower their bad debts,” said Jashan Augustine, Director – Scores Credit Bureau Alliances at FICO.

“The FICO score provides clear insights into the factors influencing a consumer’s score. Additionally, it enables lenders to assess applicants more accurately, tailor credit terms accordingly and enable credit access for more consumers,” added Mike Manaton, Vice President of Scores at FICO.

The broader ambition of the partnership is to expand the lending market to micro, small, and medium-sized enterprises (MSMEs), many of which struggle to scale due to limited credit access. Small and medium-sized enterprises account for more than 70% of employment across Africa, yet 30% of Kenyans remain “invisible” to the formal credit system.

A 2024 Consumer Pulse Study by TransUnion found that just 36% of consumers seeking financial services felt they had sufficient access to credit, up slightly from 33% in 2023.

“About 84% of Kenyans can access the financial system but there are challenges in moving across the financial continuum—that is, moving from saving your money to being able to access loans,” observed Lee Naik, CEO of TransUnion Africa.

While digital lenders and fintechs have made strides in bridging the financing gap, reliance on traditional credit-scoring models—without factoring in more dynamic variables—has constrained capital allocation.