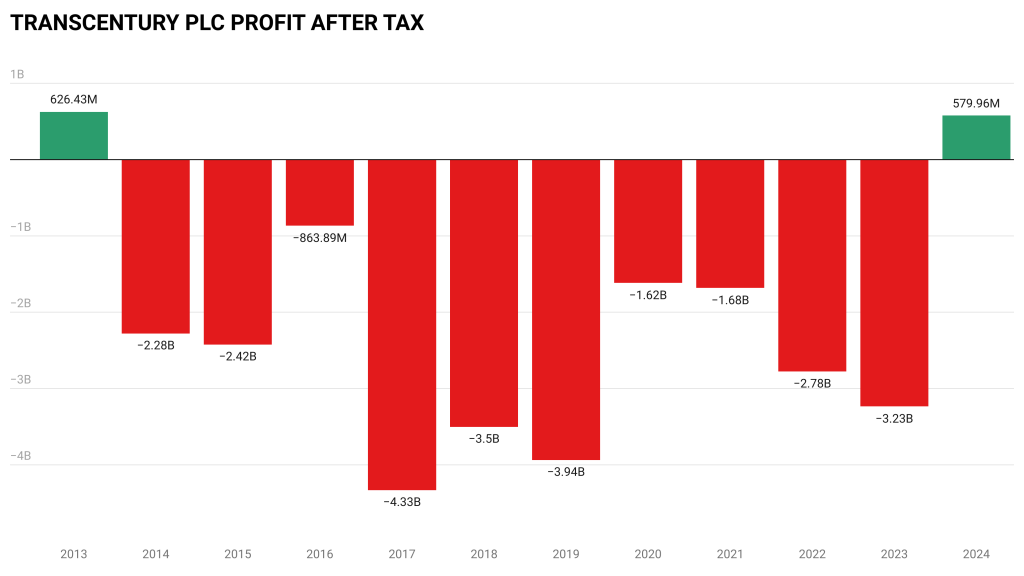

TransCentury Plc, the best-performing NSE stock in 2025 with +212.82% year-to-date gain at the time of publishing, has reported a net profit of KSh 580 million for the year ended December 2024.

- •This marks its first annual profit since 2013, ending a decade-long run of losses and showing early signs of financial recovery for the Nairobi-listed infrastructure investment group.

- •The firm posted KSh 6.70 billion in revenue, up 2.0% from KSh 6.57 billion in FY2023, and a 27.1% rise in gross profit to KSh 2.34, reflecting improved operational margins.

- •Despite the return to profitability, TransCentury’s cash and cash equivalents declined 86.8% to KSh 41.9 million from KSh 317.8 million, reflecting continued liquidity strain.

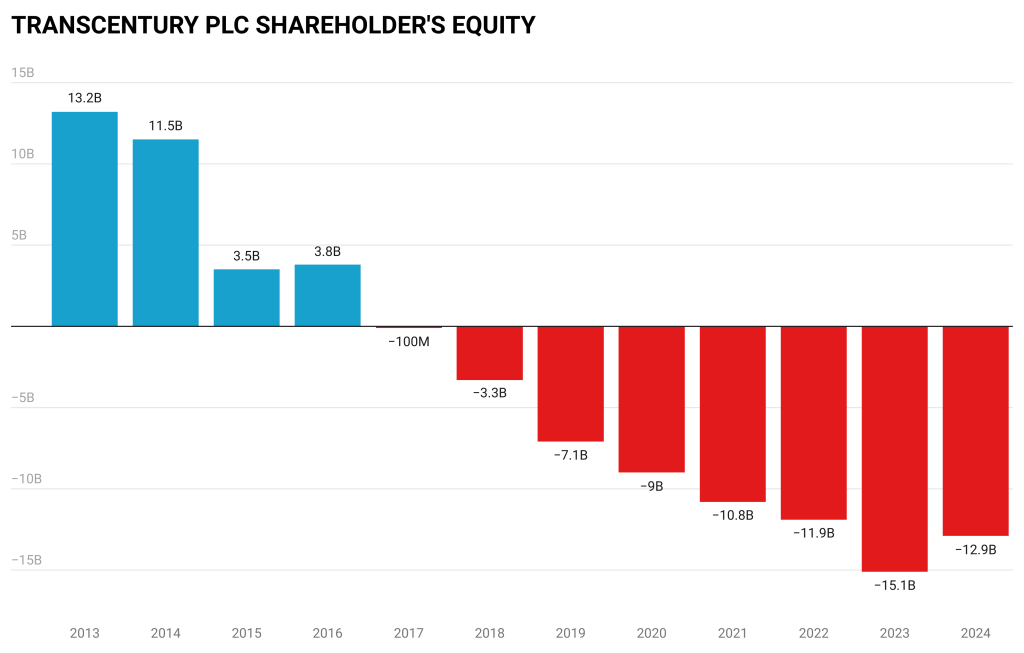

A prolonged period of losses, high finance costs, and currency exposure gradually eroded its capital base, leading to negative equity in 2017. By FY2023, accumulated losses had pushed equity to KSh -15.1 billion. FY2024 marks the first post-tax profit since FY2013 and the first equity gain in eight years.

The company posted an operating profit of KSh 714.5 million, compared to a loss of KSh 317.4 million in FY2023—marking a full turnaround in operating performance.

Other income more than doubled to KSh 355.3 million, while foreign exchange gains increased 19.4% to KSh 1.23 billion. The company also reported earnings per share (EPS) of KSh 0.53, reversing a loss of KSh 4.86 in the previous year.

FY2024 Highlights

| Metric | FY2024 | FY2023 | YoY Change |

|---|---|---|---|

| Revenue | KSh 6.70Bn | KSh 6.57Bn | ▲ 2.0% |

| Gross Profit | KSh 2.34Bn | KSh 1.85Bn | ▲ 27.1% |

| Operating Profit | KSh 714.5M | (KSh 317.4M) | Turnaround |

| Net Profit | KSh 580M | (KSh 3.23Bn) | Turnaround |

| EPS | KSh 0.53 | (KSh 4.86) | Positive |

| Forex Gains | KSh 1.23Bn | KSh 1.03Bn | ▲ 19.4% |

| Other Income | KSh 355.3M | KSh 171.2M | ▲ 107.5% |

| Cash & Equivalents | KSh 41.9M | KSh 317.8M | ▼ 86.8% |

| Shareholders’ Equity | KSh -12.9Bn | KSh -15.1Bn | ▲ KSh 2.2Bn |

The Group’s total assets decreased by 19.5% year-on-year to KSh 10.77 billion.

Shareholders’ equity improved for the first time since 2016, rising to KSh -12.9 billion from KSh -15.1 billion in FY2023. While still negative, the KSh 2.2 billion improvement represents a break in the downward equity trend that had persisted for eight consecutive years.

In FY2013, TransCentury reported a net profit of KSh 626 million and held KSh 13.2 billion in shareholders’ equity.