Bitcoin or Gold, which is the better investment over time? The comparison of the two asset classes has been a great debate. It is essential to ascertain each instrument’s intended use, value proposition, and critical fundamentals.

Bitcoin (BTC) is a revolutionary digital currency that operates independently of any central authority, making it a medium of exchange and store of value. Gold is a store of value, a safe haven asset in times of market uncertainty, and, throughout history, a medium of exchange.

Whenever volatility increases, the price of Gold rises proportionately to the level of risk measured in the market. Over the years, it has been used as a hedge against inflation, hence the inverse relationship between Gold and interest rates.

The demand for Gold drives the price action. As mentioned above, this demand is primarily driven by market volatility and the outlook of interest rates, particularly US interest rates. Therefore, global geopolitical risks and US inflation readings tend to cause volatility in gold prices.

Gold has done well in retaining the safe haven asset status over time. Although the price tends to be volatile, the volatility compared to Bitcoin is far less, hence the Gold’s attractiveness as a safe haven asset. Stablecoins have been introduced with the hope of reducing the volatility of cryptocurrencies. These have been pegged to fiat currencies, such as the US dollar, but this has done very little to stabilize cryptocurrencies, such as the price volatility of Bitcoin.

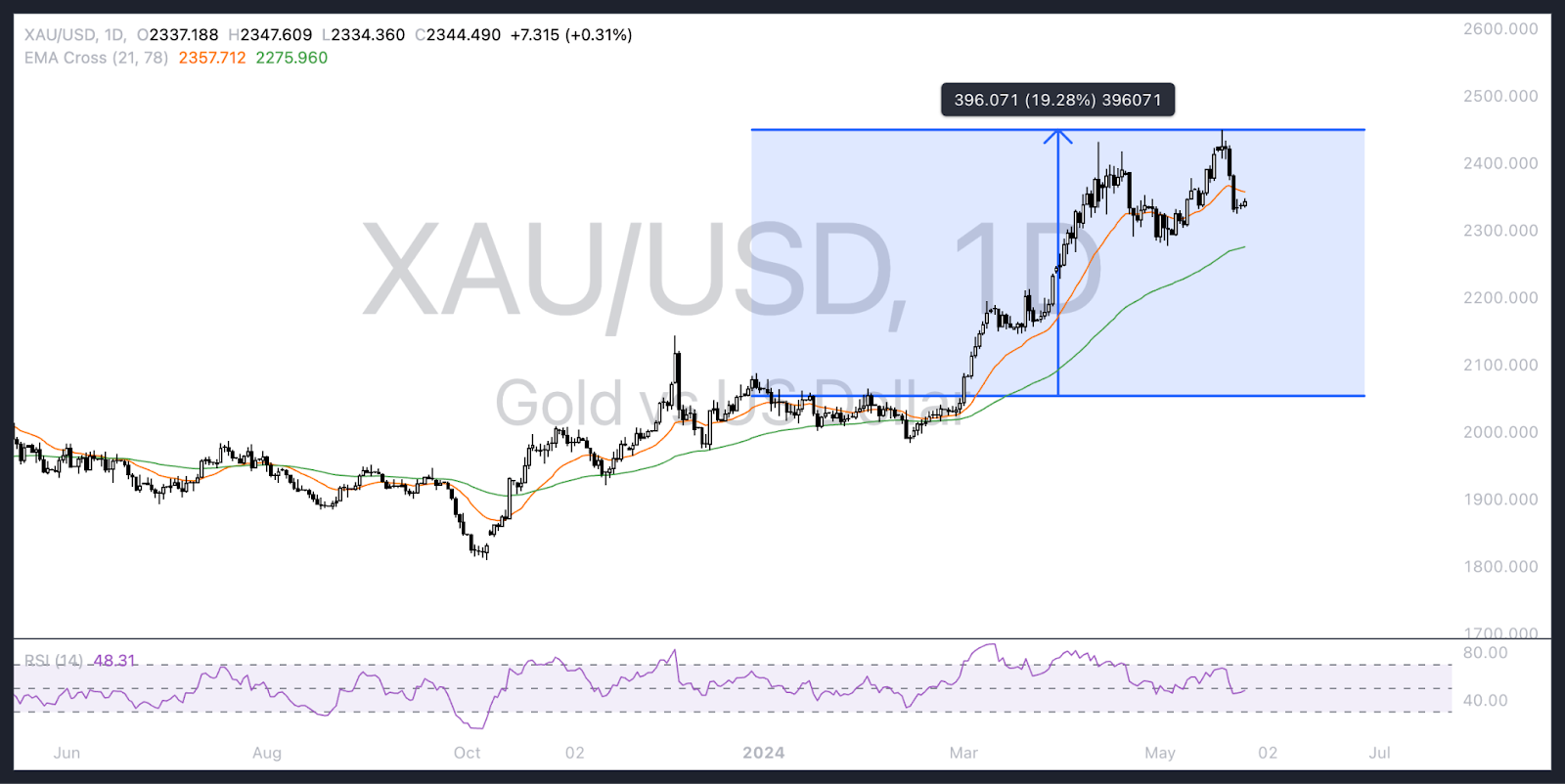

Since January 2024, Gold has recently reached its all-time high of $2,450, with its price rising by circa 19.28%. Bitcoin, leading to its all-time high of $73,706, has achieved as much as circa 74.83%.

The case becomes evident that Bitcoin as an asset class has outperformed Gold.

Earlier in the year, the US Security Exchange Commission approved Blackrock’s Electronically Traded Fund (ETF) for Bitcoin. This is seen as a way of attracting investors to a more stable investment vehicle than the underlying instrument itself. Hence, Bitcoin has become a more attractive investment vehicle.

Bitcoins and Ethereum both are developing themselves in the present time. Bitcoin is a very popular Cryptocurrency in the present time compared to Ethereum, and it has the highest market cap in the present. Bitcoin is the most valuable Cryptocurrency in the year 2021, and it is well known as a Cryptocurrency all around the world. Rather than Ethereum, which is not popular as Bitcoin is. But Ethereum is the second valuable Cryptocurrency in the world also. The advantage of Ethereum is, its developer learned from Bitcoins, and then they make it more functionally strong. If you're looking for the right time toThe long-term view is that Gold will have more utility over time than Bitcoin, whose primary function is as a medium of exchange. The value proposition for Bitcoin as a store of value still needs further support.

Hence, by definition of an investment, Gold is a more attractive vehicle than Bitcoin.

Terence Hove is the Senior Financial Market Strategist at Exness.