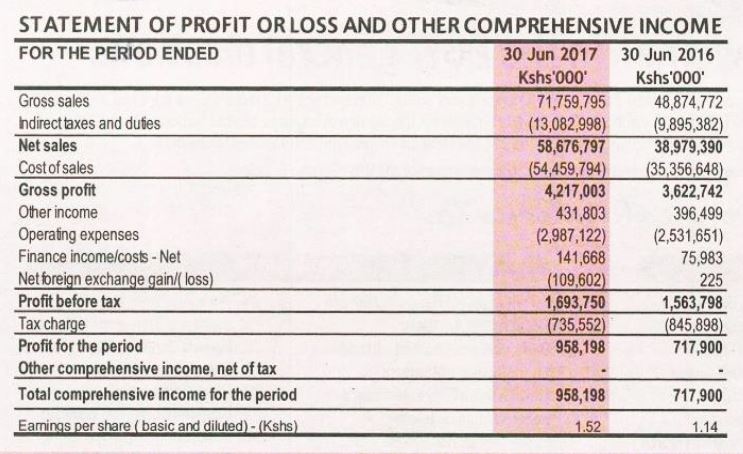

On August 22nd 2017, those investors who filled up their tanks with Total Kenya PLC shares were in for very pleasant news. The half year ended June 2017 results recorded a 33% surge in net profit; the energy released was similar to a long hydrocarbon chain! Profit for the period came in at Kshs. 958.2 million compared to Kshs. 717.9 million in a similar period (HY16). This translated to an EPS (Earnings per Share) of Kshs. 1.52 compared to Ksh 1.14 (+33%) for HY16. However, profit before tax presented a mere 8% growth to Kshs. 1.69 Billion. The bottom line was therefore pumped further by a 13% decrease in the tax charge for the period.

Net sales jumped by 51% to Kshs. 58.68 billion mainly due to an increase in international oil prices. Gross profit leapt by 16% to Kshs. 4.2 billion from Kshs. 3.6 billion in the previous period but the gross profit margin deteriorated to 7.19% from 9.29%, also affecting the net profit margin. Other income increased by Kshs. 35 million as a result of diversification from non-fuel business channels.

The oil marketer’s France based parent company recently announced acquisition of Maersk Oil, a unit of Danish shipping giant A.P. Moller-Maersk, for US$7.45 billion (€6.35 billion). Total said the acquisition would bolster its positions in the Gulf of Mexico, Algeria, Kenya and Kazakhstan.

Operating expenses increased by 18% to Kshs. 2.99 billion from Kshs. 2.53 billion. This was within management expectations. On the negative side, a forex loss of Kshs. 109.6 million was borne by the company, as compared to a microscopic forex gain of Kshs. 225,000 in 2016. This came as the consequence of a depreciating Kenya Shilling which opened the year at Kshs. 102.22 for the dollar and closed the period under review at Kshs. 103.69.

Total assets decreased by a marginal 2.6% due to conversion of current assets into sales, some disposal of non-current assets and a little realisation of deferred tax. Retained earnings obviously lifted the equity portion of the statement of financial position and non-current liabilities followed suit, albeit by a puny 0.97%, partly as a result of the fact that gross investments totalling Kshs. 490 million were made during the period to enhance safety and continue to develop the business. Return on capital employed was 8.04% in the current period as compared to 7.53% in the previous period, indicating greater returns on shareholder’s funds and long-term debt, while asset turnover was 2.78 times and 1.88 times respectively. This was a commendable improvement in capital management.

The current ratio, which is a standard test of gearing, improved to 1.74 from 1.65, showing the corporation’s robust ability to repay its short-term obligations. The quick ratio, which ignores inventories when assessing short-term liquidity, was 1.05 in the current period and 0.863 for the half year ended 30th June 2016. This is an admirable movement in the right direction. For companies with a fast inventory turnover like Total, a quick ratio can be less than one, without suggesting that the company is in cash flow difficulties. The cash position of the business deteriorated slightly to Kshs. -350,293,000 from Kshs. -305,940,000 in the previous period, mostly due to the payment of Kshs. 670,288,000 worth of dividends but boosted by healthier investment income.

Total’s 76% acquisition of Gulf Africa Petroleum Corporation’s (GAPCO) assets in Kenya, Uganda and Tanzania will strengthen Total’s logistics in the region and significantly accelerate the growth of its retail network there, especially in Tanzania. The principal assets acquired were two logistics terminals, in Mombasa, Kenya and Dar es Salaam, Tanzania, as well as a retail network of more than a hundred service stations.

Over the past one year, the counter’s share price has risen from Kshs. 18.15 to a close of Kshs. 24 on 23rd August 2017 (+32%). During that period, the ticker had a 52-week low of Kshs. 16 and a 52-week high, set quite recently of Kshs. 25. The percentage return between these two extremes is a whopping 56.25%!

In the latest Petroleum industry statistics released by Petroleum Institute of East Africa (PIEA) for the period January to March 2017, Kenol Kobil topped the industry’s overall market share (including exports) at 16.7% while Total Kenya took third spot in Overall market share at 13.6%.

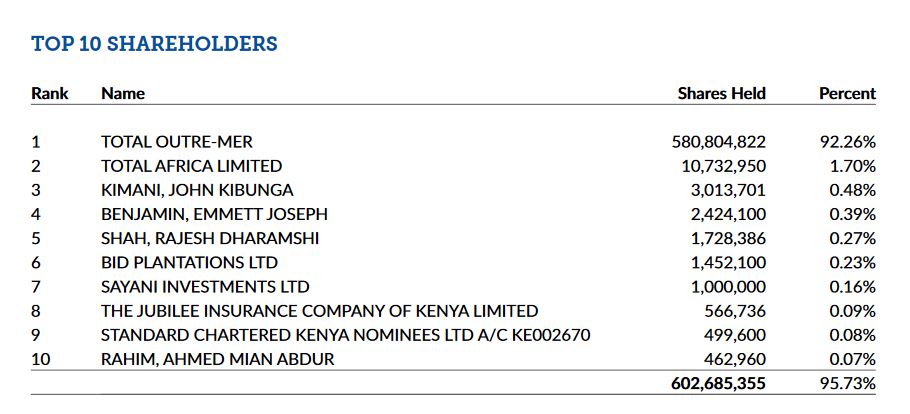

Total Kenya’s current Net Asset Value per share (NAV)/Book Value stands at Ksh 31.19 and with the current market price of Ksh 24.00 per share indicates a 29.96% discount. The challenge for investors’ on this counter is that it has a very low free float hence liquidity may become a challenge. The parent company Total holds a combined 93.96% holding of the company as at 31 December 2016.

Overall the half year results were commendable!

Overall the half year results were commendable!

Source: (Total Kenya Financials, Nairobi Securities Exchange, PIEA, FT, Kenyan Wall Street)