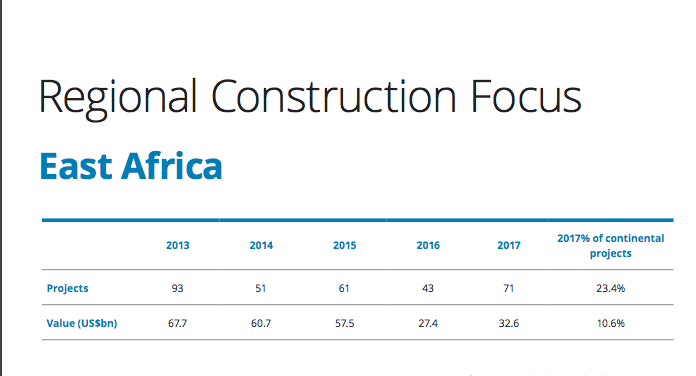

East Africa – which includes Burundi, Comoros, Djibouti, Eritrea, Ethiopia, Kenya, Rwanda, Seychelles, Somalia, Tanzania and Uganda – has 71 projects valued at US$32.6bn according to a recent report by Deloitte.

The total number of projects in East Africa account for 23.4% of projects on the continent and 10.6% in terms of US dollar value. The EA projects also rose by a substantial 65.1% between 2016 and 2017 while the increase in the total US dollar value of projects has been much lower, but still considerable at 20.7%.

Although Kenya has the largest number of projects in East Africa (23 versus Ethiopia’s 20), the total value of projects in Ethiopia is almost twice that of the value of projects in Kenya. Ethiopia overtook Kenya as the largest economy in East Africa in 2016.

The Transport sector, this year accounting for more than half of projects, continues to be the largest sector, with 27 Road & Bridge projects currently underway. Energy & Power projects are also significant, accounting for nearly a quarter of all projects in East Africa.

Governments continue to own the vast majority of projects (90.1%). Roughly, only one in 10 projects are not Government-owned. East Africa is one of the regions where Governments are most proactive in driving projects through both national and regional infrastructure development plans. Private Domestic firms only own 4.2% of projects. Private firms from China, Singapore, the UAE and the US own the remaining 5.6% of projects in East Africa.

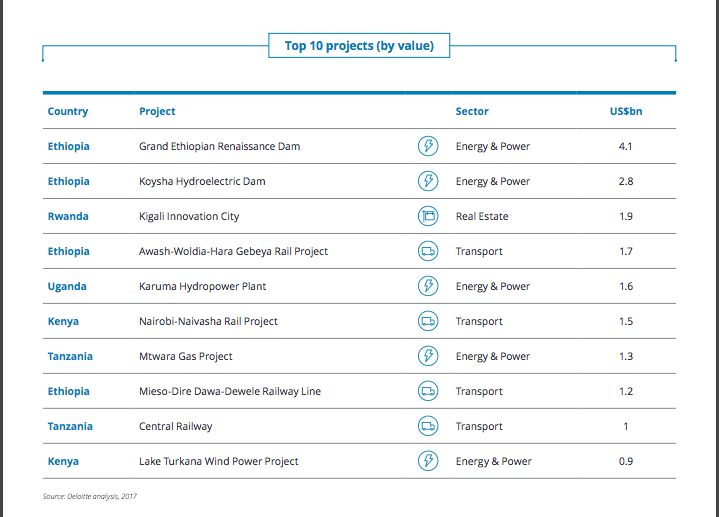

Although still highly concentrated, East Africa’s ten largest projects account for only 55.1% of the total US dollar value of projects in the region.

China is also the most visible builder, now constructing over half of all projects. Private Domestic firms are responsible for building 11.3% of projects while firms from the Middle East and other European countries each build 8.5% of projects.

However, Governments only fund 15.5% of projects. China is the most prolific funder of large-scale construction projects in East Africa, financing one in four projects in the region. International DFIs follow with 19.7%, and have overtaken African DFIs, which fund 16.9% of projects.

-Deloitte