First Published on March 10th, 2022 by Bob Ciura for SureDividend

Warren Buffett, Chairman and CEO of Berkshire Hathaway (BRK.B), is referred to as the Oracle of Omaha. Given his investing track record, this reputation is well-earned.

Berkshire Hathaway has an equity investment portfolio worth more than $330 billion, as of the end of the 2021 fourth quarter. In turn, Buffett’s personal net worth exceeds $100 billion, making him one of the richest individuals on the planet.

You can see all of Warren Buffett’s stock holdings (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Over Buffett’s life and career, he has offered many bits of wisdom along the way. Investors would be well-advised to learn from the Oracle of Omaha.

With this in mind, this article summarizes Warren Buffett’s top 20 quotes on investing and finance.

The article is organized by category. Click on a section to read it immediately, or read the whole article in order:

20 Warren Buffett Quotes On Investing and Finance

Quote #1

For the first Warren Buffett quote, we selected one that sums up his investment strategy:

“We select such investments on a long-term basis, weighing the same factors as would be involved in the purchase of 100% of an operating business:

(1) favorable long-term economic characteristics;

(2) competent and honest management;

(3) purchase price attractive when measured against the yardstick of value to a private owner; and

(4) an industry with which we are familiar and whose long-term business characteristics we feel competent to judge.”

The above is the basic ‘secret formula’ to Warren Buffett’s $100+ billion fortune.

Quote #2

Warren Buffett is a long-term investor. Three of his longest-term holdings are shown below:

- American Express (AXP): 1st purchase in 1964

- Coca-Cola (KO): 1st purchase in 1988

- Wells Fargo (WFC): 1st purchase in 1989

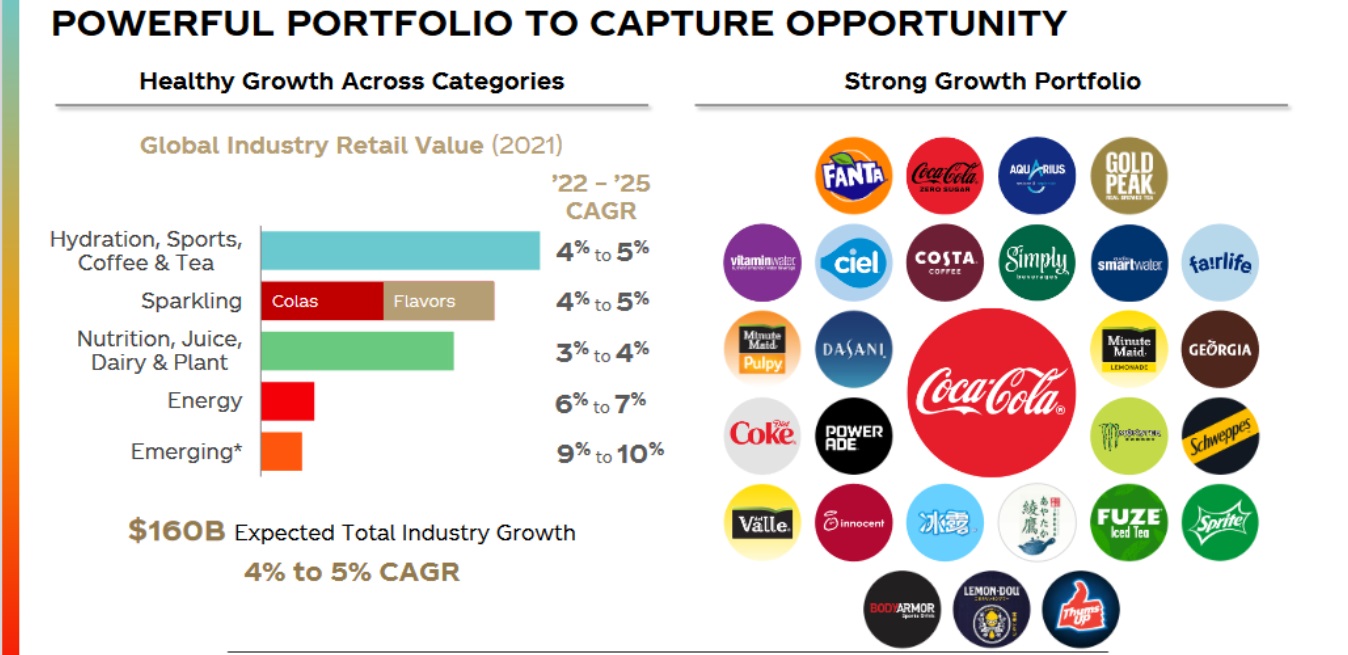

Over time, these companies have grown to become giants in their respective industries. For example, Coca-Cola is the largest non-alcoholic beverage company in the world.

Source: Investor Presentation

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”

This quote shows Warren Buffett thinks in investing time frames of at least 5 years. But his holding period is preferably much longer…

Quotes #3 & #4

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

&

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes”

These quotes shows that a 10 year holing period is really what you should look for when examining stocks to buy.

Quotes #5 & #6

But even 10 years is too short a time period for outstanding businesses.

“When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

&

“Time is the friend of the wonderful company, the enemy of the mediocre.”

You should not buy just any business and hold it for the long-run. Businesses with strong competitive advantages and quality managements are preferred long-term holdings.

Quote #7

Great businesses withstand the test of time. Time itself has been very favorable to the stock market.

“Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a fly epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

The quote above shows the powerful tailwind of economic progress that pushes stable businesses to ever greater heights.

Quote #8

One advantage of buy & hold investing is lower taxes. When you don’t sell your holdings, the money you would have paid in capital gains tax is left compounding in your investment.

“Charlie and I would follow a buy-and-hold policy even if we ran a tax-exempt institution.”

Tax advantages are not the primary reason why Warren Buffett (and Charlie Munger) prefer to hold great businesses for the long run.

The compounding effects (the ‘snowball effect’) of business growth are reward enough, irrespective of tax advantages.

Quotes #9 through #12

The four quotes below use analogies and metaphors to explain the power of long-term investing.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

&

“Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.”

&

“Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.”

&

“Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market.”

The quote about not producing a baby in a month by getting nine women pregnant is especially poignant. It drives home the point that several mediocre short-term investments are not the same as one well-timed long-term investment.

This brings up another aspect of Warren Buffett’s success…

Only invest when the best opportunities present themselves – and ignore everything else.

Opportunities come in waves. These ‘waves’ coincide with recessions (which are discussed later in this article). Dry spells are usually during protracted bull markets – when great businesses are not trading at a discount.

Quotes #13 & #14

The two Warren Buffett quotes below elaborate further on the disparity between action and results.

“You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

&

“It is not necessary to do extraordinary things to get extraordinary results.”

Quote #15

You don’t have to be an expert on every stock to find great businesses trading at fair or better prices.

The less complicated an investment is, the less room for error in your analysis. Similarly, sticking to investing in businesses you understand reduces investing mistakes.

Warren Buffett calls sticking with what you know staying in your “circle of competence”.

“What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected’: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

Quote #16

Everyone knows at least one ‘know-it-all’. If you want to invest well, don’t be a know-it-all.

“There is nothing wrong with a ‘know nothing’ investor who realizes it. The problem is when you are a ‘know nothing’ investor but you think you know something.”

If you know you don’t know much about investing, don’t fool yourself. Instead, invest in the world’s best dividend paying businesses through high quality dividend ETFs.

Quote #17

Warren Buffett is incredibly smart. But genius is not a requirement to realize exceptional investing results.

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.”

Quote #18

Knowing the limits of your circle of competence is more important than being brilliant and thinking your circle of competence includes all stocks. There’s no mistaking Buffett’s business genius. But even Buffett does not think he can accurately assess all businesses.

“We make no attempt to pick the few winners that will emerge from an ocean of unproven enterprises. We’re not smart enough to do that, and we know it. Instead, we try to apply Aesop’s 2,600-year-old equation to opportunities in which we have reasonable confidence as to how many birds are in the bush and when they will emerge.”

Instead of taking unnecessary risks, invest in great businesses you understand when they go on sale.

Quote #19

Investors can be divided into two broad categories:

- Bottom up investors

- Top down investors

Top down investors look for rapidly growing industries or macroeconomic trends. They then try to find good investments that will capitalize on these trends.

Bottom up investors do they exact opposite. They look for individual investment opportunities irrespective of industry or macroeconomic trends.

Warren Buffett wants to invest in great businesses. He is a bottom up investor.

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”

Understanding the competitive advantage of a business requires a sufficiently evolved understanding of the operations of a business.

Quote #20

“Be fearful when others are greedy and greedy only when others are fearful.”

It’s not easy to buy great businesses when they are down. That’s because the zeitgeist is decidedly against buying – stocks become undervalued because the general consensus is negative. Intelligent investors profit from irrational fears.

Paying too high a price is an investing risk that can be avoided (for the most part) by staying disciplined.

Final Thoughts

Warren Buffett is arguably the greatest investor of all time. You can see Buffett’s 20 most owned stocks here to see real-world examples of what he invests in.

Over Buffett’s career, he has shown that he invests in companies that share a few key qualities.

In general, Buffett has invested in many companies that have durable competitive advantages, long-term growth potential, and strong management teams.

We believe the highest-quality dividend growth stocks possess many of the characteristics that Buffett looks for.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Warren Buffett Stocks: Kraft Heinz

Warren Buffett Stocks: United Parcel Service

Warren Buffett Stocks: The Coca-Cola Company

Warren Buffett Stocks: Apple Inc.