First Published on June 4th, 2023 by Samuel Smith for SureDividend

Mortgage Real Estate Investment Trusts (i.e., “REITs”) – often referred to as “mREITs” – can provide a very attractive source of income for investors. This is because they invest in mortgages that are typically backed by hard assets (commercial and/or residential real estate) with fairly conservative loan-to-value ratios.

They finance these portfolios with a mixture of equity (that they raise by selling shares to investors) and debt that they generally raise at an interest cost that is meaningfully lower than the interest rates they can command on their real estate mortgage investments. The result is significant and stable cash flow for the mREIT.

Moreover, as REITs they are exempt from having to pay corporate taxes on their net interest income and are required to pay out at least 90% of their taxable income to shareholders via dividends. This generally means that mREIT shareholders earn very high dividend yields, making mREIT shares an exceptional source of passive income.

Of course, there is no such thing as a free lunch, and mREITs – due to their significant amount of leverage – do come with risks that occasionally lead to dividend cuts. As a result, investors need to be prudent when selecting which mREITs to invest in. This article will look at 10 of the most attractively priced mREITs in the marketplace today.

You can download your free 200+ REIT list (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- •#1: ARMOUR Residential REIT (ARR)

- •#2: Two Harbors Investment Corp. (TWO)

- •#3: Orchid Island Capital, Inc. (ORC)

- •#4: AGNC Investment Corporation (AGNC)

- •#5: KKR Real Estate Finance Trust Inc. (KREF)

- •#6: Ares Commercial Real Estate Corporation (ACRE)

- •#7: Annaly Capital Management (NLY)

- •#8: Apollo Commercial Real Estate Finance (ARI)

- •#9: Blackstone Mortgage Trust Inc. (BXMT)

- •#10: Starwood Property Trust (STWD)

#1: ARMOUR Residential REIT (ARR)

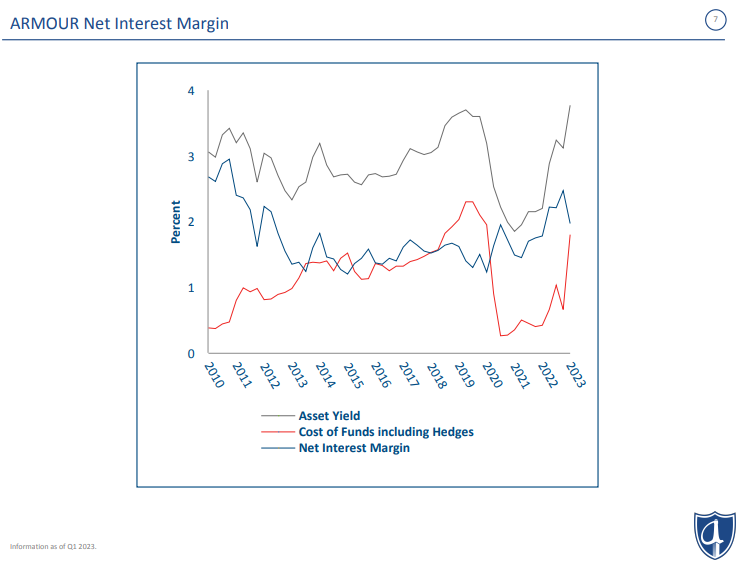

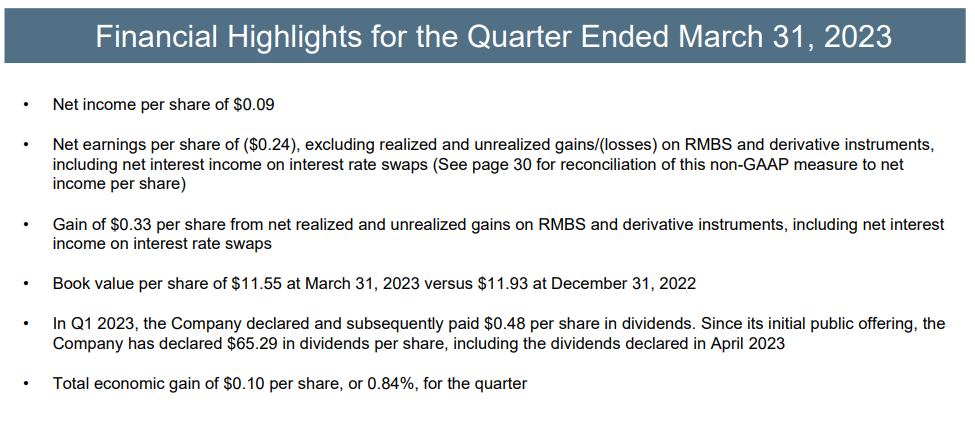

ARMOUR Residential is an mREIT established in 2008. Its main focus is investing in residential mortgage-backed securities guaranteed or issued by US government entities like Fannie Mae, Freddie Mac, and Ginnie Mae. ARMOUR has experienced volatility in its cash flow since its inception, leading to dividend cuts in some cases.

Fortunately, ARMOUR is currently undergoing a recovery phase, which is expected to continue in the coming quarters and years. However, the company’s growth is predicted to be relatively flat, meaning it will likely take a significant amount of time for ARMOUR to rebuild its previous levels of book value and earnings power. In the meantime, it offers investors a very attractive – though not entirely dependable – 20.1% dividend yield and trades at a steep discount to its book value.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT (ARR) (preview of page 1 of 3 shown below):

#2: Two Harbors Investment Corp. (TWO)

Two Harbors Investment Corp. is a residential mREIT that focuses on residential mortgage-backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and commercial real estate. The trust generates the majority of its revenue through interest earned on available-for-sale securities. Despite a decline in book value per share over the years, Two Harbors has a track record of delivering strong total returns to investors thanks to its hefty dividend payouts.

To boost its share price and attract more funds, Two Harbors recently completed a 4-for-1 reverse stock split. Since its establishment in October 2009, the stock has outperformed the total return of the BBG REIT MTG index. This outperformance can be attributed to several factors, including pairing mortgage servicing rights (MSR) assets with Agency RMBS, employing various instruments to hedge against interest rate exposure, and maintaining a unique portfolio of legacy non-Agency securities.

However, due to economic and industry challenges and a high payout ratio, it is projected that the book value per share of Two Harbors will only experience a slight increase over the next five years. Despite this weak growth outlook, the 19.5% dividend yield and deep discount to book value at present should reward shareholders handsomely assuming the dividend does not get cut and the book value per share does not plunge due to economic turmoil.

Click here to download our most recent Sure Analysis report on Two Harbors Investment Corp. (TWO) (preview of page 1 of 3 shown below):

#3: Orchid Island Capital, Inc. (ORC)

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs. These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Orchid Island has experienced significant earnings volatility recently, with net losses in 2013 and 2018 and several years where profits were minimal. Looking ahead, the book value per share of Orchid Island is expected to recover, although the high payout will likely weaken earnings per share and dividends per share. Still, the 19.1% dividend yield and large discount to book value make it an attractive investment for investors with a relatively high-risk tolerance.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

#4: AGNC Investment Corporation (AGNC)

American Capital Agency Corp is an mREIT founded in 2008. It primarily invests in agency mortgage-backed securities (MBS). Its portfolio consists of residential mortgage pass-through securities, collateralized mortgage obligations (CMO), and non-agency MBS, many guaranteed by government-sponsored enterprises. Most of American Capital’s investments are fixed-rate agency MBS, focusing on 30-year maturities. The trust’s counterparties are primarily located in North America, with a significant percentage of the portfolio represented by European counterparties. American Capital generates most of its revenue from interest income.

Due to its highly leveraged business model and sensitivity to interest rates, American Capital’s financial results have been volatile over the years. However, the current lower interest rate environment resulting from weak global growth and the Federal Reserve’s accommodative stance during the COVID-19 pandemic is expected to help the company navigate challenges by maintaining attractive spreads and stability in the mortgage market.

In the long term, the company’s substantial dividend payout and the inherent volatility of its business model are anticipated to hinder earnings per share growth. It is also projected that dividend growth will be minimal or non-existent in the foreseeable future. That said, risk-tolerant investors could generate attractive risk-adjusted returns between its steep discount to book value and its 15.8% dividend yield.

Click here to download our most recent Sure Analysis report on AGNC Investment Corporation (AGNC) (preview of page 1 of 3 shown below):

#5: KKR Real Estate Finance Trust Inc. (KREF)

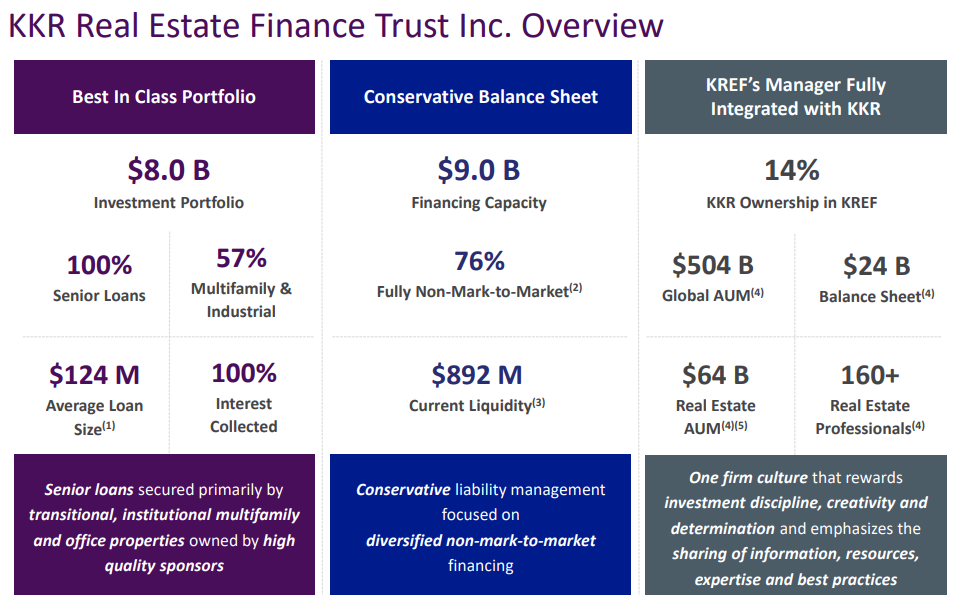

KKR Real Estate Finance Trust (KREF) is an mREIT that specializes in originating and acquiring senior loans to commercial real estate properties that are owned and operated by experienced sponsors in liquid markets with strong underlying fundamentals. KREF has built a multi-billion portfolio of senior loans primarily secured by multifamily and office properties owned by reputable sponsors.

Since its initial public offering (IPO), KREF has experienced rapid growth in its loan portfolio by borrowing at lower rates and issuing shares with a lower cost of equity compared to the spreads it earns as net interest income. The company has leveraged its manager’s (KRR) access to low-cost financing in a favorable low-rate environment. KREF’s term loan financing facilities provide KRR with matched-term financing on a non-mark-to-market and non-recourse basis, strengthening the company’s liability structure and enhancing its risk management capabilities and liquidity position.

While this strategy has been successful, KREF’s profitability in the future is sensitive to changes in interest rates as its entire portfolio is tied to floating rates. Therefore, KREF could benefit from the ongoing rising-rate environment if its financing remains cost-effective.

Although KREF has increased its dividend in line with its growing earnings per share, the risks associated with mortgage REITs pose a potential compression of earnings, leaving limited room for growth. Considering the uncertain real estate market, no dividend growth is expected in the future. That said, not much growth is needed to generate satisfactory total returns given that the current yield is 15.5%.

Click here to download our most recent Sure Analysis report on KKR Real Estate Finance Trust Inc. (KREF) (preview of page 1 of 3 shown below):

#6: Ares Commercial Real Estate Corporation (ACRE)

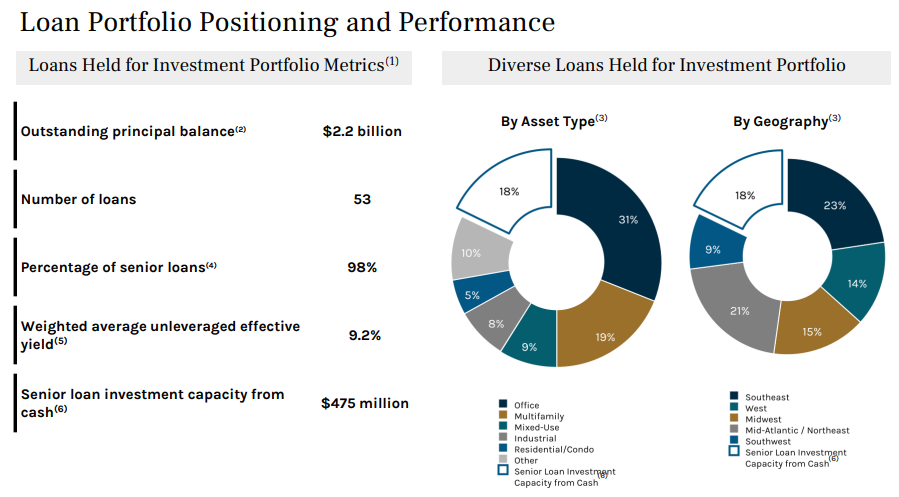

Ares Commercial Real Estate Corporation (ACRE) is an mREIT that is externally managed by a subsidiary of Ares Management Corporation, a globally recognized alternative asset manager.

ACRE has grown its asset base over the years into a well-diversified loan portfolio today. This approach has contributed to relatively strong earnings per share (EPS) performance over the past decade. Fluctuations in EPS are influenced by factors such as investment yields, interest rates, the percentage of contractual payments received, and the weighted average remaining life of the portfolio. Moving forward, the impact of rising rates may be offset by higher borrowing costs, resulting in no forecasted growth in EPS in the medium term.

While little to no dividend growth is expected in the future, the current yield of 14.4% means that shareholders should be richly rewarded as long as the company can sustain its current payout.

Click here to download our most recent Sure Analysis report on Ares Commercial Real Estate Corporation (ACRE) (preview of page 1 of 3 shown below):

#7: Annaly Capital Management (NLY)

Annaly Capital Management, Inc. is an mREIT that invests in residential and commercial mortgages. The trust’s investments include agency mortgage-backed securities, non-agency residential mortgage assets, residential mortgage loans, commercial mortgage loans, securities, and other commercial real estate investments. Annaly operates as a broker-dealer, financing middle-market businesses backed by private equity.

Looking ahead, further increases in interest rates could lead to reduced refinancing activity. As long as the real estate market remains stable, Annaly is expected to experience gradual growth and maintain its significant dividend. However, any significant market downturn could severely impact the company, potentially resulting in a dividend cut. The current yield of 14.1% compensates investors quite well for the increased risk, especially given that Annaly is considered one of the higher quality publicly traded mREITs in the market today.

Click here to download our most recent Sure Analysis report on Annaly Capital Management (NLY) (preview of page 1 of 3 shown below):

#8: Apollo Commercial Real Estate Finance (ARI)

Apollo Commercial Real Estate Finance, Inc. is an mREIT specializing in investing in various debt securities, including senior mortgages, mezzanine loans, and other commercial real estate-related debt types. The underlying properties collateralize Apollo’s investments, which are made in the United States and Europe. The company is externally managed by ACREFI Management, LLC, which is an indirect subsidiary of Apollo Global Management, LLC.

Apollo Commercial Real Estate Finance maintains a large commercial real estate portfolio valued at billions of dollars. Its portfolio composition includes 26% in hotels, 17% in office properties, 14% in urban redevelopment, 12% in residential-for-sale inventory, and 11% in residential-for-sale construction. Geographically, approximately 34% of the portfolio is based in Manhattan, New York, 14% in the United Kingdom, 13% in the Midwest, 12% in the West, and 11% in the Southeast.

Apollo Commercial Real Estate Finance faces significant challenges to its growth prospects in the near future. The company’s main growth drivers are its loan portfolio expansion and higher returns on its loans. However, it is expected to encounter headwinds due to rising interest rates and a decline in demand for new mortgage loans. If the economy enters a severe recession, Apollo may experience a higher rate of loan defaults, further reducing its income.

Despite these headwinds, ARI is well-managed and offers investors an attractive current yield of 13.8%, so investors who trust management to sustain the dividend in the face of macroeconomic headwinds should find the stock attractive.

Click here to download our most recent Sure Analysis report on Apollo Commercial Real Estate Finance (ARI) (preview of page 1 of 3 shown below):

#9: Blackstone Mortgage Trust Inc. (BXMT)

Blackstone Mortgage Trust is an mREIT specializing in originating and acquiring senior loans secured by commercial properties in North America and Europe. The majority of its asset portfolio consists of floating-rate loans secured by first-priority mortgages, primarily in office, hotel, and manufactured housing properties. Managed by a subsidiary of The Blackstone Group, the company benefits from its parent’s market data and brand advantage.

As the company’s loan portfolio is predominantly tied to floating interest rates, Blackstone Mortgage Trust’s earnings growth is directly influenced by changes in interest rates. Its affiliation with a large parent company grants access to a wide range of lucrative deals, supporting gradual growth over time. The company has a track record of issuing shares at a premium to book value, indicating its ability to access affordable capital for earnings-per-share and book value-per-share growth.

However, Blackstone Mortgage Trust has faced challenges in growing its dividend in recent years, and this trend is expected to persist. Additionally, the current headwinds in the mortgage and real estate industry may result in a slight decline in earnings per share and potentially a dividend cut in the future. That said, given its strong track record and high-quality external management, the current 13.5% dividend yield looks attractive.

Click here to download our most recent Sure Analysis report on Blackstone Mortgage Trust Inc. (BXMT) (preview of page 1 of 3 shown below):

#10: Starwood Property Trust (STWD)

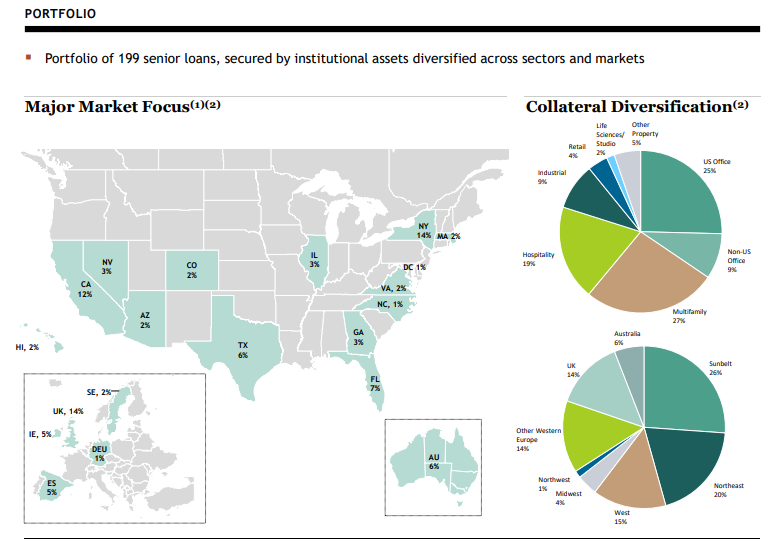

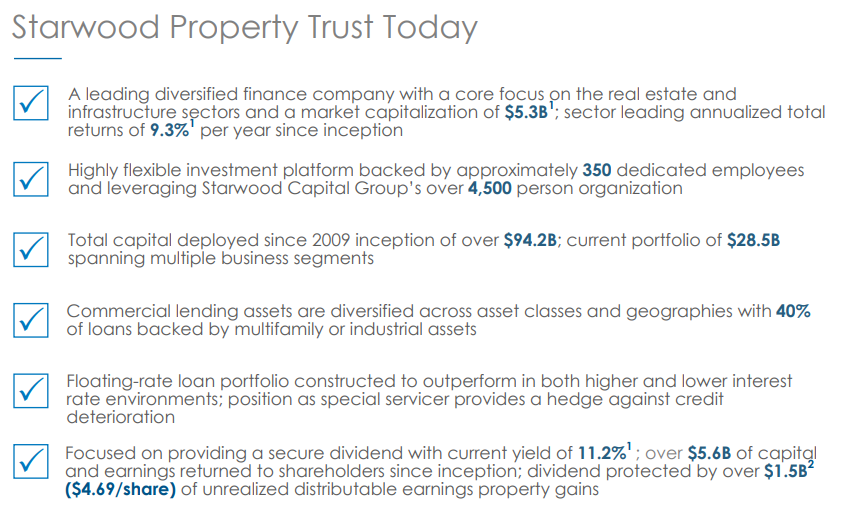

Starwood Property Trust, Inc. is an mREIT that originates, acquires, finances and manages commercial mortgage loans and other debt and equity investments. It operates across multiple segments, including Real Estate Lending, Real Estate Property, and Real Estate Investing and Servicing. The Real Estate Lending segment focuses on various types of commercial and residential loans, while the Real Estate Property segment involves acquiring equity interests in commercial real estate properties. The Real Estate Investing and Servicing segment primarily invests in commercial real estate assets of different credit ratings.

Starwood demonstrated robust performance in the face of the COVID-19 lockdowns due to its portfolio of high-quality assets, which allowed it to avoid cutting its dividend at a time when nearly all of its peers were cutting theirs. With recent acquisitions at attractive prices, the company’s financial performance is expected to remain solid in the medium term. Nevertheless, both the earnings per share (EPS) and dividends per share (DPS) are anticipated to stay stagnant going forward, as any incremental profits from capital deployment are typically offset by an increase in the company’s share count. The 10.9% dividend yield is attractive for a high-quality mREIT like Starwood.

Click here to download our most recent Sure Analysis report on Starwood Property Trust (STWD) (preview of page 1 of 3 shown below):

Conclusion

As you can see from the dividend yields offered by the ten stocks discussed

Related:

5 Dividend Stocks Worth Considering At 12-Month Lows

The 6 Best Beer Stocks To Invest In Now For Dividends And Growth