First Published on October 28th, 2022, by Quinn Mohammed for SureDividend

Exchange-traded funds (ETFs) are collections of securities that trade on a stock market exchange, just like stocks. They are often compared to mutual funds, but have some differentiating factors, and benefits.

ETFs may hold a multitude of assets, for example, stocks, bonds, commodities, and even other ETFs. There are also passively managed, high-yield ETFs, which can offer investors a strong distribution yield with low fees. This style of ETF could be suitable for investors interested in income.

With this in mind, we created a downloadable Excel list of dividend ETFs that we believe are the most attractive for income investors. We have also included the dividend yield, expense ratio, and average price-to-earnings ratio of the ETF (if available).

You can download your full list of 20+ dividend-focused ETFs by clicking on the link below:

Furthermore, there are covered-call ETFs, which often have supersized yields. These ETFs utilize covered-call options to generate income and pay them to shareholders. However, covered calls sometimes also present a limit to the upside.

A benefit to exchange-traded funds is the often significant increase in diversification as opposed to analyzing and buying single stocks. For investors who rely on dividend income, catastrophes or unforeseen events affecting one company that makes up a large portion of your portfolio income could be disastrous.

For example, shareholders who relied on dividend income from AT&T to pay their bills were likely disappointed by the loss of income once the company completed its WarnerMedia spin-off and merger with Discovery, Inc. The company effectively reduced its dividend payment to shareholders by 47%.

This sort of drastic change in dividend income is unlikely to occur with a high-dividend ETF, however it is not impossible. At the same time, ETFs relay the dividends and income earned from its holdings to shareholders, which is also subject to fluctuation. The holdings within the fund can also change semi-frequently, which can affect the ETF’s distribution month-to-month.

This fluctuation in dividend income is unlikely to be as drastic as the change in dividend income that single-stock investors, like previous AT&T investors, may experience when a position changes its dividend.

Fees are also generally lower for ETFs, especially passive funds, when compared to mutual funds. Over an investor’s lifetime, these lower fees and resulting higher total return can make a significant difference to the total value of their stock portfolio.

In this article, we will look at 5 High Dividend ETFs that pay a higher yield than the S&P 500 Index.

Table of Contents

- •High Dividend ETF #1: JPMorgan Equity Premium Income ETF (JEPI)

- •High Dividend ETF #2: Schwab US Dividend Equity ETF (SCHD)

- •High Dividend ETF #3: iShares Core High Dividend ETF(HDV)

- •High Dividend ETF #4: Vanguard High Dividend Yield Index ETF (VYM)

- •High Dividend ETF #5: iShares Select Dividend ETF (DVY)

High Dividend ETF #1: JPMorgan Equity Premium Income ETF (JEPI)

JPMorgan Equity Premium Income ETF, as its name implies, aims to provide investors with income. The fund was launched on May 20th, 2020, so it is relatively new. The ETF generates income through both selling options and investing in large cap U.S. stocks.

The JEPI fund share price has shed 14.4% year-to-date, which compares favorably to the S&P 500 Index’s 16.5% loss. Furthermore, JEPI has paid a much higher yield in this time frame as well.

JPMorgan Equity Premium Income ETF has paid dividends amounting to $5.77967 in the trailing 12 months. At the current share price of $53.61, this represents a trailing dividend yield of 10.8%, which is astronomical. JEPI also pays dividends every month, so compounding can be slightly faster.

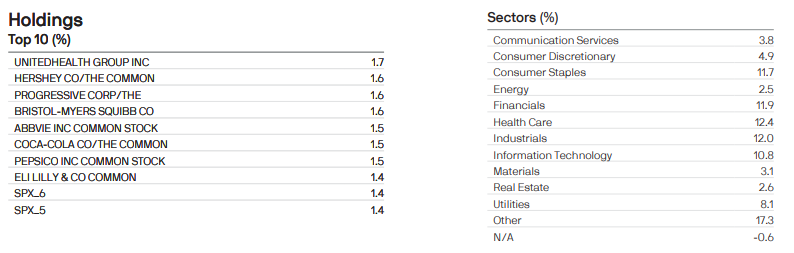

The fund’s top three sectors after “other” are healthcare, industrials, and financials at 12.4%, 12.0, and 11.9% weightings. And the fund’s top three holdings are United Health Group, Hershey Co., and Progressive, at 1.7%, 1.6%, and 1.6% weightings. The fund has a total 122 holdings in the portfolio.

High Dividend ETF #2: Schwab US Dividend Equity ETF (SCHD)

The Schwab U.S. Dividend Equity ETF aims to track the total return of the Dow Jones U.S. Dividend 100 Index, which is composed of high dividend-yielding stocks in the U.S. The fund dates back to October 20th, 2011, so it has some history to it.

The SCHD fund share price has decreased by 10.0% year-to-date, but this still compares favorably to the S&P 500 Index’s 16.5% decline. Year-to-date, SCHD also paid a higher distribution yield to shareholders.

Schwab US Dividend Equity ETF paid dividends in the trailing 12 months which represents a distribution yield of 3.7% at the current share price of $72.40. While unimpressive compared to covered-call ETFs, this yield is still more than 2% higher than the S&P 500 Index. SCHD pays dividends every quarter.

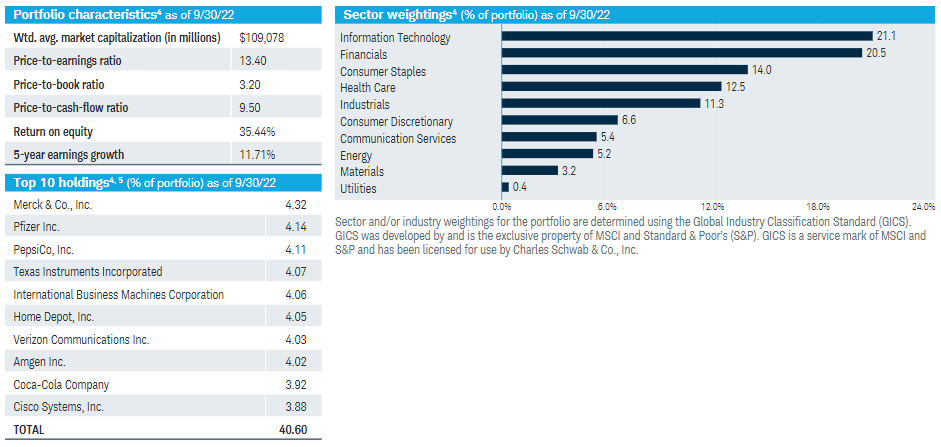

The fund’s top three sectors are information technology, financials, and consumer staples at 21.1%, 20.5%, and 14.0% weightings. And the fund’s top three holdings are Merck & Co, Pfizer, and PepsiCo at 4.3%, 4.1%, and 4.1% weightings. The fund is composed of 101 securities in total.

High Dividend ETF #3: iShares Core High Dividend ETF(HDV)

The iShares Core High Dividend ETF aims to track the returns generated by U.S. stocks that have high dividend yields. The fund’s inception date is March 29th, 2011.

The HDV fund share price has increased by 0.3% year-to-date, which is a significant outperformance compared to the S&P 500 Index’s 16.5% loss.

iShares Core High Dividend ETF declared dividends amounting to $3.6222 in the trailing 12 months. At the current share price of $101.48, this represents a trailing dividend yield of 3.6%. HDV pays dividends quarterly.

The fund’s top three sectors are energy, healthcare, and information technology at 25.5%, 21.1%, and 12.0% weightings. And the fund’s top three holdings are Exxon Mobil, Chevron, and Verizon at 9.1%, 6.8%, and 6.6% weightings. The fund has 75 holdings.

High Dividend ETF #4: Vanguard High Dividend Yield Index ETF (VYM)

The Vanguard High Dividend Yield Index ETF aims to track the returns generated by the FTSE High Dividend Yield Index, which invests in stocks that have high dividend yields. The fund’s inception date is November 10th, 2006.

The VYM fund share price has shed 7.1% year-to-date, which compares favorably to the S&P 500 Index’s 16.5% loss.

Vanguard High Dividend Yield Index ETF has paid dividends amounting to $3.22 in the trailing 12 months. At the current share price of $104.66, this represents a trailing dividend yield of 3.1%. VYM pays dividends quarterly.

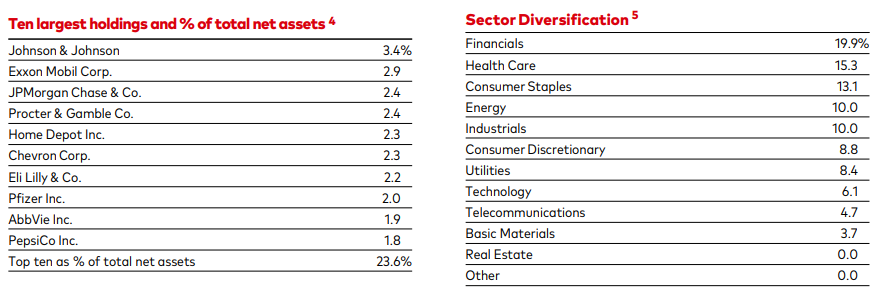

The fund’s top three sectors are financials, healthcare, and consumer staples at 19.9%, 15.3%, and 13.1% weightings. And the fund’s top three holdings are Johnson & Johnson, Exxon Mobil, and JPMorgan Chase at 3.4%, 2.9%, and 2.4% weightings. The fund has 443 stocks in its portfolio, so it is highly diversified.

High Dividend ETF #5: iShares Select Dividend ETF (DVY)

The iShares Select Dividend ETF aims to track the returns generated by U.S. stocks that have high dividend yields. The fund’s inception date is November 3rd, 2003.

The DVY fund share price has decreased by 5.7% year-to-date, which compares favorably to the S&P 500 Index’s 16.5% loss.

iShares Core High Dividend ETF paid dividends amounting to $3.9385 in the trailing 12 months. At the current share price of $116.09, this represents a trailing dividend yield of 3.4%. DVY pays dividends quarterly.

The fund’s top three sectors are utilities, financials, and consumer staples at 27.4%, 21.2%, and 10.3% weightings. And the fund’s top three holdings are Valero Energy, Altria Group, and Gilead Sciences at 2.3%, 2.2%, and 2.0% weightings. The fund has 99 holdings.

Final Thoughts

High Dividend ETFs allow investors to invest in a single entity with a significant amount of diversification. This diversification offers dividend income protection.

A drastic dividend cut at one single company is unlikely to have a significant impact on the overall portfolio of an ETF, but would likely have a dire impact if that single company made up a sizable portion of an investor’s stock portfolio.

While these High Dividend ETFs can offer enticing income, investors must make sure to perform their own due diligence before buying.

Related: