Kenya’s banking sector has facilitated sustainable development through affordable finance. The financial services sector has been at the centre of driving and shaping Kenya’s GDP growth.

In a report; The Banking Industry Shared Value Report 2019 it is evident that Kenyan banks are collaborating with stakeholders both in public and private realms in aligning with national development agenda.

Key contributions are in job creation, taxes, wealth creation, and credit access.

Jobs

For Jobs, during 2017/2018 banks spent Sh39 billion on staff costs including wages and benefits to more than 30,000 workers. In addition, Salaries and wages as a ratio of the bank’s income increased to 18.6 per cent in 2017 from 16.9 per cent in 2016.

Related; 6% Salary increase for banking sector workers

Taxes

The National Government has benefited from banks’ profitability as tax revenue paid has increased exponentially over the years. In the 2016/17 – 2017/2018 financial years, banks paid more than Sh143 billion to Kenya Revenue Authority (KRA).

Credit access

Data from CBK shows that the total value of outstanding gross loans and advancements banks made to households and private sectors increased by Sh126 billion to Sh2.53 trillion as of September 2018.

Banks facilitated personal loans and trade loans accounting for 25 per cent and 19 per cent respectively of the total loan portfolio.

On top of that, banks are working to reduce barriers to access to credit/finance for vulnerable groups – women, youth, and persons with disability

Moreover, Kenyan banks lent out a cumulative Sh480 billion to the National Treasury over three years (2016-2018) – monies used to fund development, government’s recurrent expenditure,

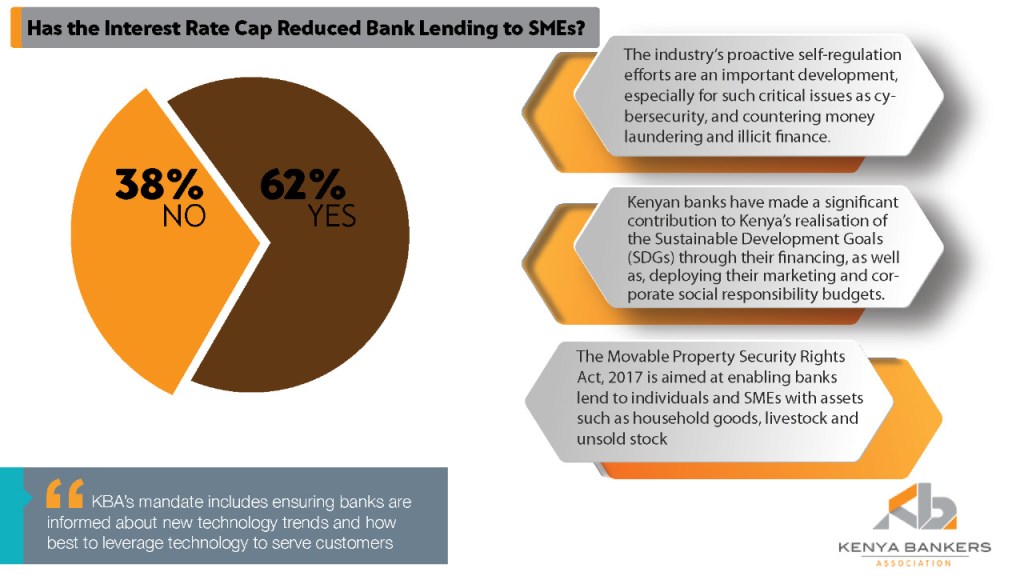

Interest rate cap reducing lending to MSMEs

The period 2016-2018 saw the National Assembly introduce interest rates controls leading to reduced lending to Micro, Small, and Medium Enterprises (MSMEs) consequently contributing to a 1.4 per cent drop in GDP growth in 2017. For instance, between August 2016 and April 2017 lending to MSMEs fell by 5.7 per cent or Sh.13.8 billion.

Prior to the caps, KBA reports that the SME portfolio was growing at 15 per cent per annum with this growth falling to 6 per cent by September 2016. KBA estimates that more than 40 billion have been redirected from MSMEs to government debt. The KBA Shared Value report showed that 62 per cent of banks agree that the interest rate cap reduced lending to SMEs.