First Published on October 18th, 2022 by Bob Ciura for SureDividend

DRIP stands for Dividend Reinvestment Plan. When an investor is enrolled in DRIP stocks, it means that incoming dividend payments are used to purchase more shares of the issuing company – automatically.

Many businesses offer DRIPs that require the investors to pay fees. Obviously, paying fees is a negative for investors. As a general rule, investors are better off avoiding DRIP stocks that charge fees.

Fortunately, many companies offer no-fee DRIP stocks. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies – for free.

Dividend Aristocrats are the perfect form of DRIP stocks. Dividend Aristocrats are elite companies that satisfy the following:

- •Are in the S&P 500 Index

- •Have 25+ consecutive years of dividend increases

- •Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet with the full list of all 65 Dividend Aristocrats (with additional financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

Think about the powerful combination of DRIPs and Dividend Aristocrats…

You are reinvesting dividends into a company that pays higher dividends every year. This means that every year you get more shares – and each share is paying you more dividend income than the previous year.

This makes a powerful (and cost-effective) compounding machine.

This article takes a look at the top 15 Dividend Aristocrats that are no-fee DRIP stocks, ranked in order of expected total returns from lowest to highest.

The updated list for 2022 includes our top 15 Dividend Aristocrats, ranked by expected returns according to the Sure Analysis Research Database, that offer no-fee DRIPs to shareholders.

You can skip to analysis of any individual Dividend Aristocrat below:

- •#15: Chubb Limited (CB)

- •#14: Aflac Incorporated (AFL)

- •#13: AbbVie Inc. (ABBV)

- •#12: Abbott Laboratories (ABT)

- •#11: Hormel Foods (HRL)

- •#10: Illinois Tool Works (ITW)

- •#9: Sherwin-Williams (SHW)

- •#8: Federal Realty Investment Trust (FRT)

- •#7: Johnson & Johnson (JNJ)

- •#6: Emerson Electric (EMR)

- •#5: S&P Global (SPGI)

- •#4: Realty Income (O)

- •#3: A.O. Smith (AOS)

- •#2: Albemarle Corporation (ALB)

- •#1: 3M Company (MMM)

Additionally, please see the video below for more coverage.https://www.youtube.com/embed/VwKe03oYrHI

No-Fee DRIP Dividend Aristocrat #15: Chubb Limited (CB)

- •5-year expected annual returns: 1.4%

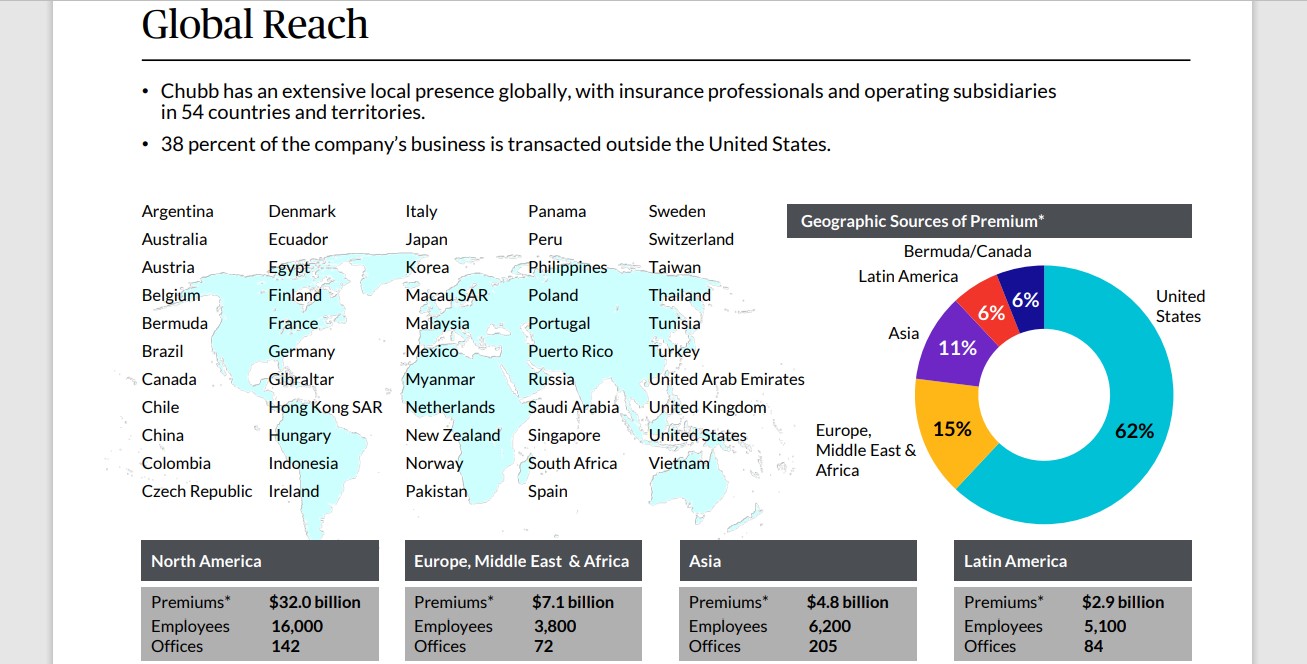

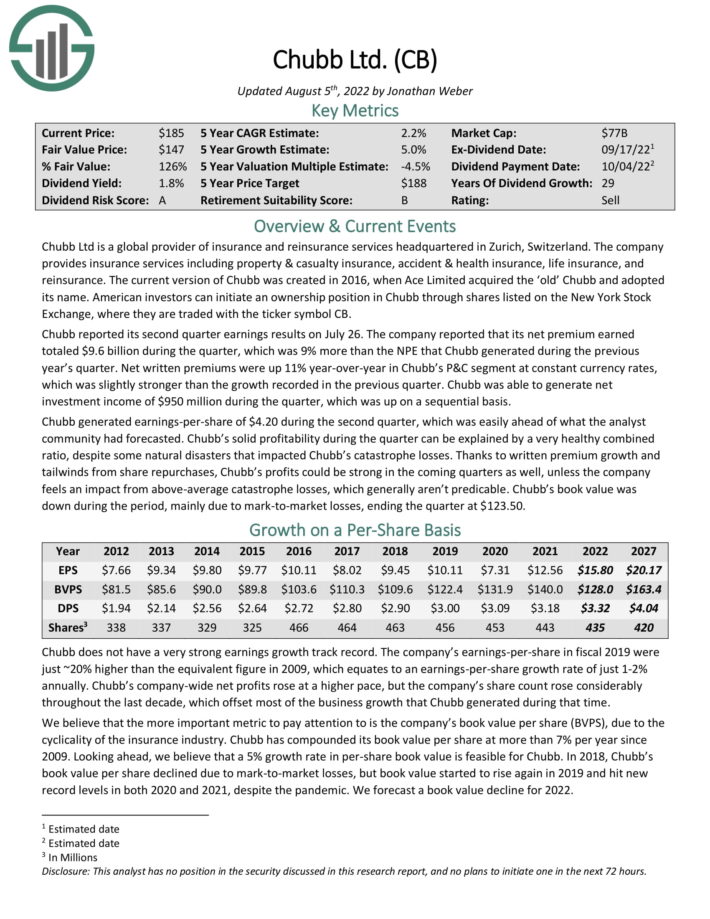

Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. The company provides insurance services including property & casualty insurance, accident & health insurance, life insurance, and reinsurance.

The current version of Chubb was created in 2016, when Ace Limited acquired the ‘old’ Chubb and adopted its name. Chubb has a large and diversified product portfolio.

Source: Investor Presentation

Chubb reported its second quarter earnings results on July 26. The company reported that its net premium earned totaled $9.6 billion during the quarter, which was 9% more than the NPE that Chubb generated during the previous year’s quarter.

Net written premiums were up 11% year-over-year in Chubb’s P&C segment at constant currency rates, which was slightly stronger than the growth recorded in the previous quarter. Chubb was able to generate net investment income of $950 million during the quarter, which was up on a sequential basis.

Chubb generated earnings-per-share of $4.20 during the second quarter, which was easily ahead of what the analyst

community had forecasted. Chubb’s solid profitability during the quarter can be explained by a very healthy combined ratio, despite some natural disasters that impacted Chubb’s catastrophe losses.

Thanks to written premium growth and tailwinds from share repurchases, Chubb’s profits could be strong in the coming quarters as well, unless the company feels an impact from above-average catastrophe losses, which generally aren’t predicable. Chubb’s book value was down during the period, mainly due to mark-to-market losses, ending the quarter at $123.50.

Click here to download our most recent Sure Analysis report on Chubb (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #14: Aflac Inc. (AFL)

- •5-year expected annual returns: 3.9%

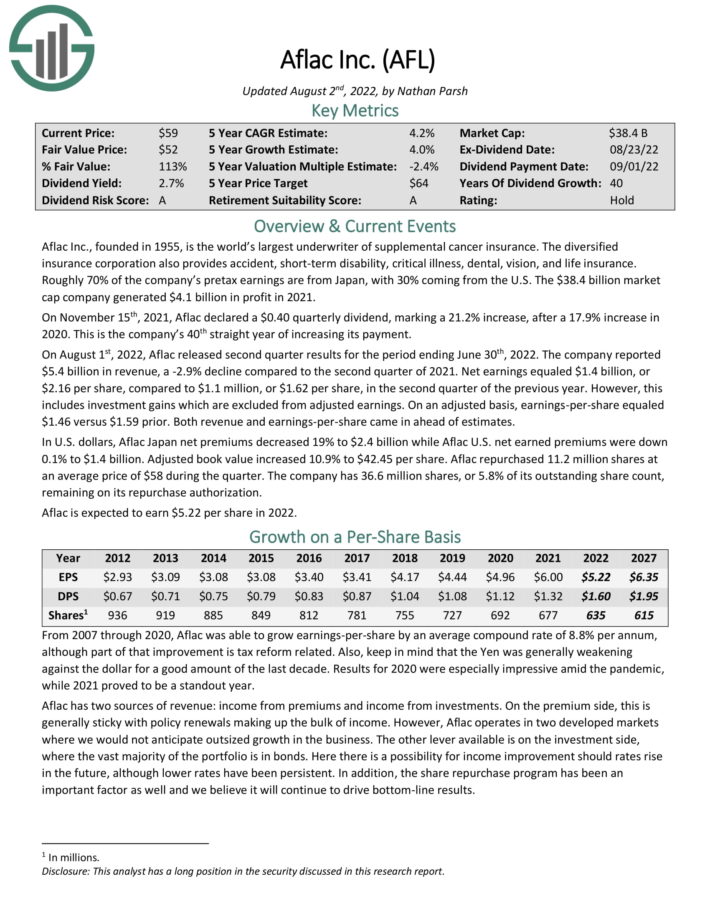

Aflac was formed in 1955, when three brothers — John, Paul, and Bill Amos — came up with the idea to sell insurance products that paid cash if a policyholder got sick or injured. In the mid-20th century, workplace injuries were common, with no insurance product at the time to cover this risk.

Related: Detailed analysis on the best insurance stocks.

Today, Aflac has a wide range of product offerings, some of which include accident, short-term disability, critical illness, hospital indemnity, dental, vision, and life insurance.

The company specializes in supplemental insurance, which pays out to policy holders if they are sick or injured, and cannot work. Aflac operates in the U.S. and Japan, with Japan accounting for approximately 70% of the company’s revenue. Because of this, investors are exposed to currency risk.

In general terms, Aflac has two sources of income: income from premiums and income from investments. Taking the items collectively, in addition to an active share repurchase program, reasonable expectations would be for 4% annual earnings-per-share growth over the next five years.

Click here to download our most recent Sure Analysis report on Aflac (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #13: AbbVie Inc. (ABBV)

- •5-year expected annual returns: 5.6%

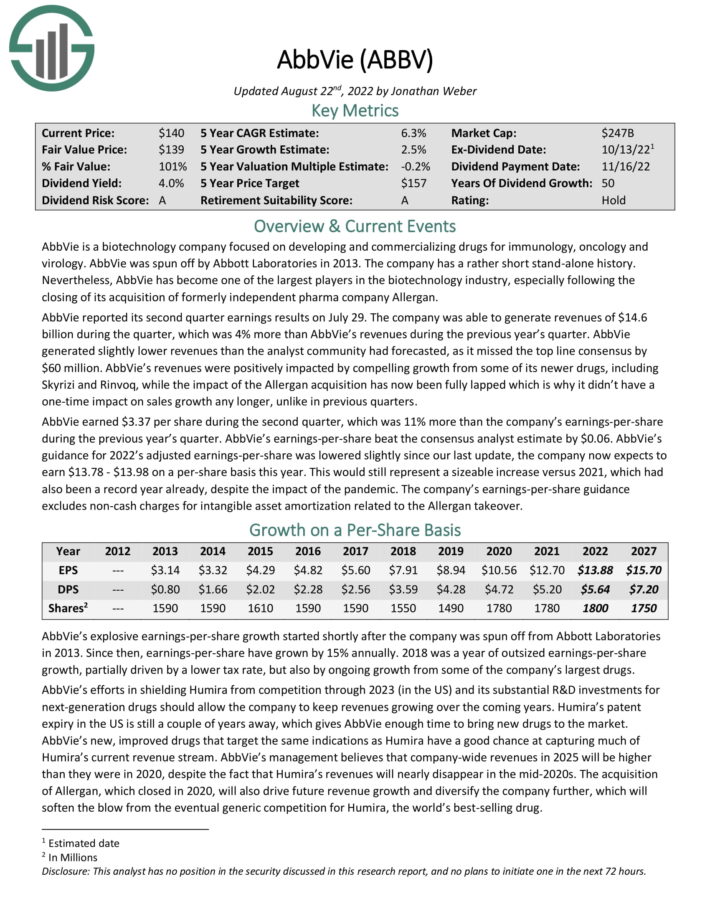

AbbVie Inc. is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, which is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. Humira will lose patent protection in the U.S. in 2023.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

AbbVie reported its second quarter earnings results on July 29. The company was able to generate revenues of $14.6 billion during the quarter, which was 4% more than AbbVie’s revenues during the previous year’s quarter. AbbVie generated slightly lower revenues than the analyst community had forecasted, as it missed the top line consensus by $60 million.

AbbVie’s revenues were positively impacted by compelling growth from some of its newer drugs, including Skyrizi and Rinvoq, while the impact of the Allergan acquisition has now been fully lapped which is why it didn’t have a one-time impact on sales growth any longer, unlike in previous quarters.

AbbVie earned $3.37 per share during the second quarter, which was 11% more than the company’s earnings-per-share during the previous year’s quarter. AbbVie’s earnings-per-share beat the consensus analyst estimate by $0.06. AbbVie’s guidance for 2022’s adjusted earnings-per-share was lowered slightly since our last update, the company now expects to earn $13.78 – $13.98 on a per-share basis this year.

Click here to download our most recent Sure Analysis report on AbbVie (preview of page 1 of 3 shown below):

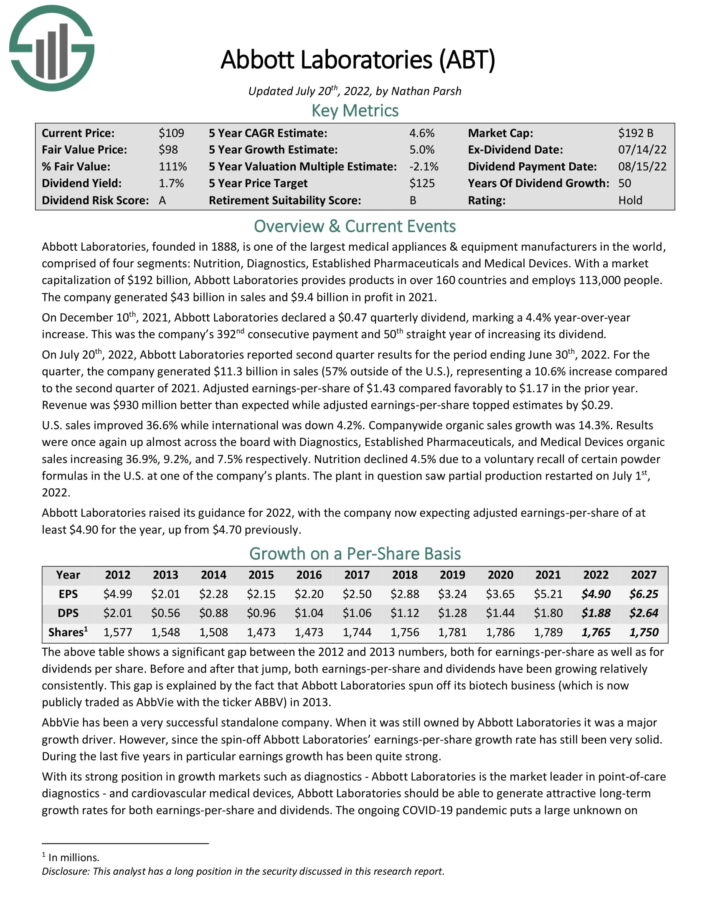

No-Fee DRIP Dividend Aristocrat #12: Abbott Laboratories (ABT)

- •5-year expected annual returns: 5.7%

Abbott Laboratories is one of the largest medical appliances & equipment manufacturers in the world, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals and Medical Devices.

Abbott has increased its dividend for 50 years. Abbott has a large and diversified product portfolio, with leadership across multiple categories.

On July 20th, 2022, Abbott Laboratories reported second quarter results for the period ending June 30th, 2022. For the quarter, the company generated $11.3 billion in sales (57% outside of the U.S.), representing a 10.6% increase compared to the second quarter of 2021. Adjusted earnings-per-share of $1.43 compared favorably to $1.17 in the prior year.

Revenue was $930 million better than expected while adjusted earnings-per-share topped estimates by $0.29. U.S. sales improved 36.6% while international was down 4.2%. Company-wide organic sales growth was 14.3%.

Results were once again up almost across the board with Diagnostics, Established Pharmaceuticals, and Medical Devices organic sales increasing 36.9%, 9.2%, and 7.5% respectively. Nutrition declined 4.5% due to a voluntary recall of certain powder formulas in the U.S. at one of the company’s plants. The plant in question saw partial production restarted on July 1st 2022.

Abbott Laboratories raised its guidance for 2022, with the company now expecting adjusted earnings-per-share of at least $4.90 for the year, up from $4.70 previously.

Click here to download our most recent Sure Analysis report on Abbott Laboratories (preview of page 1 of 3 shown below):

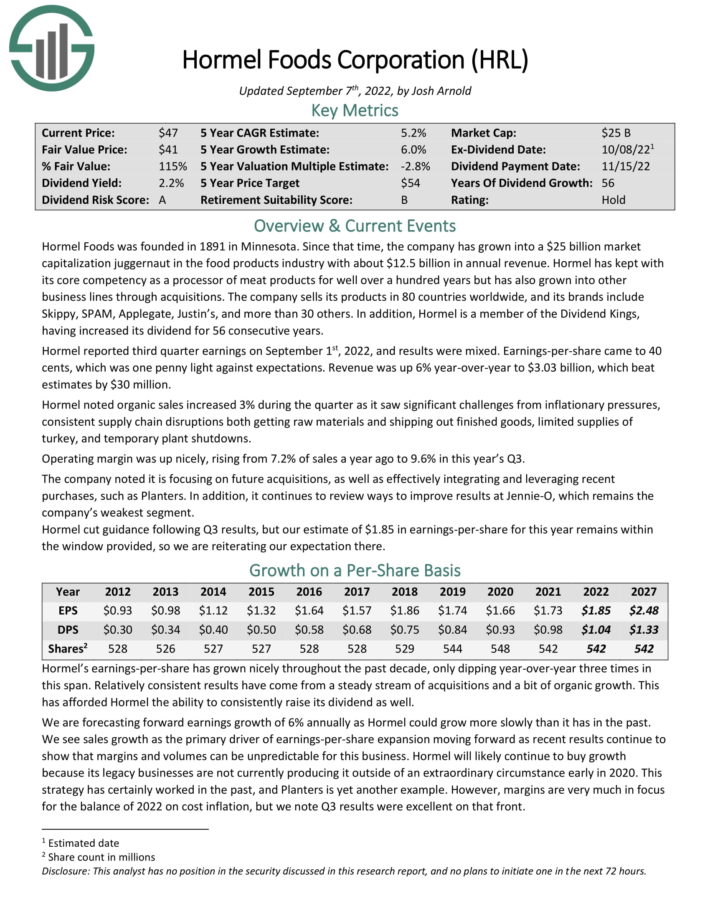

No-Fee DRIP Dividend Aristocrat #11: Hormel Foods (HRL)

- •5-year expected annual returns: 6.1%

Hormel Foods was founded back in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with nearly $10 billion in annual revenue.

Hormel has kept with its core competency as a processor of meat products for well over a hundred years, but has also grown into other business lines through acquisitions.

Hormel has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

Hormel reported third quarter earnings on September 1st, 2022, and results were mixed. Earnings-per-share came to 40 cents, which was one penny light against expectations. Revenue was up 6% year-over-year to $3.03 billion, which beat estimates by $30 million.

Hormel noted organic sales increased 3% during the quarter as it saw significant challenges from inflationary pressures, consistent supply chain disruptions both getting raw materials and shipping out finished goods, limited supplies of turkey, and temporary plant shutdowns.

Click here to download our most recent Sure Analysis report on Hormel (preview of page 1 of 3 shown below):

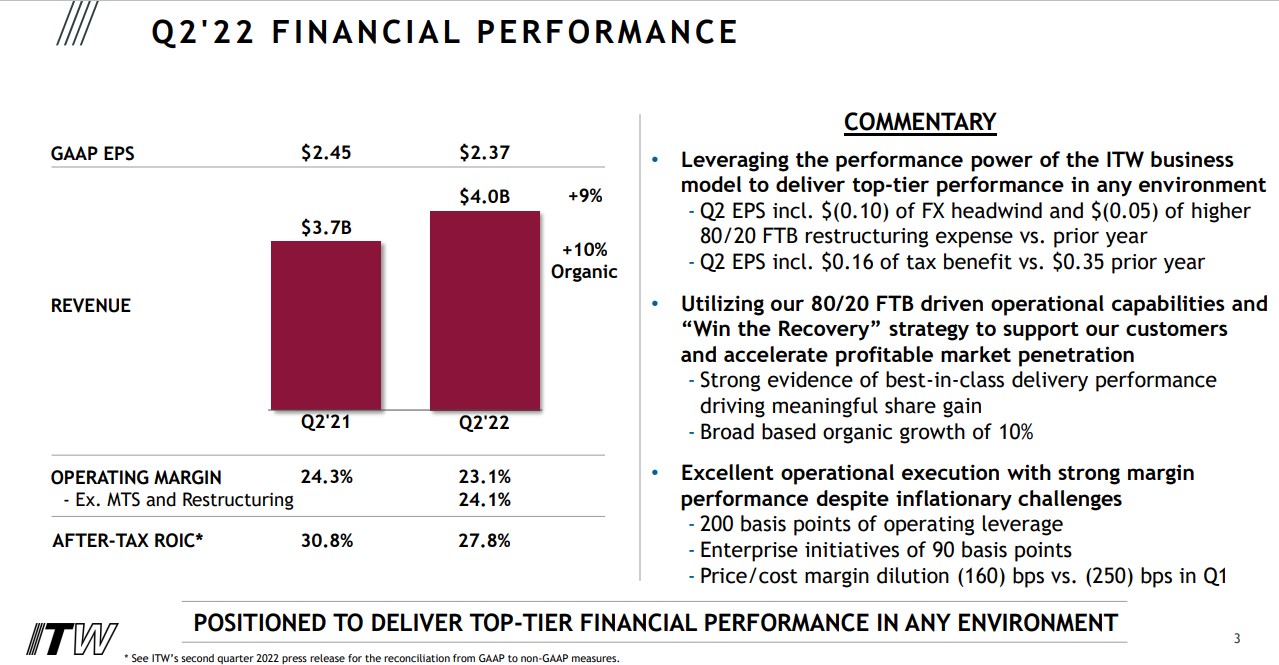

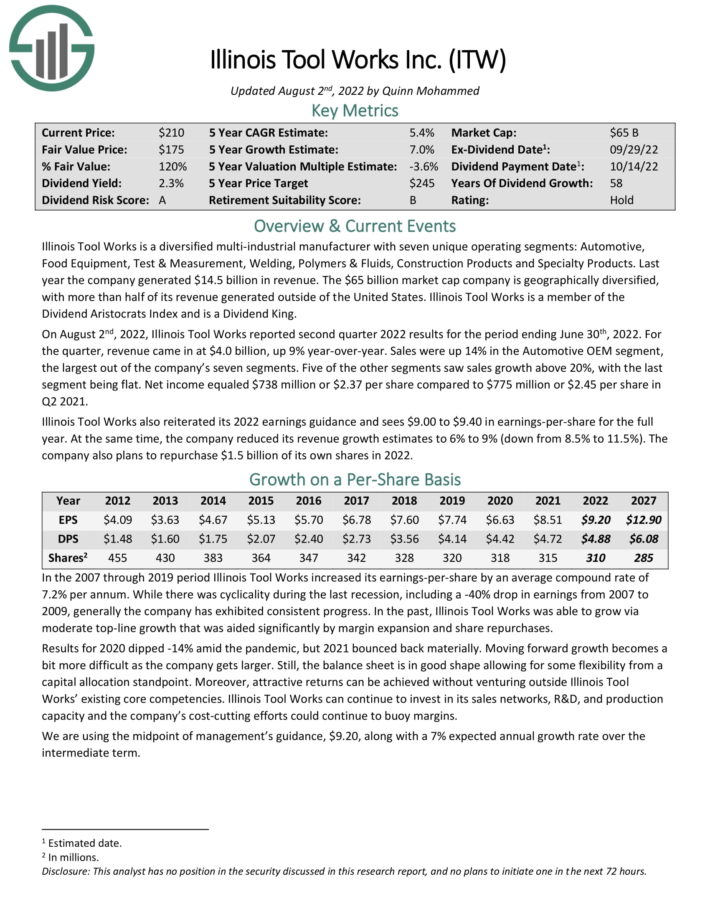

No-Fee DRIP Dividend Aristocrat #10: Illinois Tool Works (ITW)

- •5-year expected annual returns: 7.3%

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

On August 2nd, 2022, Illinois Tool Works reported second quarter 2022 results for the period ending June 30th, 2022. For the quarter, revenue came in at $4.0 billion, up 9% year-over-year. Sales were up 14% in the Automotive OEM segment, the largest out of the company’s seven segments. Five of the other segments saw sales growth above 20%, with the last segment being flat. Net income equaled $738 million or $2.37 per share compared to $775 million or $2.45 per share in Q2 2021.

Source: Investor Presentation

Illinois Tool Works also reiterated its 2022 earnings guidance and sees $9.00 to $9.40 in earnings-per-share for the full year. At the same time, the company reduced its revenue growth estimates to 6% to 9% (down from 8.5% to 11.5%). The company also plans to repurchase $1.5 billion of its own shares in 2022.

Illinois Tool Works has an excellent dividend growth history. Its payout ratio was relatively high during the last financial crisis, but the company was not forced to cut the payout. Today the dividend payout ratio sits at 53% of expected earnings, above the company’s long-term target, meaning that future dividend growth may trail earnings growth.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

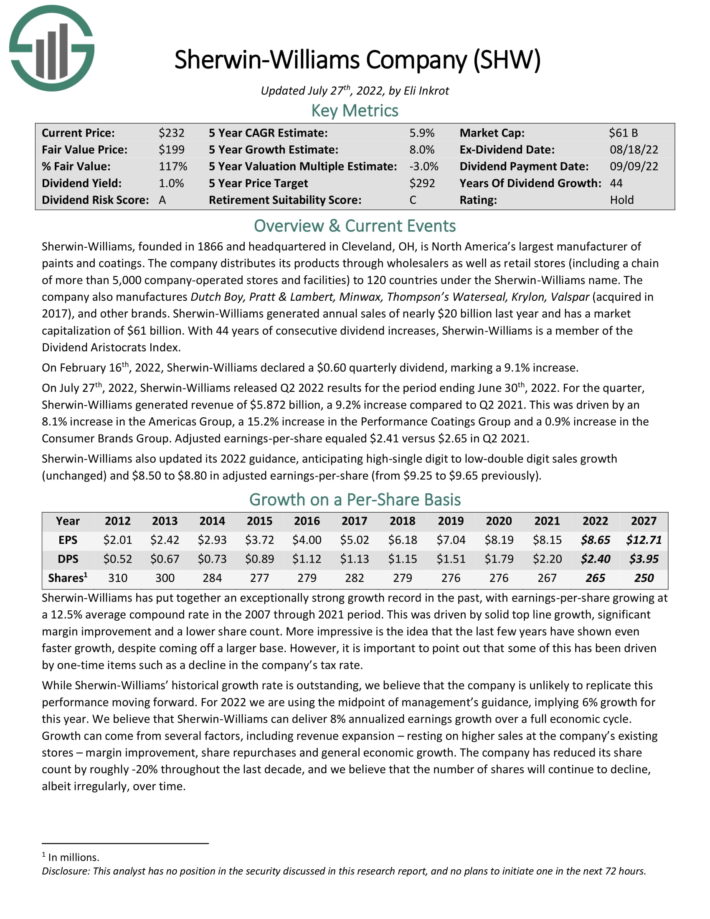

No-Fee DRIP Dividend Aristocrat #9: Sherwin-Williams (SHW)

- •5-year expected annual returns: 8.1%

Sherwin-Williams, founded in 1866 and headquartered in Cleveland, OH, is North America’s largest manufacturer of paints and coatings.

The company distributes its products through wholesalers as well as retail stores (including a chain of more than 4,900 company-operated stores and facilities) to 120 countries under the Sherwin-Williams name.

The company also manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and other brands.

Source: Investor Presentation

On July 27th, 2022, Sherwin-Williams released Q2 2022 results for the period ending June 30th, 2022. For the quarter, Sherwin-Williams generated revenue of $5.872 billion, a 9.2% increase compared to Q2 2021. This was driven by an 8.1% increase in the Americas Group, a 15.2% increase in the Performance Coatings Group and a 0.9% increase in the Consumer Brands Group.

Adjusted earnings-per-share equaled $2.41 versus $2.65 in Q2 2021. Sherwin-Williams also updated its 2022 guidance, anticipating high-single digit to low-double digit sales growth (unchanged) and $8.50 to $8.80 in adjusted earnings-per-share (from $9.25 to $9.65 previously).

Click here to download our most recent Sure Analysis report on Sherwin-Williams (preview of page 1 of 3 shown below):

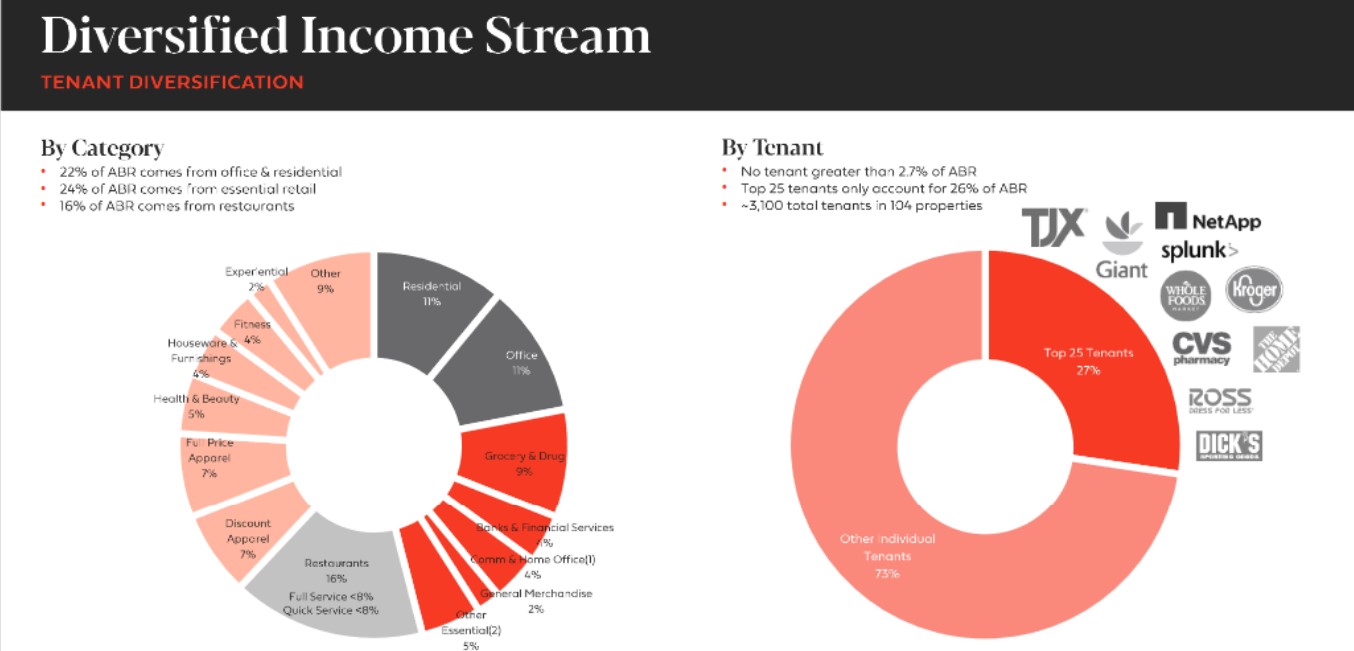

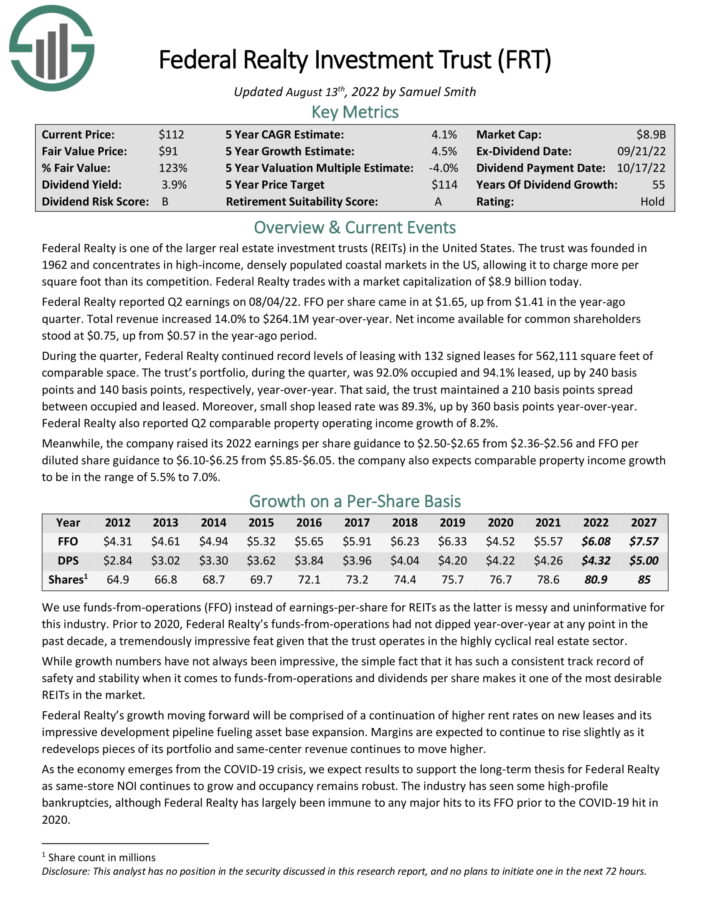

No-Fee DRIP Dividend Aristocrat #8: Federal Realty Investment Trust (FRT)

- •5-year expected annual returns: 8.3%

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty’s business model is to own and rent out real estate properties. It uses a significant portion of its rental income, as well as external financing, to acquire new properties. This helps create a “snow-ball” effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in redevelopment of multi-purpose properties including retail, apartments, and condominiums. The portfolio is highly diversified in terms of tenant base.

Source: Investor Presentation

Federal Realty reported Q2 earnings on 08/04/22. FFO per share came in at $1.65, up from $1.41 in the year-ago quarter. Total revenue increased 14.0% to $264.1M year-over-year. Net income available for common shareholders stood at $0.75, up from $0.57 in the year-ago period.

During the quarter, Federal Realty continued record levels of leasing with 132 signed leases for 562,111 square feet of comparable space. The trust’s portfolio, during the quarter, was 92.0% occupied and 94.1% leased, up by 240 basis points and 140 basis points, respectively, year-over-year. That said, the trust maintained a 210 basis points spread between occupied and leased. Moreover, small shop leased rate was 89.3%, up by 360 basis points year-over-year. Federal Realty also reported Q2 comparable property operating income growth of 8.2%.

Meanwhile, the company raised its 2022 earnings per share guidance to $2.50-$2.65 from $2.36-$2.56 and FFO per diluted share guidance to $6.10-$6.25 from $5.85-$6.05. the company also expects comparable property income growth to be in the range of 5.5% to 7.0%.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

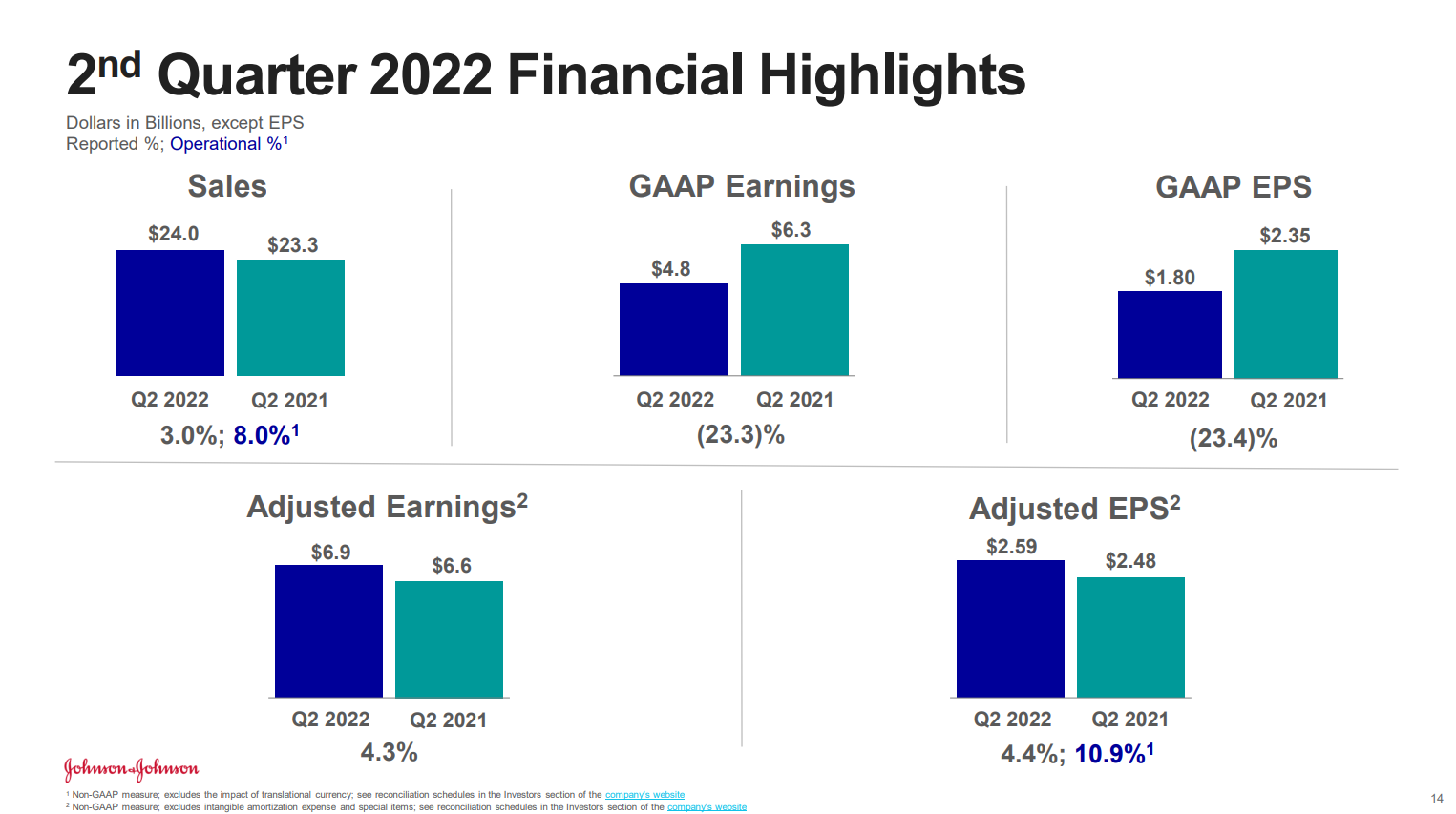

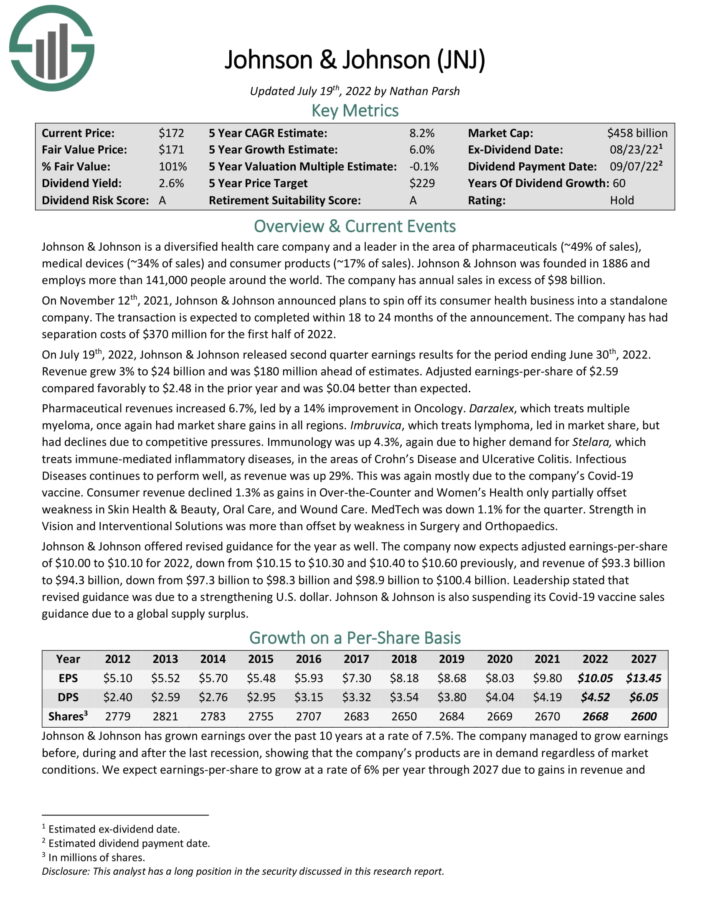

No-Fee DRIP Dividend Aristocrat #7: Johnson & Johnson (JNJ)

- •5-year expected annual returns: 9.0%

Johnson & Johnson is a diversified health care company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales) and consumer products (~17% of sales). The company has annual sales in excess of $93 billion.

The company’s most recent earnings report was delivered on July 19th 2022, for the second quarter. Results were better than expected on both revenue and profits, but the company lowered guidance for the full year, which it attributed to a much stronger US dollar.

Source: Investor presentation, page 14

For the second quarter, adjusted earnings-per-share came to $2.59, which was four cents ahead of expectations. Revenue was $24 billion, up 3% year-over-year and $180 million ahead of estimates.

Johnson & Johnson has averaged 7% growth in earnings-per-share for the past decade, which is impressive given its massive size. The company has been able to move the needle steadily through a combination of higher sales, better profit margins, and a slight reduction in the float through buybacks.

Click here to download our most recent Sure Analysis report on J&J (preview of page 1 of 3 shown below):

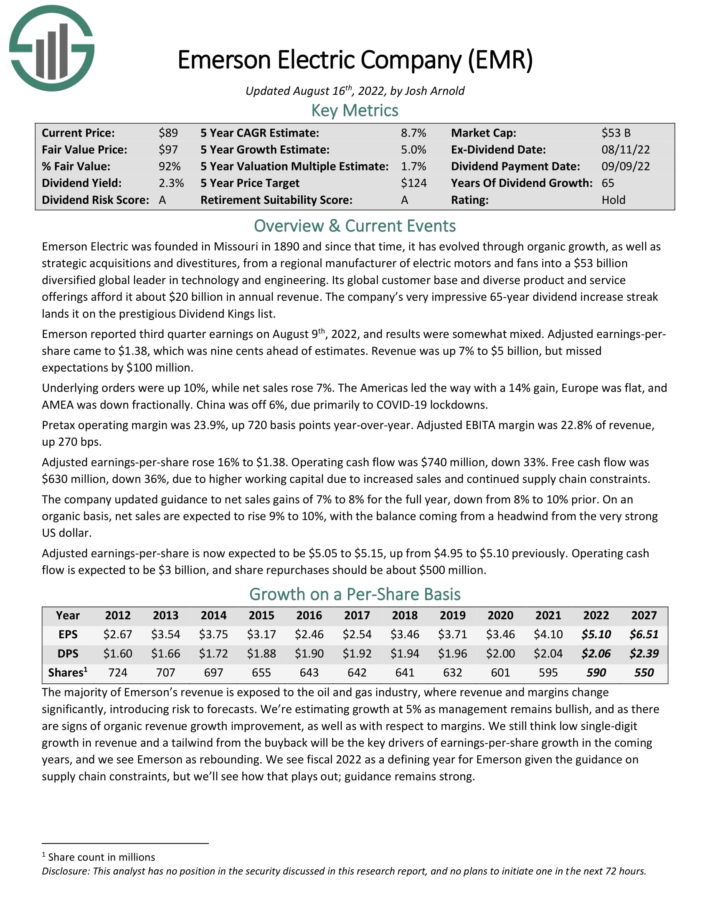

No-Fee DRIP Dividend Aristocrat #6: Emerson Electric (EMR)

- •5-year expected annual returns: 11.0%

Emerson Electric is an ideal candidate for a no-fee DRIP program, as the company has increased its dividend for over 60 years in a row.

Emerson Electric was founded in Missouri in 1890 and since that time, it has evolved through organic growth, as well as strategic acquisitions and divestitures, from a regional manufacturer of electric motors and fans into a $49 billion diversified global leader in technology and engineering. Its global customer base and diverse product and service offerings afford it about $20 billion in annual revenue. The company has increased its dividend for 65 years in a row.

Emerson reported second quarter earnings on May 4th, 2022, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $1.29, beating expectations by 11 cents. Revenue was $4.8 billion, up 8% year-over-year and $80 million better than estimates.

Sales in Automation Solutions rose 5% to $2.93 billion, while Commercial and Residential Solutions saw sales rise 13% to $1.85 billion. Net profit was $674 million, up from $561 million year-over-year. Adjusted EBITA margin was up 20 basis points to 20.2% of revenue.

Free cash flow for Q2 fell by half year-over-year to $333 million, which was attributable to higher inventory resulting from supply chain constraints. The company raised guidance for this year to adjusted earnings-per-share of $4.95 to $5.10, up about 25 cents from prior guidance.

Click here to download our most recent Sure Analysis report on EMR (preview of page 1 of 3 shown below):

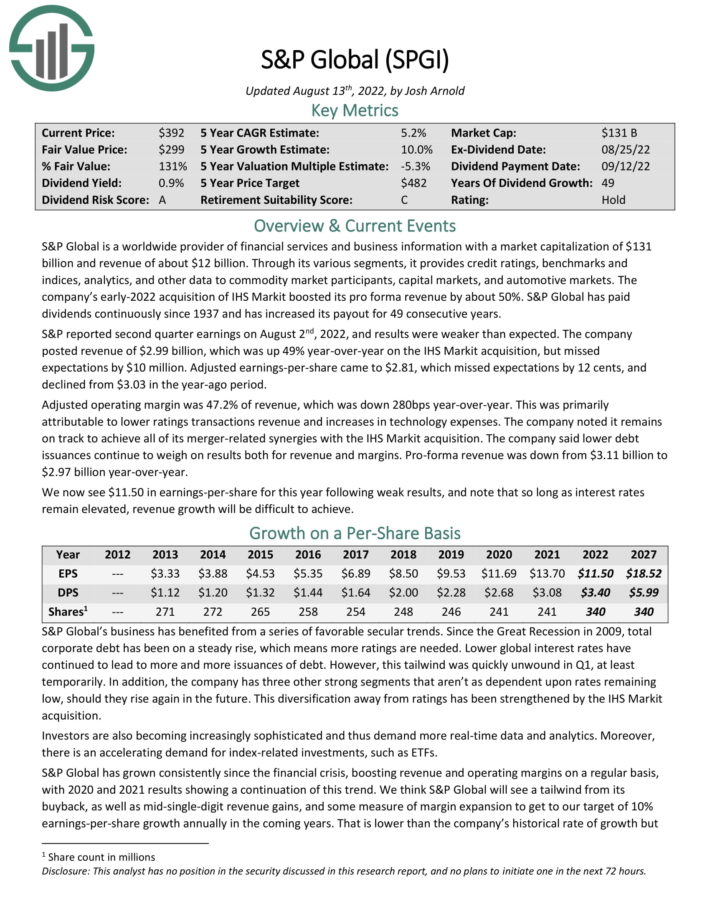

No-Fee DRIP Dividend Aristocrat #5: S&P Global Inc. (SPGI)

- •5-year expected annual returns: 11.2%

S&P Global is a worldwide provider of financial services and business information. The company has generated strong growth over the past several years.

S&P reported second quarter earnings on August 2nd, 2022, and results were weaker than expected. The company posted revenue of $2.99 billion, which was up 49% year-over-year on the IHS Markit acquisition, but missed expectations by $10 million. Adjusted earnings-per-share came to $2.81, which missed expectations by 12 cents, and declined from $3.03 in the year-ago period.

Adjusted operating margin was 47.2% of revenue, which was down 280bps year-over-year. This was primarily attributable to lower ratings transactions revenue and increases in technology expenses. The company noted it remains on track to achieve all of its merger-related synergies with the IHS Markit acquisition. The company said lower debt issuances continue to weigh on results both for revenue and margins. Pro-forma revenue was down from $3.11 billion to $2.97 billion year-over-year.

Click here to download our most recent Sure Analysis report on S&P Global (preview of page 1 of 3 shown below):

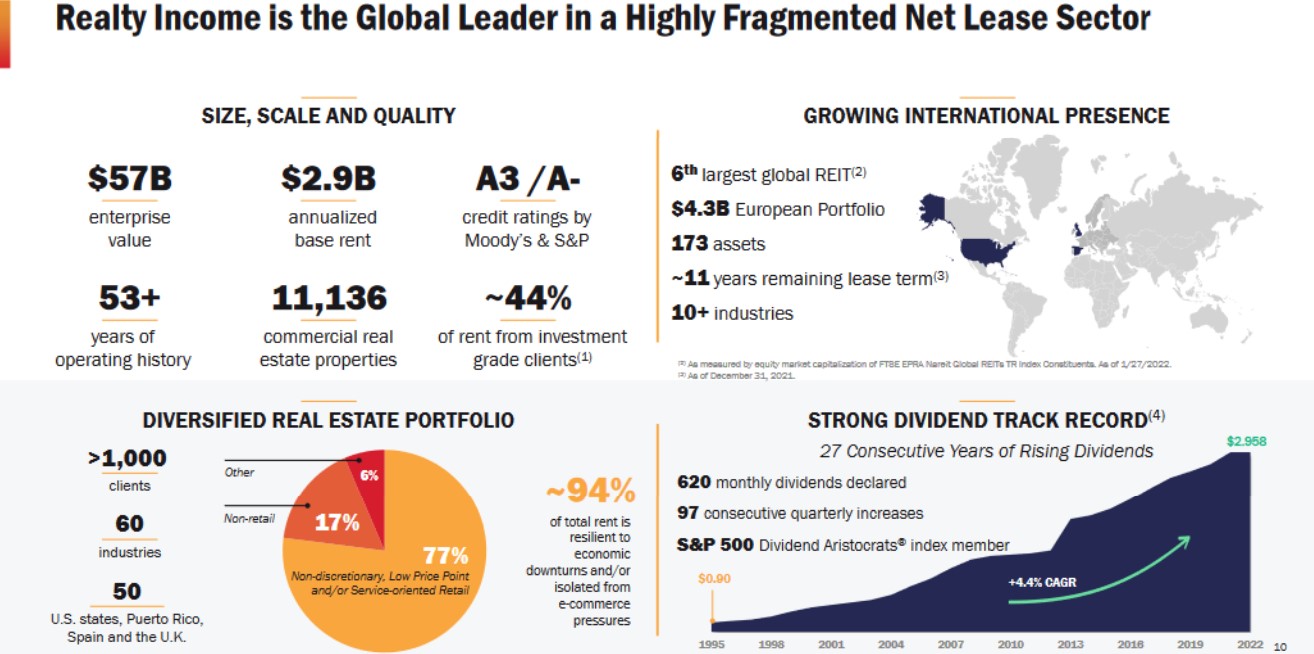

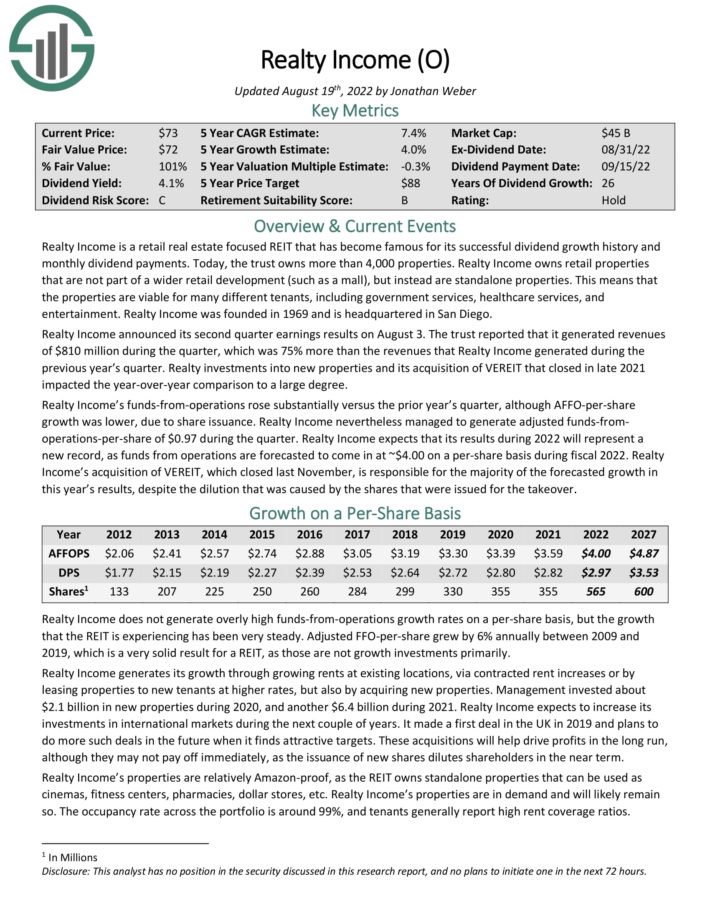

No-Fee DRIP Dividend Aristocrat #4: Realty Income (O)

- •5-year expected annual returns: 12.6%

Realty Income is a retail-focused REIT that owns more than 6,500 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Source: Investor Presentation

The company’s long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Realty Income announced its second quarter earnings results on August 3. The trust reported that it generated revenues of $810 million during the quarter, which was 75% more than the revenues that Realty Income generated during the previous year’s quarter. Realty investments into new properties and its acquisition of VEREIT that closed in late 2021 impacted the year-over-year comparison to a large degree.

Realty Income’s funds-from-operations rose substantially versus the prior year’s quarter, although AFFO-per-share growth was lower, due to share issuance. Realty Income nevertheless managed to generate adjusted funds-from operations-per-share of $0.97 during the quarter. Realty Income expects that its results during 2022 will represent a new record, as funds from operations are forecasted to come in at ~$4.00 on a per-share basis during fiscal 2022.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

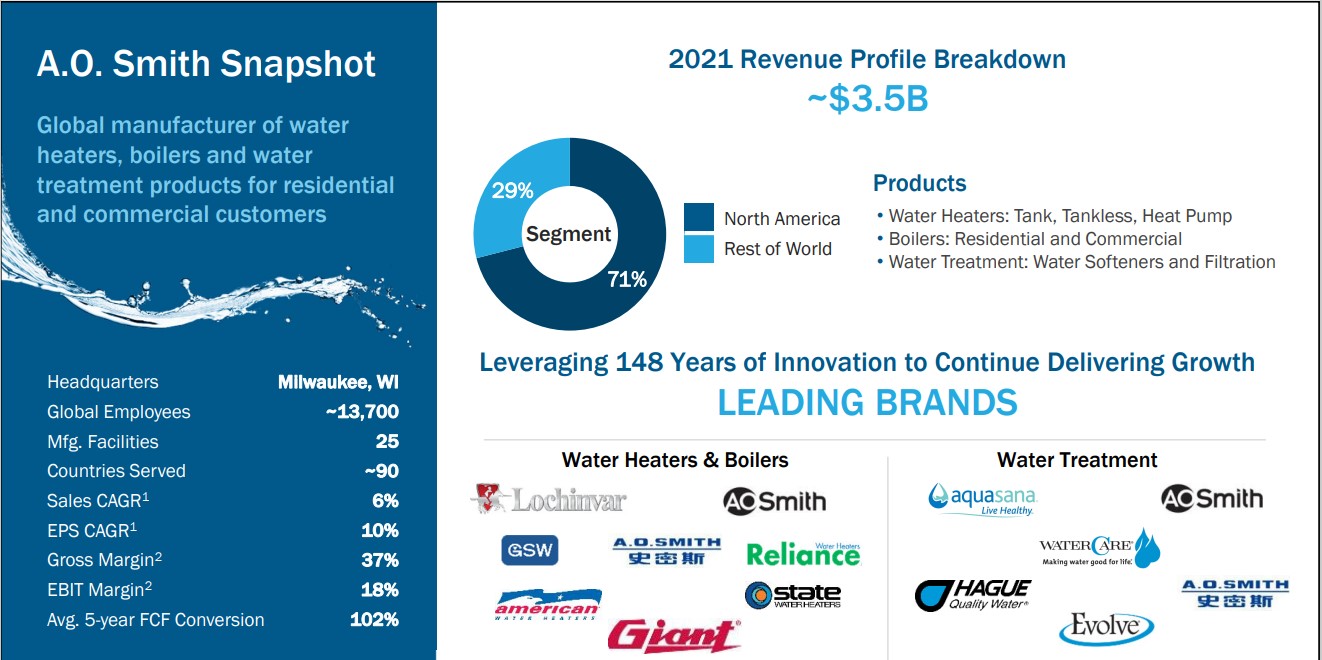

No-Fee DRIP Dividend Aristocrat #3: A.O. Smith (AOS)

- •5-year expected annual returns: 13.1%

A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment products. A.O. Smith generates the majority of its sales in North America, with the remainder from the rest of the world.It has category-leading brands across its various geographic markets.

Source: Investor Presentation

A.O. Smith is one of the top water stocks.

A.O. Smith reported its second quarter earnings results on July 28. The company generated revenues of $970 million during the quarter, which represents an increase of 12% compared to the prior year’s quarter. A.O. Smith’s revenues were up 23% in North America, while revenue growth was lower in the rest of the world, where sales during the quarter were down 13% year over year, with the decline being explained by factors such as COVID measures in China.

A.O. Smith generated earnings-per-share of $0.82 during the second quarter, which was up by 11% on a year over year basis. This can mostly be explained by the solid revenue performance, which lifted the company’s profits at a comparable level, despite commodity price headwinds.A.O. Smith has also reaffirmed its guidance for 2022.

The company is forecasting earnings-per-share in a range of $3.35 and $3.55, which reflects that management expects earnings-per-share to meaningfully grow this year, on top of the strong growth in 2021. At the midpoint of the guidance range, A.O. Smith’s earnings-per-share would rise by an attractive 14% compared to 2021.

Click here to download our most recent Sure Analysis report on A.O. Smith (preview of page 1 of 3 shown below):

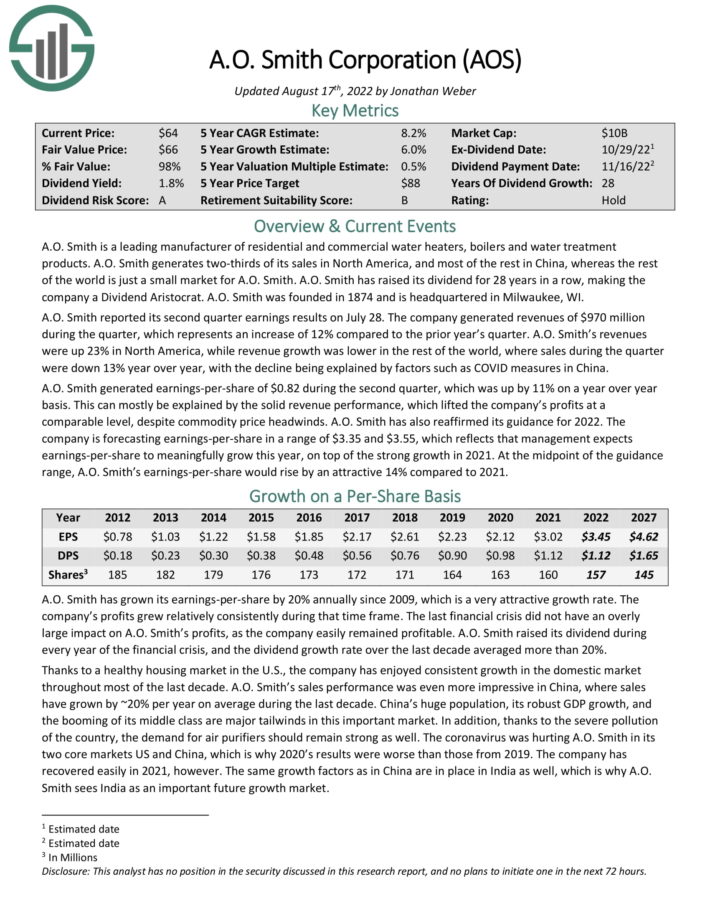

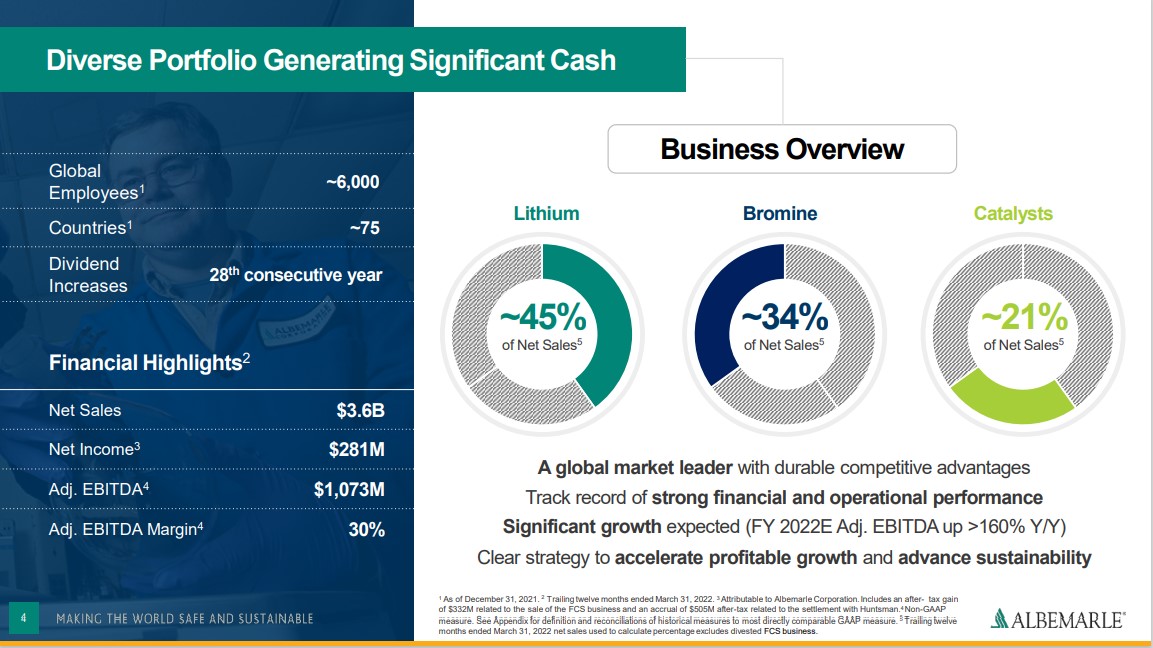

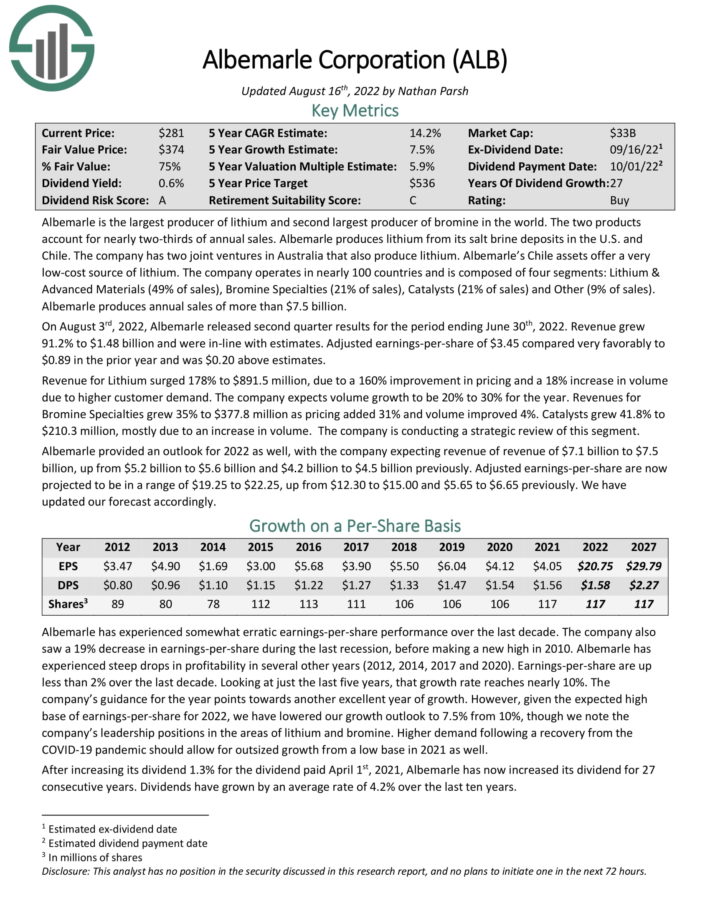

No-Fee DRIP Dividend Aristocrat #2: Albemarle Corporation (ALB)

- •5-year expected annual returns: 17.1%

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium.

Albemarle’s Chile assets offer a very low-cost source of lithium.The company operates in nearly 100 countries and is composed of four segments. Albemarle produces annual sales of more than $5 billion.

Source: Investor Presentation

On August 3rd, 2022, Albemarle released second quarter results for the period ending June 30th, 2022. Revenue grew 91.2% to $1.48 billion and were in-line with estimates. Adjusted earnings-per-share of $3.45 compared very favorably to $0.89 in the prior year and was $0.20 above estimates.

Revenue for Lithium surged 178% to $891.5 million, due to a 160% improvement in pricing and a 18% increase in volume due to higher customer demand. The company expects volume growth to be 20% to 30% for the year. Revenues for Bromine Specialties grew 35% to $377.8 million as pricing added 31% and volume improved 4%. Catalysts grew 41.8% to $210.3 million, mostly due to an increase in volume. The company is conducting a strategic review of this segment.

Albemarle provided an outlook for 2022 as well, with the company expecting revenue of revenue of $7.1 billion to $7.5 billion, up from $5.2 billion to $5.6 billion and $4.2 billion to $4.5 billion previously. Adjusted earnings-per-share are now projected to be in a range of $19.25 to $22.25, up from $12.30 to $15.00 and $5.65 to $6.65 previously.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

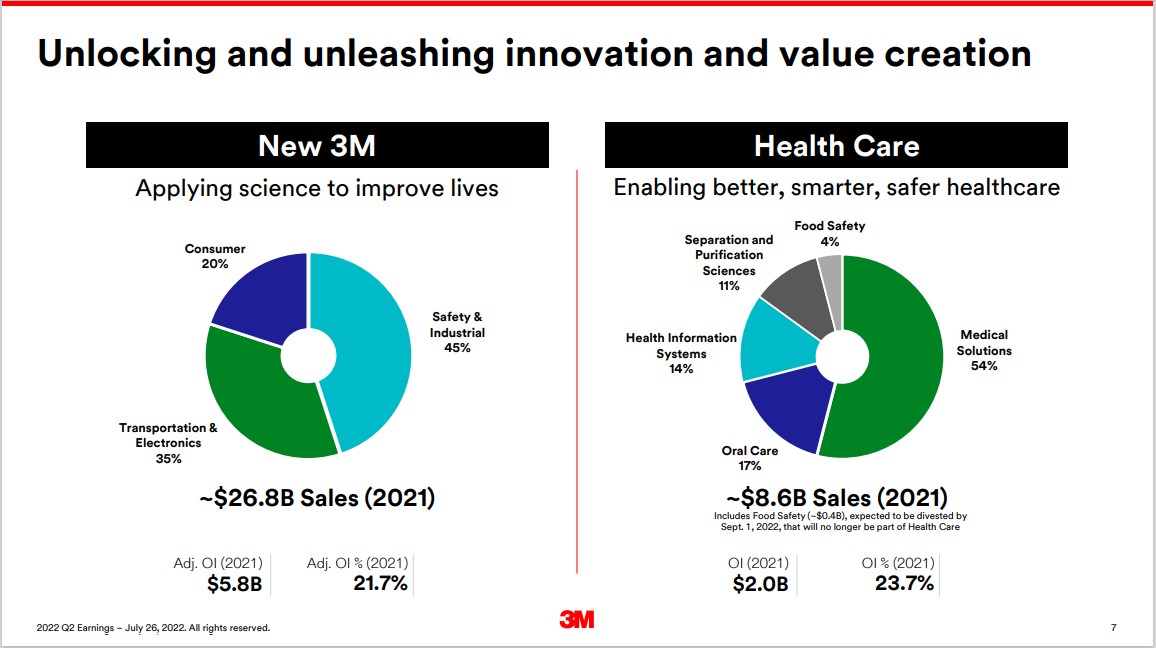

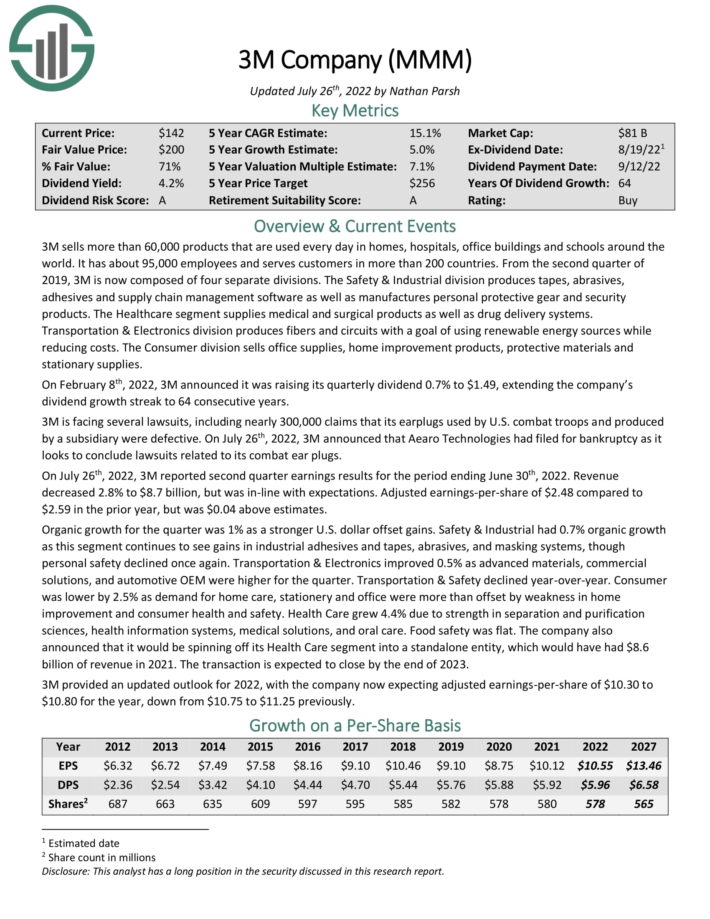

No-Fee DRIP Dividend Aristocrat #1: 3M Company (MMM)

- •5-year expected annual returns: 20.3%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000employees and serves customers in more than 200 countries.3M is nowcomposed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management softwareas well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

Source: Investor Presentation

On July 26th, 2022, 3M reported second quarter earnings results for the period ending June 30th, 2022. Revenue decreased 2.8% to $8.7 billion, but was in-line with expectations. Adjusted earnings-per-share of $2.48 compared to $2.59 in the prior year, but was $0.04 above estimates. Organic growth for the quarter was 1% as a stronger U.S. dollar weighed.

The company also announced that it would be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.3M provided an updated outlook for 2022, with the company now expecting adjusted earnings-per-share of $10.30 to $10.80 for the year, down from $10.75 to $11.25 previously.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

Final Thoughts and Additional Resources

Enrolling in DRIP stocks can be a great way to compound your portfolio income over time.Additional resources are listed below for investors interested in further research for DRIP stocks.

For dividend growth investors interested in DRIP stocks, the 15 companies mentioned in this article are a great place to start. Each business is very shareholder friendly, as evidenced by their long dividend histories and their willingness to offer investors no-fee DRIP stocks.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- •The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- •The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- •The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 45 stocks with 50+ years of consecutive dividend increases.

- •The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- •The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings.

- •The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- •The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- •The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years. Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

- •The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- •The Dividend Challengers List: 5-9 consecutive years of dividend increases.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

7 High Dividend Stocks To Buy and Hold For Decades